Dax and Meta Stock Tumble 2% Today After Record Highs

Today stock markets are showing a mixed picture, with the Dax index and the Meta stock losing around 2% of the value.

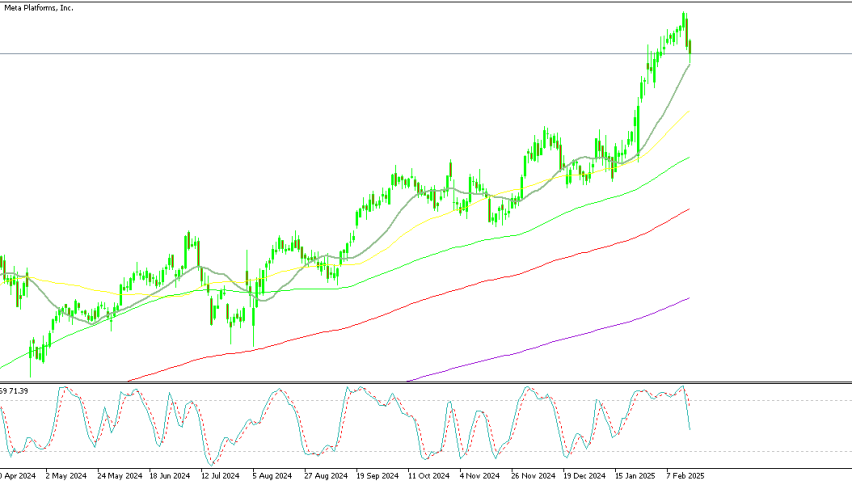

Live META Chart

[[META-graph]]Today stock markets are showing a mixed picture, with the Dax index and the Meta stock losing around 2% of the value.

The shares of Meta corporation were on a strong bullish trend since October 2022 when the rice was at $88, and kept surging until Friday last week, when they peaked at $740. But the shares reversed lower yesterday losing around 3% and today the decline continues, with the price shedding another 2% and dipping below $700 as profit taking kicks in.

Today’s stock market heatmap presents a mixed outlook across various industries. The technology sector saw slight declines, with Microsoft (MSFT) slipping 0.25%, while Nvidia (NVDA) posted a gain of 1.5%. The semiconductor industry displayed uneven performance. Analog Devices (ADI) recorded a notable surge of 4.30%, whereas AMD faced a marginal decline of 0.5%. Meanwhile, the consumer cyclical sector demonstrated strength, highlighted by Tesla (TSLA) rising by 3%. However, investor sentiment toward Amazon (AMZN) appeared divided, as the stock fell by 1%.

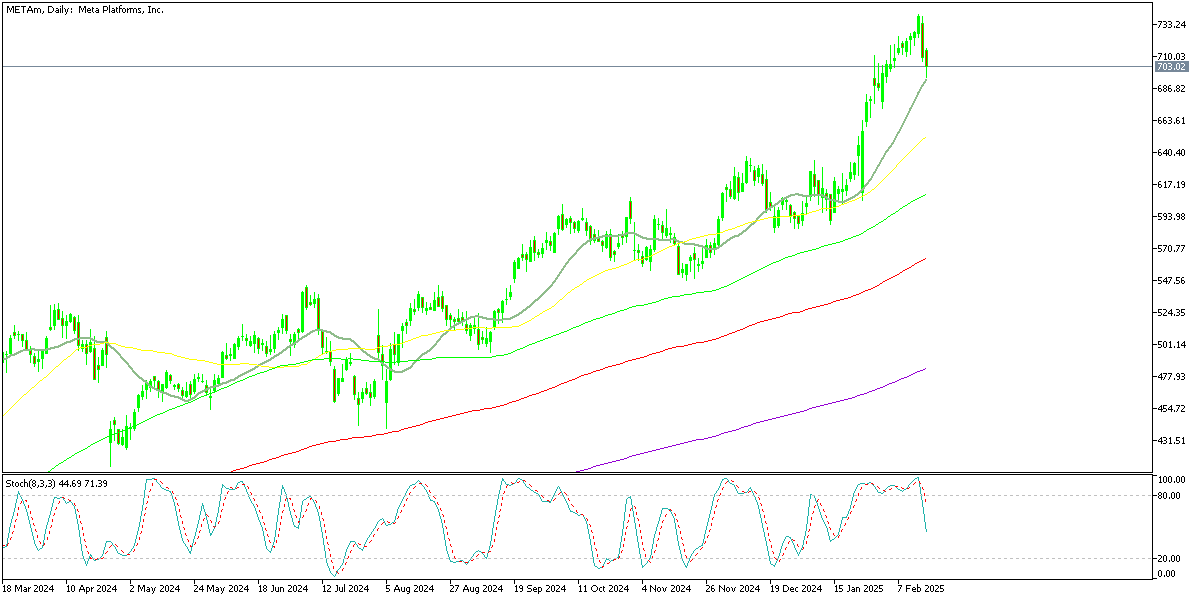

Dax Index Chart Daily – Forming A Big Bearish Candlestick

The European stock market in general experienced a widespread decline, with the STOXX Europe 600 falling nearly 1%. This downturn reflected a broader trend of market caution and investor uncertainty. Germany’s DAX suffered the most significant loss among the major indices, dropping by 1.80%. The sharp decline was likely driven by sector-wide selloffs, which contributed to the index’s weak performance.

France’s CAC 40 and Spain’s IBEX 35 also recorded notable losses, signaling a broader sentiment of caution among investors. These declines suggest that market participants are growing wary of potential economic challenges and external pressures. The UK’s FTSE 100 experienced a relatively smaller drop of 0.62%. This milder decline may have been supported by the resilience of commodity stocks, which helped cushion the overall market performance. Italy’s FTSE MIB showed the smallest decline at 0.53%, indicating a level of relative stability in the Italian market compared to its European counterparts.

Closing Levels for Main European Bourses

Key Index Performance

- STOXX Europe 600: Closed at 552.10 points, down −5.07 (0.91%).

- German DAX-INDEX: Closed at 22,433.63 points, down −410.87 (1.80%).

- France CAC 40: Closed at 8,110.54 points, down −96.02 (1.17%).

- UK FTSE 100: Closed at 8,712.53 points, down −54.20 (0.62%).

- Spain IBEX 35: Closed at 12,929.40 points, down −214.50 (1.63%).

- Italy FTSE MIB: Closed at 38,348.16 points, down −205.99 (0.53%).

Dax Index Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM