Bitcoin Faces Headwinds as Coinbase Indicator Flashes Warning

Bitcoin's reign as the digital gold standard is facing a potential storm as a key market indicator signals gathering turbulence. Coinbase's

Bitcoin’s reign as the digital gold standard is facing a potential storm as a key market indicator signals gathering turbulence. The Coinbase Premium Index (CPI), a measure of the price discrepancy between Bitcoin on Coinbase Pro and other major exchanges, has dipped below its 14-day Simple Moving Average (SMA), a pattern historically associated with increased selling pressure.

This ominous signal, highlighted by CryptoQuant analyst burakkesmeci, suggests that US-based investors may be losing faith in Bitcoin’s upward trajectory. The analyst warns that such a discrepancy between the CPI and its SMA has often preceded price corrections.

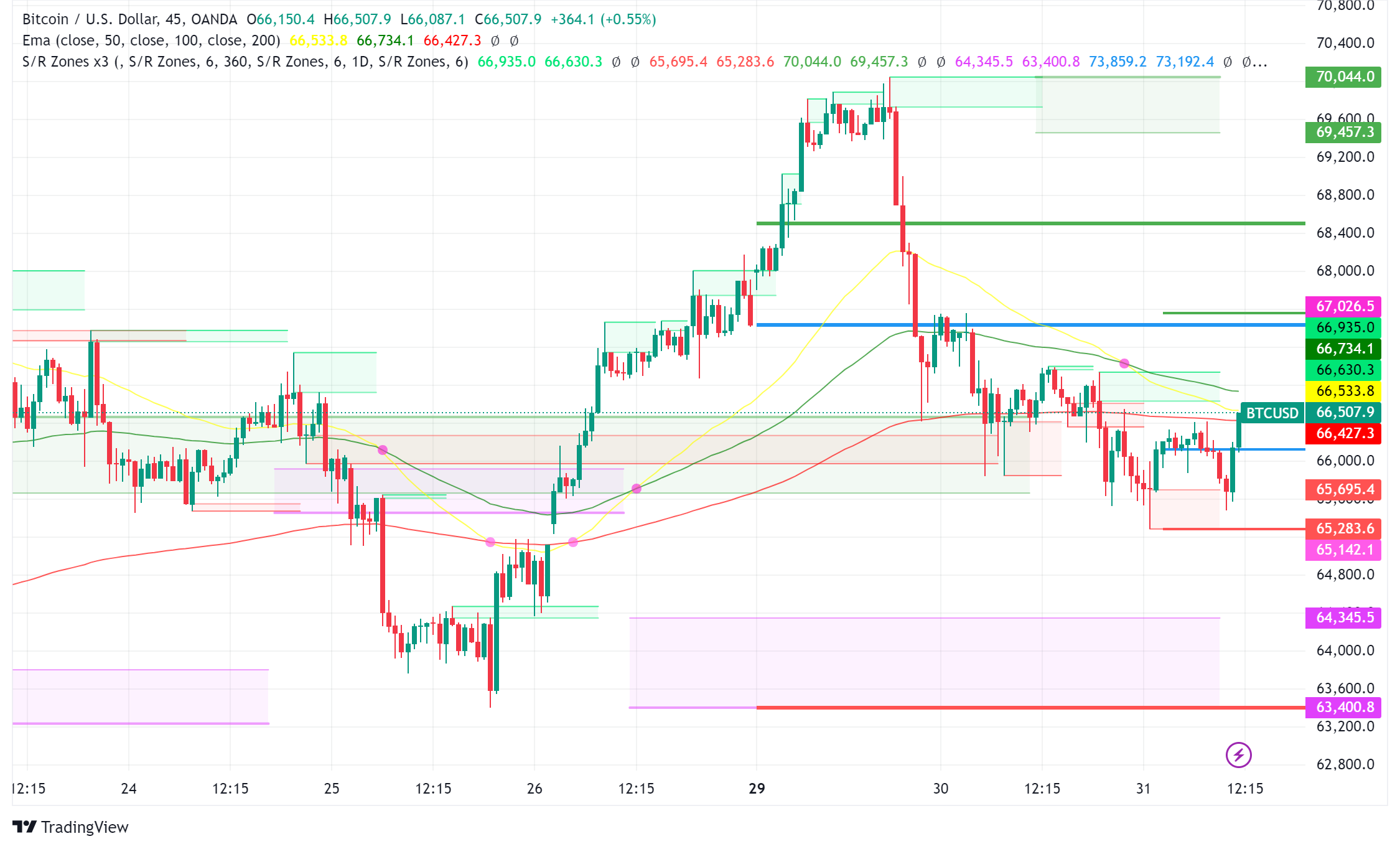

The cryptocurrency market has already responded to these cues, with Bitcoin shedding over 3% in the past 24 hours. The king of crypto is currently trading at $65,805, a far cry from the recent highs that had many investors jubilant. While trading volume has surged, indicating heightened activity, the overall market sentiment remains cautious.

Adding to the mix of uncertainties, the recent distribution of billions of dollars worth of Bitcoin by the defunct exchange Mt. Gox has introduced a new variable. While the full impact of this massive influx of Bitcoin into the market remains to be seen, it could potentially exert downward pressure on prices.

Despite the bearish undercurrents, some analysts remain steadfast in their bullish outlook. Crypto Rover, a well-known industry figure, believes Bitcoin is currently consolidating within a bullish flag pattern, suggesting a potentially explosive price surge once the pattern resolves.

However, the prevailing sentiment seems to be one of caution. The combination of a bearish CPI, price declines, and the looming shadow of Mt. Gox’s Bitcoin distribution has created a perfect storm of uncertainty for Bitcoin investors. As the market navigates these choppy waters, traders and investors alike are closely monitoring the situation, bracing for potential volatility.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM