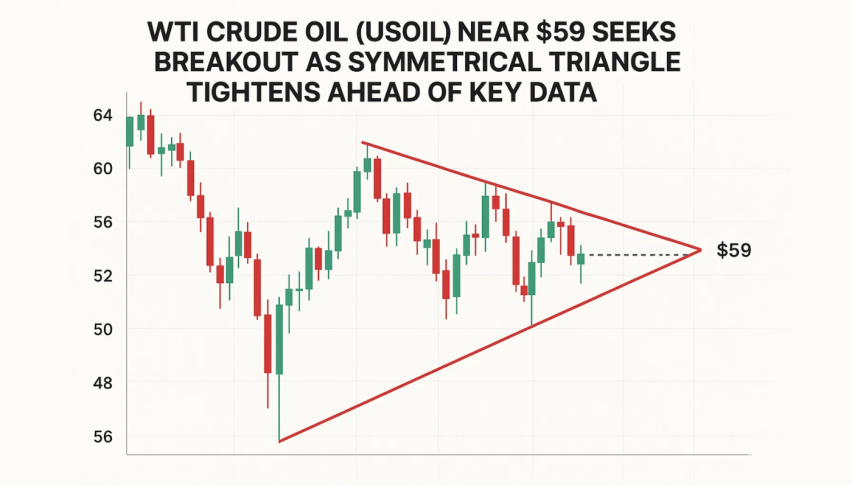

Can Crude Oil End the Week Bullish Or Retreat Lower on Profit Taking?

Crude Oil has been gaining for eight straight days, but yesterday we saw a retreat on profit taking despite another major EIA drawdown

Crude Oil has turned bullish since the end of June, despite a slowing global economy and increasing worries about China, which is experiencing difficulties across different sectors. Many are expecting major economies to fall into a recession or get pretty close to it after central banks increased interest rates to extreme levels. This should have kept crude Oil on a bearish trend, but the efforts from Saudi Arabia to hike prices, which are being supported by other OPEC+members have kept Oil prices bullish for more than two months, since they bounced off the support zone around $67.

In the second week of August, US WTI crude increased to $85 almost in a straight line, but we saw a retrace for the next two weeks, which was due, sending the price to the 200 SMA (purple). This moving average held as support at around $77.50 and we saw a bounce in the second week of August. Since then, buyers have been in total control, with 8 bullish days, sending the price to $88, although yesterday we saw a retreat lower, despite another major drawdown in EIA inventories, as shown below:

EIA Crude Oil Inventories for Last Week

- Crude Oil inventories -6,307K vs -2,064K expected

- Prior crude -10,584K

- Gasoline -2,666K vs -950K expected

- Distillates +679K vs +239K expected

- Refinery utilization -0.2% vs +0.1% expected

- Production estimate 12.8 mbpd vs 12.8 mbpd prior

- Impld mogas demand: 9.32 mbpd vs 9.07 mbpd prior

Despite a surprisingly significant draw in US crude oil inventories, it was not enough to counteract the expected profit-taking following a nine-day rally in oil prices. As a result, WTI crude oil settled lower, declining by 67 cents to $86.87 per barrel.

From a technical perspective, there is a case for revisiting the previous range top at $84-85 before resuming the upward price movement. This suggests that after a strong rally, a pullback or retest of previous resistance levels is not uncommon before the trend continues. In this case, oil prices may need to consolidate around the $84-85 range before potentially pushing higher once again.

US WTI Crude Oil Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account