The FED Sends Dovish Signal to Markets

The FED pledges to remain dovish for as long as it takes

•

Last updated: Wednesday, June 10, 2020

The FED held its meting just a while ago, while chairman Powell is still holing the press conference. The FED turned dovish like other major central banks in march when the coronavirus broke out in Europe and the US, and is buying $4 billion US treasury bonds a day. Now they sent the message that they will remain dovish for an extended period of time. Below are the central tendencies and the dot plot:

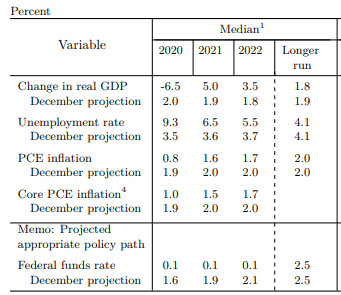

Central tendencies and dot plot for June 2020

The last time the central tendencies and dot plot was released was way back in December 2019. At that time, the world was different place.

At the time in December, the Central tendencies saw 2020 numbers at:

- GDP 2.2%

- unemployment rate 3.5%

- PCE inflation 1.9%

The 2021 projections saw:

- GDP 1.9%

- unemployment 3.6%

- PCE inflation 2.0%

The projection for the Fed funds rate at the end of 2020 was 1.6%. For 2021 the rate rose to at 1.9% with the 2022 rate at 2.1%.

The current median estimate for central tendencies shows 2020 numbers at:

- GDP -6.5%

- unemployment 9.3%

- PCE inflation 0.8%

The projections for the Fed funds rate at the end of 2020 comes in at 0.1%. For 2021 the rate targets 0.1% with the 2022 rate targeted also at 0.1%.

Below is the chart of central tendencies from the Federal Reserve

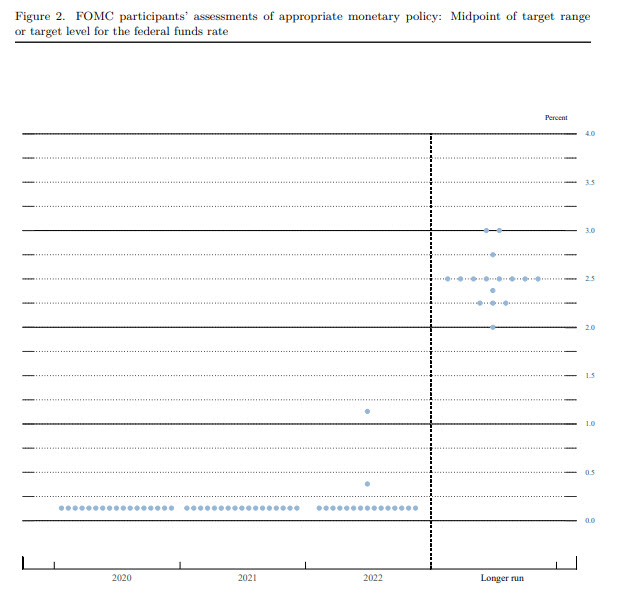

Below is the dot plot with all participants keeping the rate at 0.1%. In 2022, there are two voting members to forecast day higher rate. The market was looking for the Fed to keep rates low through 2022

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.

Related Articles

Sidebar rates

HFM

Related Posts

Pu Prime

XM

Best Forex Brokers

Join 350 000+ traders receiving Free Trading Signals