Silver Price Tests $25 Again Despite Higher Final Q4 US GDP

The Silver price turned lower last week below the resistance zone of $26, following Gold's retreat after the record high. But Silver is up..

The Silver price turned lower last week below the resistance zone of $26, following Gold‘s retreat after the record high. But, today Silver XAG is up again, as Gold XAU makes a new record high, despite positive US data such as Q4 GDP which was revised higher, while unemployment claims came in lower.

Silver Chart H4 – Facing the 50 SMA Before Reaching $25

Silver made quite a rally during the first three weeks of this month and was finding solid support at the 50 SMA (yellow) on the H4 chart. But after failing below the resistance zone at $26, XAG/USD retreated below moving averages and now that buyers are back, they have to push above the 50 SMA again in order to get to $25.

The final US Q4 GDP reading today was revised higher to 3.4%, but Silver buyers remain in control, with the price not retreating from the 50 SMA. This indicates that we might see a break to the upside, after Gold made a new record high at $2,225 just now.

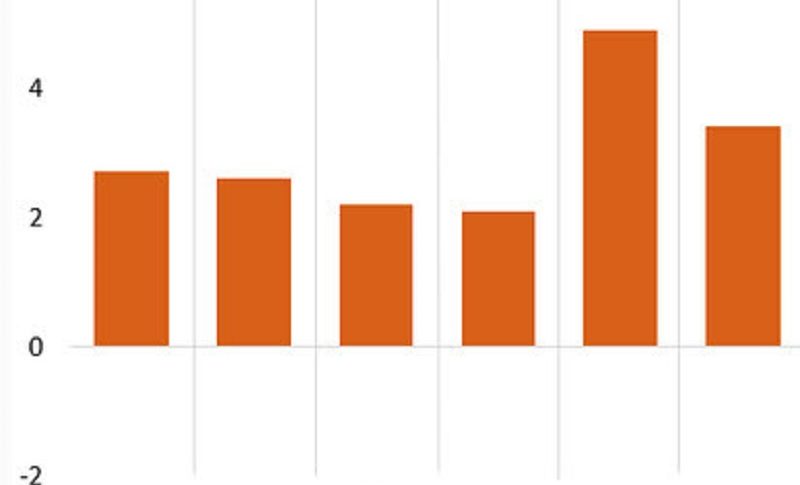

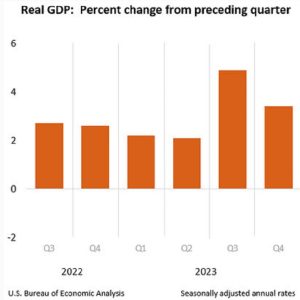

US Q4 2023 GDP Final Reading

- Q4 2023 GDP final reading +3.4% vs +3.2% expected

- Second Q4 reading was +3.2% annualized

- Final Q3 reading was +4.9% annualized

- Q2 was +2.1% annualized

Details:

- Consumer spending increased by +3.3%, slightly higher than the +3.0% reported in the second reading. Consumer spending on durables also saw a slight increase.

- GDP final sales rose by +3.9%, up from the +3.5% reported in the second reading.

- The GDP deflator remained at +1.7%, consistent with the second reading.

- Core Personal Consumption Expenditures (PCE), a key measure of inflation, came in at +2.0%, slightly lower than the +2.1% reported in the second reading.

- Business investment increased by +0.7%, slightly lower than the +0.9% reported in the second reading.

- Corporate profits increased by +3.9%.

- Government spending added 0.79 percentage points to GDP growth.

- Inventories subtracted 0.47 percentage points from GDP growth.

Overall, the final reading of Q4 2023 GDP indicates a solid economic performance, with consumer spending and GDP final sales showing strength. However, there are some signs of moderation in business investment and core PCE inflation. Government spending remained supportive of growth, while inventory levels detracted slightly from GDP expansion.

Silver Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM