Is February’s Rate Hike Reevaluation Rally Over for the USD?

the USD had a great rally during February as economic data improve din the US, but can it keep the momentum during March?

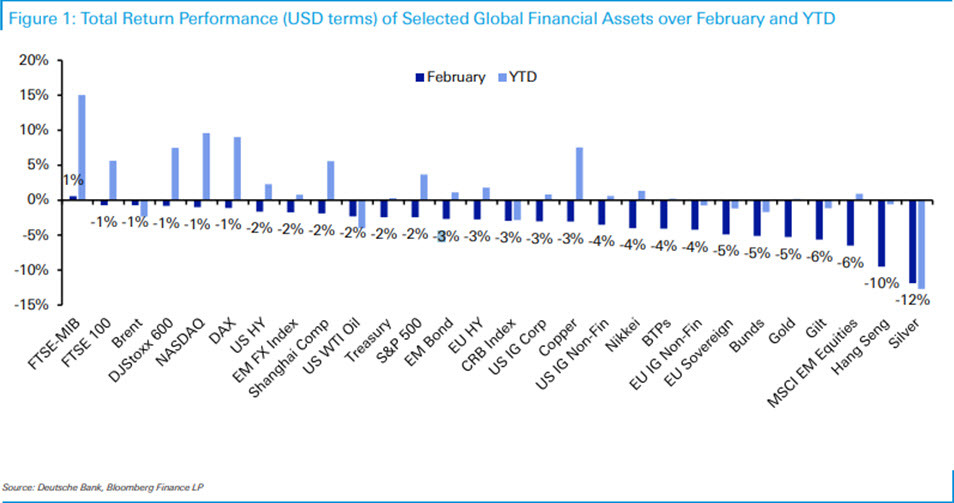

Last month we saw a revival of the USD after retreating for several months and everything else declined in value. The chart below indicates that economic data played a significant role in shaping trading activity during February, keeping sentiment subdued and risk assets bearish.

A series of positive economic releases from the US caused a reevaluation higher of the expected path of FED interest rates. As a consequence, there was a decline in the value of risk assets, and the US dollar performed well compared to other global markets.

Main Global Stock Indices

However, despite these developments, the declines observed in the market last month were not particularly severe. This suggests that the positive impact of better global growth may have provided some cushion to the market. Additionally, while there are concerns about inflation, the market is not yet showing signs of worrying about stagflation.

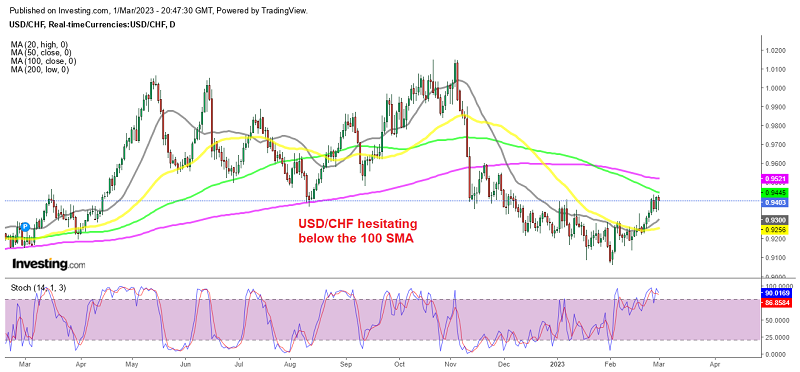

USD/CHF was on a downtrend since early November nd moving averages were providing resistance on the daily chart, particularly the 50 SMA (yellow). but they were broken during February as the trend changed. Although now the price is hanging below the 100 daily SMA (green), so this might as well be a retrace before the bearish trend resumes again.

So now the big question that comes up is whether this new top terminal FED rate repricing can push the USD further to the upside, or if this is all the buyers had? The data ahead will lead the way for traders, although the FED can only raise rates as much.

USD/CHF Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM