NZD to USD Rate Stabilizes Before Resuming the Decline?

The USD to NZD exchange rate has experienced significant volatility, but it has stabilized this week with the price becoming overbought.

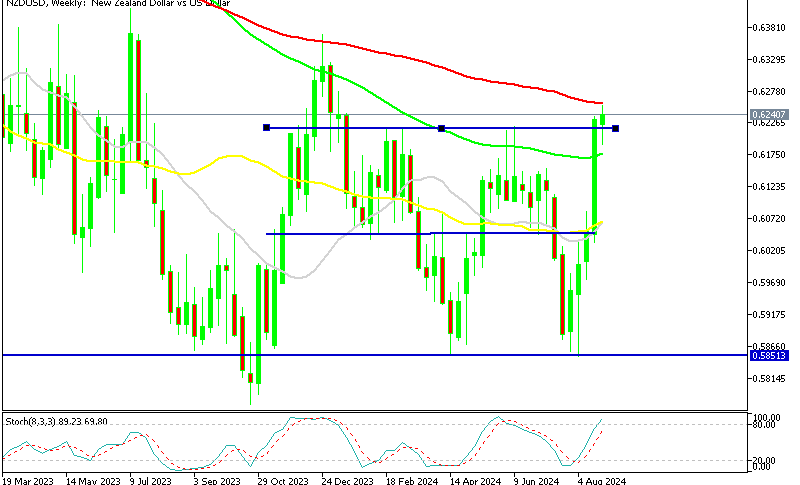

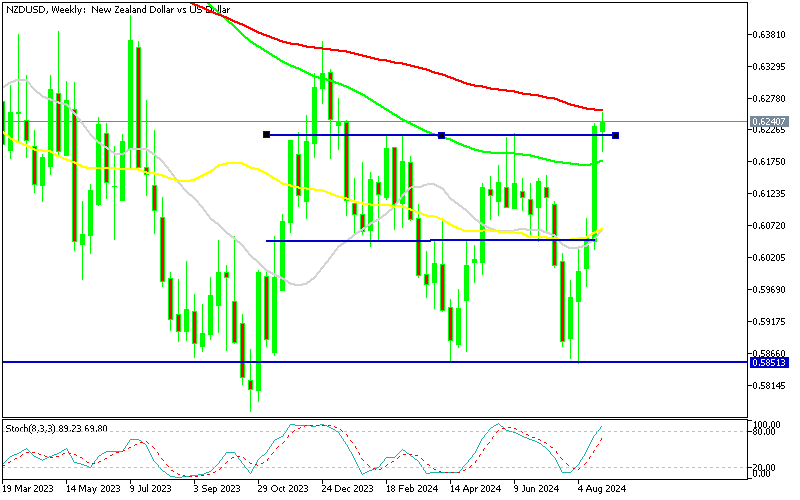

The USD to NZD exchange rate has experienced significant volatility, with a 3-cent drop in July followed by a 4-cent increase, but it has stabilized this week. The recent upward momentum has slowed just below the 100 simple weekly SMA (green), suggesting that the bullish trend may be losing steam and a bearish reversal will likely follow.

NZD/USD Chart Weekly – Buyers Slowing ahead of the 100 SMA

Last week, buyers managed to push the price above the 0.6220 resistance level in NZD/USD , which was the highest point in 2024 prior to the breakout. However, this week’s gains have been modest as buyers are wary of the 100 smooth SMA (red) on the weekly chart—a critical resistance level that has previously triggered bearish reversals in 2022 and 2023. Currently, a bearish reversal pattern appears to be forming on the weekly timeframe chart, with the stochastic indicator showing overbought conditions. Historically, this has been a reliable signal for upcoming bearish reversals whenever the stochastic has reached overbought levels.

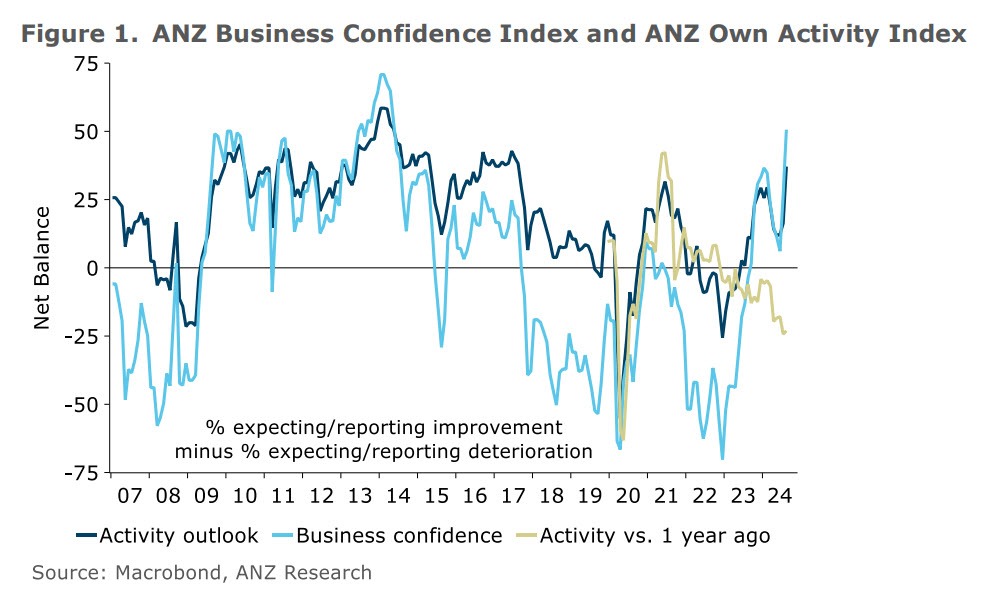

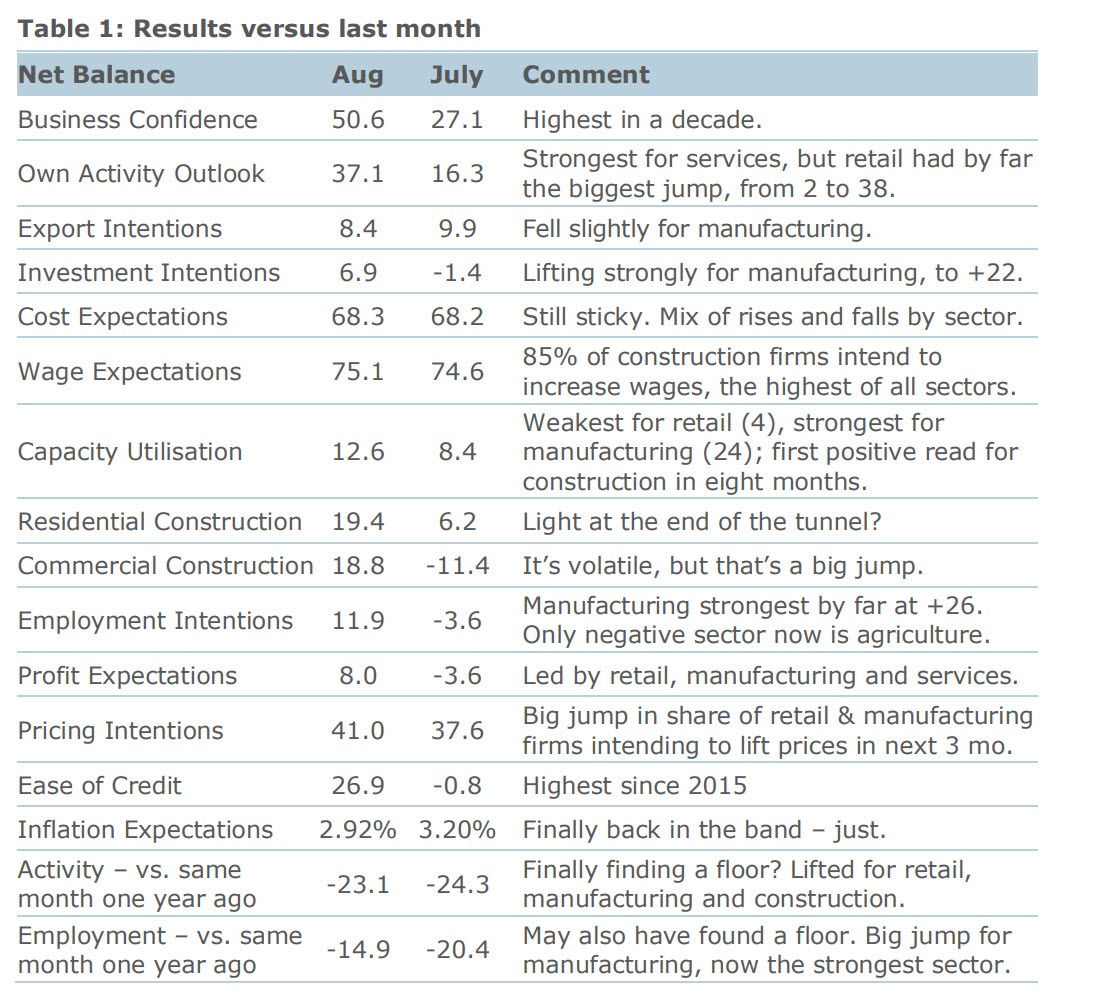

The recent increase in NZD/USD has been primarily driven by a weakening USD, with the market largely ignoring the more dovish stance of the Reserve Bank of New Zealand (RBNZ). The RBNZ is expected to lower rates by 25 basis points at its October meeting, with a total of 74 basis points of easing anticipated by the end of the year, including a 50 basis point cut projected for December. Last night we had the ANZ Business Confidence indicator, which has been on a declining trend, but showed an unexpected jump in July, so the interest was high to see if last month’s number was real or if it was a fluke.

ANZ Business Confidence Report for August![ANZ]()

- ANZ business outlook for August 50.6 points versus 27.1 points last month. 10 year high.

- Own activity 37.1 points versus 16.3 points last month. 7-year high

- Experienced own activity rose 1 point to -21, remaining weak.

- Confidence and activity expectations were high even before the Reserve Bank’s OCR cut.

- Pricing intentions increased 3 points to 41% of firms planning price hikes in the next three months.

- Planned price increase rose from 1.4% to 1.6%.

- Inflation expectations fell from 3.2% to 2.9%, the first sub-3% reading since July 2021.

NZD/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM