Is JSE Open Today? Check the Latest Market Status

So, “Is the JSE open today?”—no. The JSE is closed on Monday, April 21, for Easter Monday. Trading resumes on Tuesday

Quick overview

- The JSE is closed on April 21 for Easter Monday and will reopen on April 22 at 9:00 AM SAST.

- The JSE Top 40 Index closed at 82,461, just below a critical resistance level of 83,130 after a positive week.

- Key trading levels to watch include a buy zone between 81,300 and 80,540, with a breakout level at 83,410.

- Investors should be cautious of early volatility as liquidity returns post-holiday.

So, “Is the JSE open today?”—no. The JSE is closed on Monday, April 21, for Easter Monday.

Trading resumes on Tuesday, April 22, at 9:00 AM South Africa Standard Time (GMT+2) and runs until 4:50 PM.

The JSE doesn’t close for lunch on normal trading days and operates almost 8 hours a day. The long weekend comes after a volatile but positive week for local markets, especially the JSE Top 40 Index which closed on Friday, April 19, at 82,461.

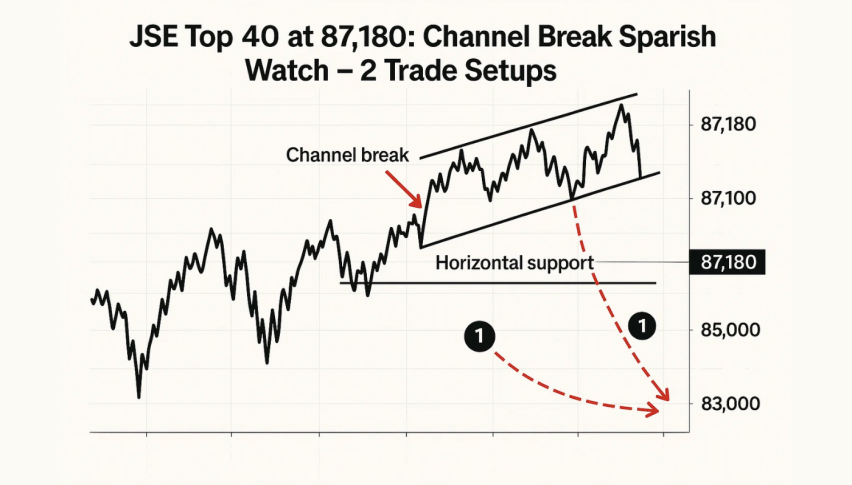

Friday’s Close and Technical Context

The South Africa Top 40 Index finished last week just below a critical resistance level of 83,130 after a strong rally from April’s low of 74,938. Price is now in a key decision zone—between the 23.6% Fibonacci retracement level of 81,306 and resistance of 83,410.

A break above this zone would likely mean continuation to 84,250 or even 85,390. Below 80,000 and we go cautious. The 50-period EMA of 80,540 has held so far and may be the first line of defence for the bulls.

-

Last Close (April 19): 82,461

-

Next Market Open: April 22, 9:00 AM SAST

-

Key Resistance: 83,410

-

Dynamic Support: 80,540 (50 EMA)

What to Watch

With the JSE opening on Tuesday, investors will be looking at global risk sentiment, SA macro data and follow through on last week’s up move. The MACD is showing fading momentum so a short pause is healthy before another move up.

Quick Trade Setup:

-

Buy Zone: 81,300–80,540

-

Breakout Level: 83,410

-

Targets: 84,250 → 85,390

-

Stop Loss: Below 80,000

Don’t chase the price, wait for momentum to confirm. Expect some early volatility when liquidity returns after the holiday.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account