Will USD/CAD Turn Bullish After BOC Signals A Pause?

USD/CAD jumped off the support zone yesterday after the BOC said to keep rates on hold after a 25 bps hike yesterday

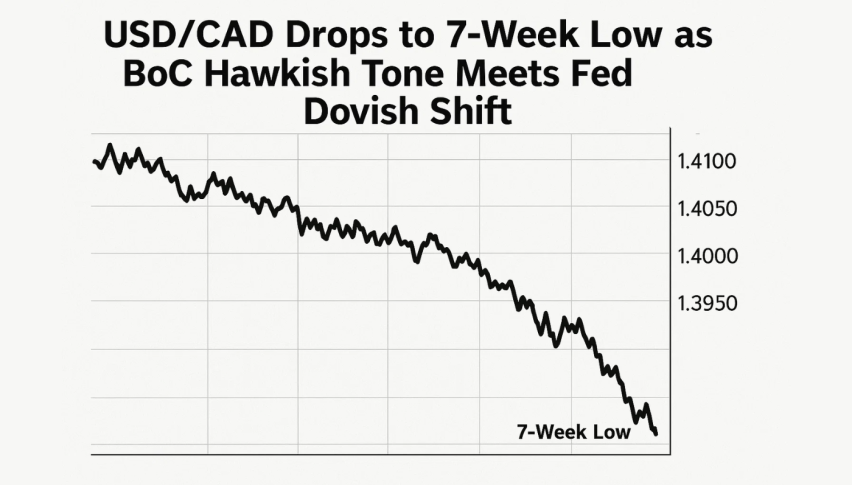

USD/CAD has been bearish this year as the USD resumed the retreat that it started in Q4 of 2022. Although, a support zone has formed abound 1.3350 and it seems like we might see a reversal from here, after yesterday’s jump following the Bank of Canada (BOC) rate decision.

USD/CAD jumped around 100 pips higher after BOC hiked interest rates by 25 bps (basis points) as expected, but also signaled a shift to the sidelines for the foreseeable future. “If economic developments evolve broadly in line with the MPR outlook, Governing Council expects to hold the policy rate at its current level while it assesses the impact of the cumulative interest rate increases,” the BOC statement said. Below is the rate decision and statement by the BOC as released yesterday:

Bank of Canada Rate Decision, January 25, 2023 Highlights

- Bank of Canada hikes rates by 25 bps as expected to 4.50% and signals intention to now hold

- Prior was 4.25%

- Inflation is coming down in many countries, largely reflecting lower energy prices as well as improvements in global supply chains

- Inflation is projected to come down significantly this year

- If economic developments evolve broadly in line with the MPR outlook, Governing Council expects to hold the policy rate at its current level while it assesses the impact of the cumulative interest rate increases

- Governing Council is prepared to increase the policy rate further if needed to return inflation to the 2% target

- The BOC estimates the global economy grew by about 3½% in 2022, and will slow to about 2% in 2023 and 2½% in 2024, which is slightly higher than in Oct

- In Canada, recent economic growth has been stronger than expected

- There is growing evidence that restrictive monetary policy is slowing activity, especially household spending

- BOC expects 1% growth in 2023, weighted towards the back half vs +0.9% prior. Sees 1.8% GDP growth in 2024 vs 2.0% prior

- Sees inflation this year at 3.6% vs 4.1% prior. Sees 2024 at 2.3% vs 2.2% prior

BOC basically spelled it out, saying that they expect to keep interest rates on hold from here on. That was largely built into the market but there was considerable uncertainty as to whether they would explicitly signal it. USD/CAD rose to 1.3430 from 1.3350 after the decision. There’s a broader market reaction as well with global bonds catching a bid (lower yields) as well. But on the other hand, the USD lost ground more broadly, likely on the idea that the Fed will ultimately follow the BOC.

USD/CAD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account