Earnings Back to Pre-Coronavirus Levels in UK, Keeping GBP Bullish

GBP/USD jumped after the impressive earnings report from the UK

Earnings were quite high in the UK in recent years, increasing by more than 3% on a quarterly basis, until the coronavirus broke out. In May they turned negative, as the economy headed down due to the lockdown restrictions, and they kept declining until August.

In September they turned positive again, and have they been increasing since then, getting back to pre-coronavirus levels. Restrictions were increased in the UK again this winter, but earnings keep increasing nonetheless, although when the report is released next month, we will see how they were affected in December. This positive performance has turned the GBP bullish, with the GBP/USD increasing by around 80 pips since then.

US Employment Report November

- November average weekly earnings +3.6% vs +2.9% 3m/y expected

- October earnings were +2.7%; revised to +2.8%

- November average weekly earnings (ex bonus) +3.6% vs +3.2% 3m/y expected

- Prior earnings excluding bonuses +2.8%

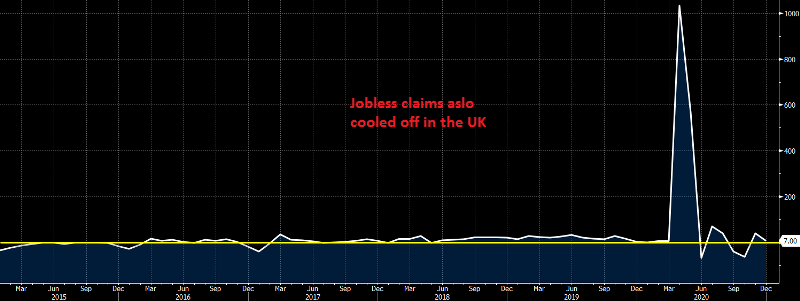

- December jobless claims change 7.0k vs 64.3k prior

- November claims were 64.3k; revised to 38.1k

- Claimant count rate 7.4%

- Prior claimant count rate 7.4%; revised to 7.3%

- November ILO unemployment rate 5.0% vs 5.1% expected

- October unemployment rate was 4.9%

- November employment change -88k vs -104k expected

- October employment change -144k

There was a slight delay in the release by the source. UK jobless claims came in much lower last month compared to November, but the data is arguably still somewhat distorted by the furlough scheme for the most part.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM