Selling the Retrace Up in AUD/USD

AUD/USD is forming a bearish reversing signal on the H1 and H4 charts

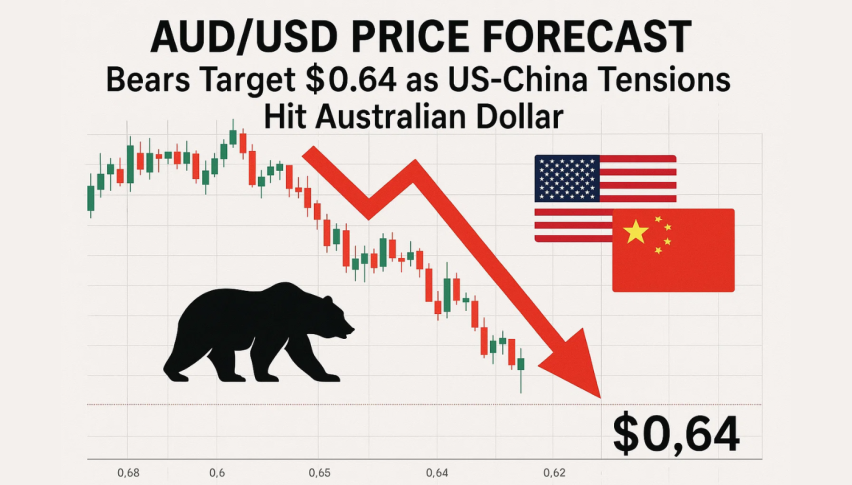

AUD/USD used to be one of the most bullish pairs during the past year, climbing around 15 cents and moving briefly above 0.80 towards the end of February. But, the bullish move ended back then, as the USD turned bullish, sending AUD/USD down.

This pair lost nearly 5 cents from top to bottom, but sellers called it off above 0.75. AUD/USD retraced higher in the first day of April and since then it has been trading mostly sideways, which indicates that buyers are weak, unable to put up a decent fight.

In the last week or so, the 100 SMA (green) has been acting as resistance on the H1 chart and it is doing that job again today, rejecting the price once again, as shown on the chart at the top of this article. The previous two candlesticks have closed as dojis, which are bearish reversing signals.

The 100 SMA keeps pushing AUD/USD down

The price is starting to retreat already, so let’s hope that the reversal will take place soon and we will get our pips from tis forex signal. The same moving average is also providing resistance on the H4 chart, which makes he case for sellers even stronger.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account