Further Losses Expected for EURUSD After the Quick Reversal

EURUSD continues to experience significant volatility driven by a mix of economic data, central bank policies, and political events.

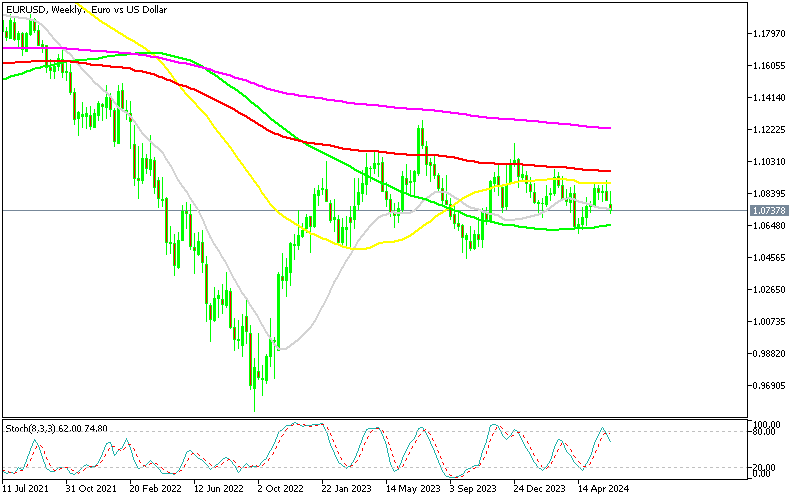

EURUSD continues to experience significant volatility driven by a mix of economic data, central bank policies, and political events, but the pressure has shifted to the downside. The recent decline following the European elections highlights the ongoing pressure on the pair, despite the soft US CPI and PPI reports this week. Key technical levels around 1.0735 and 1.0720 will be crucial for traders to watch, as they could dictate the next direction of the EUR/USD.

EUR/USD Chart H4 – New Monthly Low

EUR/USD tumbled lower after the NFP report last Friday, and fell to new lows in a month, reaching 1.0719-20 early on Monday morning. The outcome of the right-leaning European Parliament elections contributed to a significant decline in EUR/USD . The pair opened the week with a negative gap, putting downward pressure on the euro amid political uncertainties in France and other EU nations.

However the price started to reverse down there and following the disappointing US CPI (Consumer Price Index) inflation news on Wednesday, EUR/USD initially rose to around 1.0852. However, resistance from moving averages such as the 100 SMA (green) halted the ascent on the H4 chart, leading to a quick reversal that pushed the pair lower, reaching the low 1.0735 yesterday.

EUR/USD Technical Analysis

EUR/USD is currently trading below all moving average (MA) on the H4 chart, with the quick 120 pip reversal indicating bearish momentum. The pair tested and breached moderate swing regions around 1.0750 and 1.0735, with the next significant support level expected around Friday’s low near 1.0720.

Technical Support: The 1.0735 area, dating back to January/February, serves as a crucial support level that traders may watch closely. If EUR/USD continues to decline, buyers might step in near this level, potentially halting the downward trend. The next target is the low from Monday at 1.0720 and below that comes the round level at 1.07.

The next support target comes at the 100 SMA on the weekly EUR/USD chart, at 1.0650, followed by the April low at 1.06. Traders could anticipate buyers to enter the market around the identified support levels, potentially leading to a pause or reversal of the current downtrend. However, despite occasional rebounds on lower-than-expected US PPI and US employment data, the overall sentiment favors USD strength against the euro, so the rebound will likely be short lived

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM