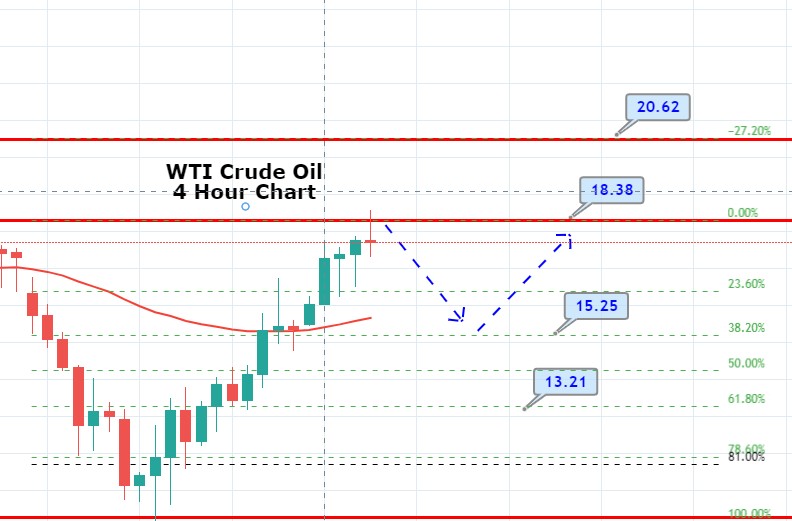

WTI Crude Oil Crosses Double Top – What’s Next?

On the technical front, the U.S. Oil is holding below the strong double top resistance level of 18.35. On the 4 hour timeframe, WTI seems to

WTI crude oil prices soar to trade at 17.79 level despite an increased number of inventories. The quantity of crude oil owned by private companies that are incapable of selling the product due to the novel coronavirus (COVID-19) pressure seems to set an all-time high in the weeks ahead.

Global producers may develop creative measures to find crude storage, which has been caused by the lack of physical demand due to coronavirus lockdowns, while US President Donald Trump made a commitment to deliver a system to help the country’s oil companies, which also helped the sentiment around the commodity. Treasury Secretary Steven Mnuchin said the plan could add millions of barrels of oil to already-teeming national reserves.

At the US-China front, US President Donald Trump’s stoked fresh trade war fears between the two countries, which weighed on the risk sentiment but not so much. On the other hand, the Fed’s dovish pause and positive updates on the virus medicine have recently improved market sentiment, which is boosting crude oil prices.

Daily Support and Resistance

S1 9.99

S2 13.21

S3 14.95

Pivot Point 16.44

R1 18.18

R2 19.66

R3 22.89

On the technical front, WTI crude oil is holding below the strong double top resistance level of 18.35. On the 4-hour timeframe, WTI seems to close a Doji candle below this level, and if it actually happens, we may see oil prices falling further until 23.6% and 28.2% Fibonacci support areas of 16.33 and 15.17 respectively. The MACD is suggesting an overbought scenario, while the 50 EMA is also far from the CMP (current market price), so we may see a selling opportunity.

Good luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account