Gold Heads for the Highs, AS USD Turns Weaker Again

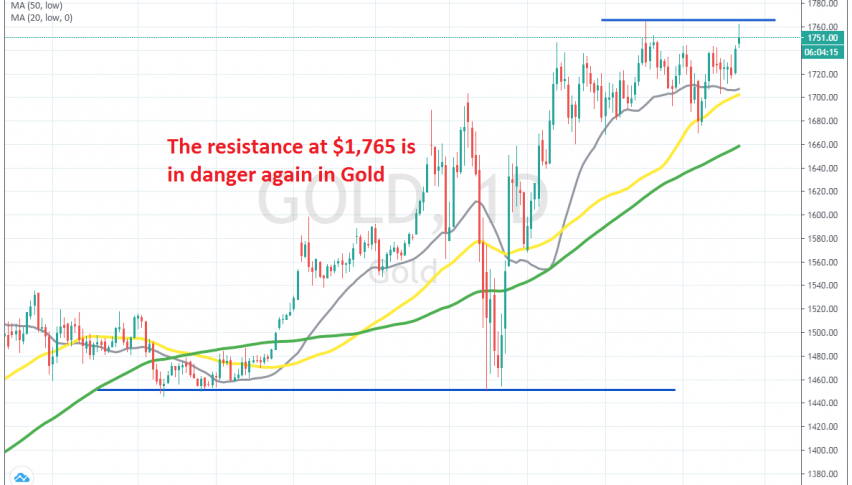

Gold is trying the resistance again at $1,765 today, after a slight pullback lower

GOLD has been really bullish this year. It turned bullish in December, after consolidating during the Q4 of last year and the upside picked up momentum in Q1 of this year, as coronavirus broke out. We saw a decent pullback in March, but that came as a result of traders turning to the USD in panic, as a global reserve currency.

The reversal down was quite ferocious, with Gold losing around $250 in a bit more than a week. But, the previous support at $1,450 held for the second time and Gold bounced off of it, reaching the highest price since 2012 in April at $1,745. The bullish momentum continued during the lock-down, which sent Gold to $1,765 in May.

We saw another retreat lower during late May and early June, but the pullback ended at the 50 SMA (yellow) on the daily chart. The price reversed back up from there and today Gold buyers are eyeing the top. The price has retreated back from the highs, but it’s not too far from it. Gold might or might not break above the previous resistance, but if we see a bearish reversing pattern, we will probably open a sell signal, targeting a pullback lower before the next bullish move.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM