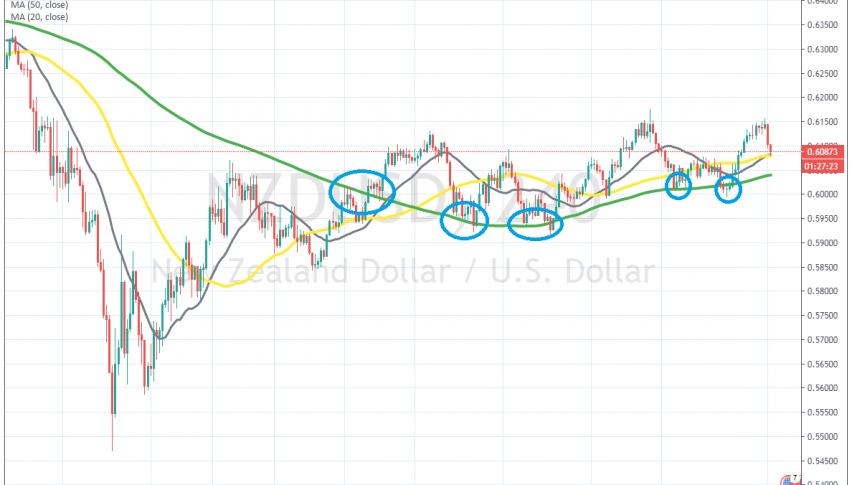

Getting Ready to Buy NZD/USD

NZD/USD is retreating lower today, but the trend is still bullish, so we are trying to pick a spot to go long on this pair

[[NZD/USD]] has been bullish since late March, when the large decline following the coronavirus panic which sent this pair crashing around 10 cents lower ended. The price climbed around 7 cents from the bottom until the end of April, with NZD/USD reaching 0.6170s.

But, the buying pressure eased somewhat this month, as the world continues to be on lockdown. The uptrend has been continuing since early April, but it has been pretty slow compared to late March. During this time, moving averages have been doing a good job in providing support.

The 100 SMA (grey) has been holding well during pullbacks lower, reversing the price back up. Last Monday, we saw a retrace lower to the 100 SMA on H4 chart and this moving average was pierced for a while, but the price turned bullish again after a pin candlestick, which is a bullish reversing signal.

Today we are seeing another pullback lower and the price is now at the 50 SMA (yellow). This moving average is providing some support now, but we will wait for the price to reach the 100 SMA, which is a better support indicator. If we get another bullish reversing signal down there, then I will try to open a buy forex signal in this pair.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account