US Household Debt Balloons to Record High in 2019

Recent research by the New York Fed reveals that household debt among US consumers has soared by over $600 billion during 2019, the highest

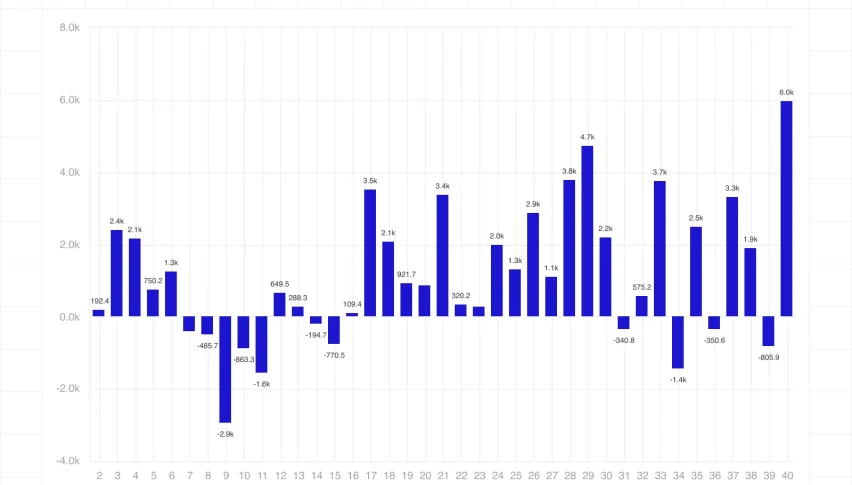

Recent research by the New York Fed reveals that household debt among US consumers has soared by over $600 billion during 2019, the highest yearly increase seen since just before the financial crisis over a decade ago. Overall household debt balances in the US now stand at over $14 trillion for the first time.

Mortgage debt balances, which accounted for around $433 billion of the the overall increase, have been the main driver behind the ballooning household debt balance. In more worrying news, delinquency among credit card borrowers have also been on the rise since 2016, with balances for credit cards rising by $46 billion in 2019.

According to Senior Vice President at the New York Fed, Wilbert Van Der Klaauw, “It could also be that the economy is very strong overall but there are some subgroups, and maybe young people in particular, who are not benefiting as much from that.”

In Q4 2019, mortgage originations touched $752 billion, marking the highest QoQ increase seen in 14 years. However, this increase was attributed to a rise in refinancing activity.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM