Consolidating Week for S&P 500, Dow Jones After Strong Earnings

The S&P 500 and Dow Jones began the week positively, edging higher but by the end of the week both indexes fluctuated within a narrow range.

The S&P 500 and Dow Jones began the week positively, edging higher, largely influenced by electric vehicle maker Tesla (TSLA), whose stock soared by an impressive 16%. However, by the end of the week, little had changed as both indexes fluctuated within a narrow range. The signs of confidence are encouraging for markets, especially after a series of economic events and data releases. Investor sentiment improved following the Federal Reserve’s latest interest rate decision on Wednesday, which was not as hawkish as anticipated.

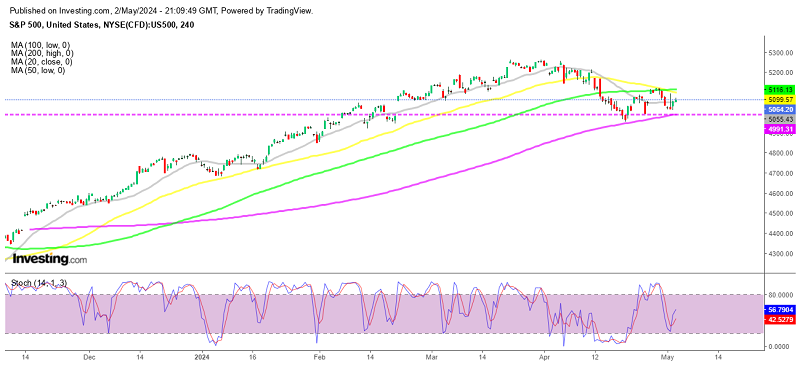

S&P 500 Chart H4 – Consolidating Between 2 MAs

Investor sentiment improved following the Federal Reserve’s recent interest rate decision, which turned out to be less hawkish than anticipated. Amazon’s cloud computing unit, Amazon Web Services (AWS), demonstrated significant growth in the latest numbers released yesterday.

Investors seem eager for the possibility of a surprise dividend announcement. Despite being the only firm in the S&P500 worth over $1 trillion that does not currently pay a dividend, Apple, which unveiled its earnings results on Thursday after the US markets closed, showed strong performance.

Apple’s Earnings Report Exceeds Expectations

- Earnings per share (EPS) came in at $1.53, surpassing the expected $1.50.

- Revenue reached $90.75 billion, beating the anticipated $90.01 billion.

Here’s a breakdown of the performance by business unit:

- iPhone revenue: $45.96 billion, slightly below the expected $46.00 billion.

- Mac revenue: $7.45 billion, exceeding the expected $6.86 billion.

- iPad revenue: $5.56 billion, falling short of the expected $5.91 billion.

- Wearables, home, and accessories revenue: $7.91 billion, missing the expected $8.08 billion.

- Services revenue: $23.87 billion, surpassing the expected $23.27 billion.

In terms of regional performance:

- China revenues totaled $16.37 billion, showing an 8.1% decrease year-on-year compared to the estimated $15.87 billion.

Additionally, gross margins stood at $42.27 billion, higher than the expected $42.01 billion.

S&P 500 Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM