ECB More Hawkish Than the FED, EUR/USD Heads for 1.10

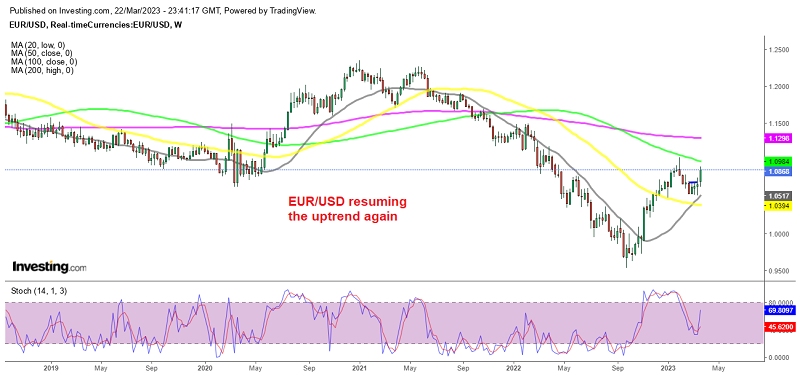

EUR/USD surged 150 pips higher yesterday after the 25 bps hike by the FED and is approaching 1.10, but can it break above?

EUR/USD saw a sharp reversal last week, which was followed by a 200 pip decline as the banking system crisis contagion spread to Europe and Credit Swiss failed. But Credit Swiss was taken over by the UBS bank, and the spread was contained without much damage, although it’s still a bit early to tell because things are changing so fast nowadays.

Although the damage seems bigger in the US, which has led to the value of the US Dollar dropping significantly this week, causing an increase in EUR/USD . The FED delivered a 25 basis points rate hike yesterday, taking them to 5.25% but investors interpreted that as a “dovish hike” and this has led to a jump in risk assets. Although we saw a reversal in US stock markets in the last few hours of trading.

But the USD didn’t recover much after that against other major currencies, as the sentiment remained dovish for the US Dollar. The FED raised its key interest rate by 25 bps as expected to the 4.75% -5.00% range. The vote was unanimous. In the statement it said that “some additional policy firming may be appropriate”, instead of “ongoing increases in the target range will be appropriate”. This was one of the main dovish lines, with Powell not changing much, including the fact that we might see a last hike to 5.25% in the next meeting.

The European Central Bank (ECB) on the other hand, is growing more confident that the banking system in the Eurozone has managed to withstand the financial turmoil, according to their words. As a result, the ECB may keep raising interest rates in the near future after delivering a 50 bps hike last week.

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account