The Positive Data keeps Coming From the US

US durable goods orders remained at good levels in November

•

Last updated: Wednesday, December 23, 2020

The Eurozone, the UK, the Canadian economies etc have been weakening since August, after the post lock-down surge. But the weakness has increased in the last two months due to the new coronavirus restrictions , although the US economy is holding well and keeping a good pace of expansion. Unemployment claims declined earlier today, while the durable goods orders remain decent.

US November durable goods orders highlights:

- November prelim durable goods orders +0.9% vs +0.6% expected

- Prior was +1.3% (revised to +1.8%)

- Durables ex transportation +0.4% vs +0.5% expected

- Prior ex transportation +1.3% (revised to +1.9%)

- Capital goods orders non-defense ex-air +0.4% vs +0.6% expected

- Prior capital goods orders non-defense ex-air +0.8% (revised to +1.6%)

- Capital goods shipments non-defense ex-air +0.4% vs +0.7% expected

- Prior capital goods shipments non-defense ex-air +2.4% (revised to +2.6%)

This is a much stronger report than it first appears. There are sizeable upward revisions to the October numbers and that bodes well for the economy in early 2021.

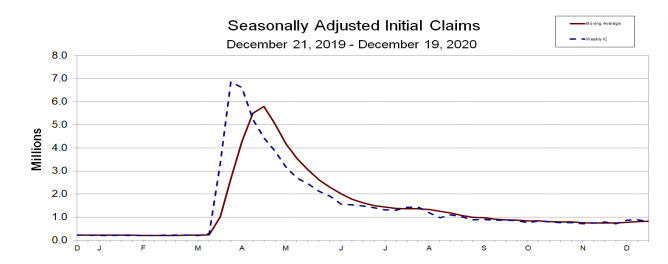

US initial jobless claims and continuing claims

- Initial jobless claims 803K vs 880K estimate. The prior week revised to 892K vs 885K prev. reported.

- 4 week moving average 818.25K vs 814.25k last week

- Continuing claims 5337K vs 5560K estimate. The prior week was revised to lower by 1K to 5507K vs 5508K previously reported.

- 4 week moving average 5538.0K vs 5726K last week

- The largest increases in initial claims for the week ending December 12 were in Illinois (+30,743 – mainly wholesale trade, retail trade, and educational services), California (+25,664 – service industry), Kansas (+5,637), Delaware (+2,355), and Ohio (+1,996),

- The largest decreases were in Georgia (-9,301), Minnesota (-9,158), Texas (-8,876), Indiana (-7,920), and Wisconsin (-7,038).

Better than expected but the weekly jobless claims are still at an elevated level of 800K. At the post pandemic low the number reached 711. Prepandemic, the low water mark was 201K during the week of January 31, 2020.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.

Related Articles

WTI crude oil (USOil) is struggling to stabilise around $58.15 after a late-month wobble down to $54.99, a level that briefly...

9 hours ago

Save

Sidebar rates

HFM

Related Posts

Pu Prime

XM

Best Forex Brokers

Join 350 000+ traders receiving Free Trading Signals