USD/CAD Dives and Bounces Up on 50 bps Hike Form the BOC

USD/CAD bounces back up from the 20 SMA after a 100 pip dive after the BOC raised rates by 50 bps

•

Last updated: Thursday, December 8, 2022

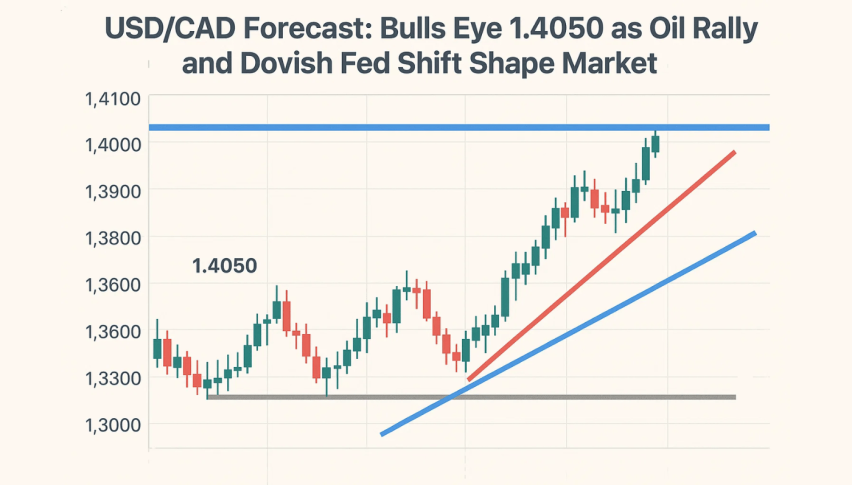

The central bank bonanza started on Tuesday with the Reserve Bank of Australia (RBA) raising interest rates by 0.25% or 25 basis points (bps). The AUD didn’t benefit much from it though. Yesterday we had the Bank of Canada rate decision, which delivered a 50 bps hike. That sent UAS/CAD 100 pips lower to the 20 SMA (gray) on the H4 chart, but the price has bounced back up from there.

Bank of Canada Rate Decision

- Bank of Canada hikes rates 50 bps vs 50 bps expected

- Prior rate was 3.75%

- Prior statement said “the Governing Council expects that the policy interest rate will need to rise further” but this has been dropped

- “Governing Council will be considering whether the policy interest rate needs to rise further to bring supply and demand back into balance and return inflation to target”

- There is growing evidence that tighter monetary policy is restraining domestic demand

- Overall, the data since the October MPR support the Bank’s outlook that growth will essentially stall through the end of this year and the first half of next year.

- We are resolute in our commitment to achieving the 2% inflation target and restoring price stability for Canadians.

- Inflation is still too high and short-term inflation expectations remain elevated

- In Canada, GDP growth in the third quarter was stronger than expected, and the economy continued to operate in excess demand. Canada’s labour market remains tight, with unemployment near historic lows

- There’s no press conference today but the BOC’s Kozicki speaks tomorrow at 12:45 pm ET

- Full statement

This is exactly the scenario I laid out in my BOC preview. It’s 50 bps but the statement indicates the BOC will now ‘consider’ rates, which is another word for pausing.

USD/CAD Live Chart

USD/CAD

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.

Related Articles

Sidebar rates

HFM

Related Posts

Pu Prime

XM

Best Forex Brokers

Join 350 000+ traders receiving Free Trading Signals