The $2,150 Support Holds, After Gold Price Dips on Stronger PPI

Today many were expecting retail sales to have the biggest impact, but PPI inflation stole the show sending Gold price down to $2,150 lows

Today many were expecting retail sales to have the biggest impact, but PPI inflation stole and Unemployment Claims the show sending Gold price down. However the area above the $2,150 level has formed a support zone which held the retreat in XAU/USD for the second day.

Gold H4 Chart – The 50 SMA Holding As Support

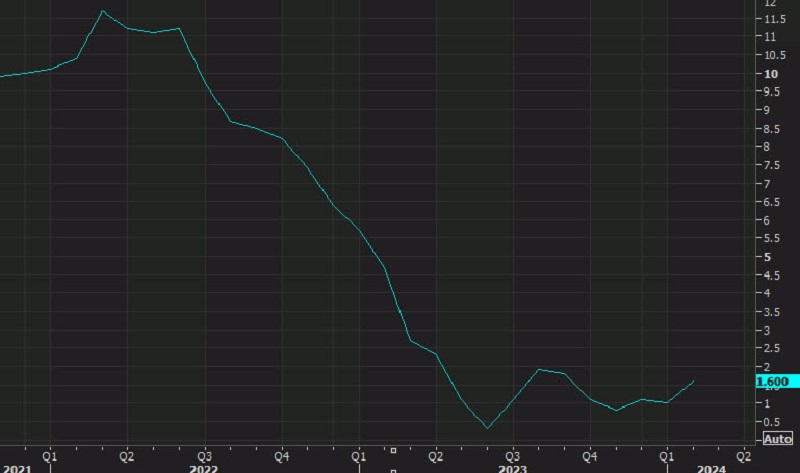

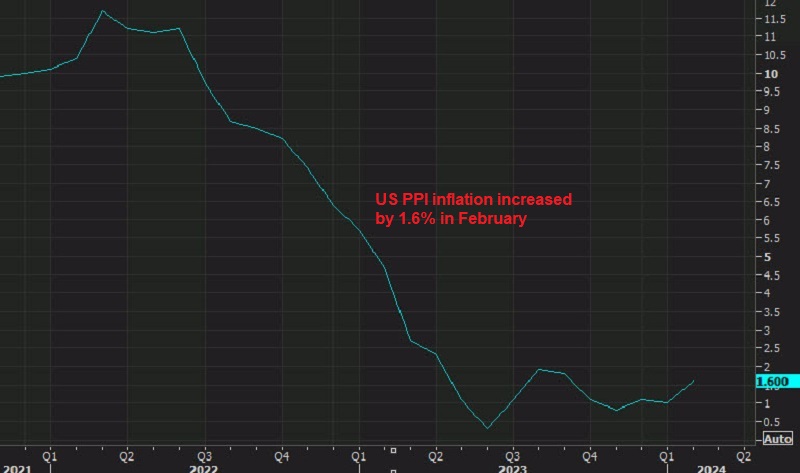

Overall, the PPI data indicates significant inflationary pressures in the producer sector, but it shouldn’t have implications for consumer prices and monetary policy moving forward. The significant increase in the energy index, particularly driven by a 4.4% rise, has contributed substantially to the overall rise in February’s Producer Price Index (PPI).

Gold was already retreating and dived further after the report, with XAU/USD falling to $2,152 after the PPI and unemployment claims numbers. But, this has turned into a support zone for Gold and wesaw another bounce today, after the one we saw yesterday.

The US Producer Price Index (PPI) Report for February 2024

- February PPI increased by 1.6% year-on-year, surpassing the forecast of +1.1% and the previous month’s figure of +0.9% (revised from +0.8%).

- On a monthly basis, PPI rose by 0.6%, exceeding the expectation of +0.3% and matching the previous month’s figure of +0.3%.

Core PPI, which excludes volatile food and energy prices, also showed strength:

- Core PPI excluding food and energy increased by 2.0% year-on-year, slightly above the expected +1.9% and consistent with the prior month’s figure of +2.0%.

- Month-on-month, Core PPI excluding food and energy rose by 0.3%, surpassing the forecast of +0.2% but lower than the previous month’s +0.5%.

Excluding food, energy, and trade services, PPI also demonstrated an increase:

- PPI excluding food, energy, and trade services rose by 2.8% year-on-year and by 0.4% month-on-month.

Given the current trajectory of oil prices, with crude oil reaching $80 per barrel and the potential for further increases toward the $85-90 range, market attention is likely to remain focused on the energy sector for the foreseeable future. The strength in the US dollar, supported by positive initial jobless claims data as well which were lower, close to 200K, further reinforces the market’s attention on the energy sector.

Despite a miss on retail sales data, which could signal potential weakness in consumer spending, the focus on energy prices and their impact on inflationary pressures seems to be outweighing other economic indicators for now. As energy prices continue to play a significant role in driving inflationary pressures, market participants will closely monitor developments in the energy sector, particularly Oil prices, for their potential implications on broader economic trends and monetary policy decisions.

XAU Gold Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account