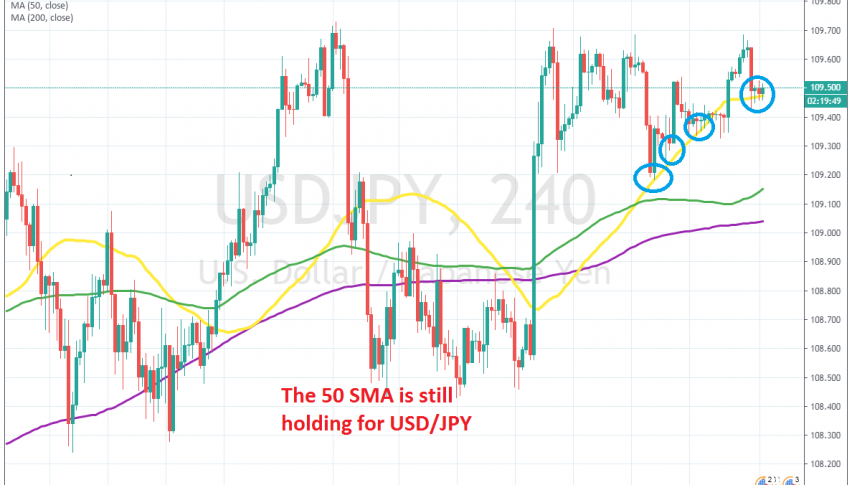

Buying the Retrace in USD/JPY at the 50 SMA

USD/JPY has been trading sideways since surging after the Phase One deal announcement and the 50 SMA is keeping it above

[[USD/JPY]] turned bullish at the end of August, below 105. The trade war rhetoric calmed down in September and the sentiment in financial markets improved, sending safe havens lower and USD/JPY higher. Comments about the Phase One deal between US and China have been keeping the sentiment positive in recent months and after they confirmed it, we saw another jump higher by the middle of this month.

But, there was no follow through because the Phase One deal is just an agricultural trade deal, which doesn’t offer much more apart from the current agricultural purchases from China. So, buyers got cold feet after seeing the details of that deal and the holiday period has kept the price action slow.

As a result, USD/JPY has been trading sideways for about two weeks and the 50 SMA (yellow) has been providing support during this time. Earlier today, we saw the price turn bearish on the H4 time-frame, but the 50 MSA held as support again. We decided to go long from there, hence the buy forex signal in USD/JPY; although, let’s see if this pair will bounce off the 50 SMA again.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM