AUD/USD Stuck Below 100 SMA as Australia Q1 Inflation Holds Steady

AUD/USD finds temporary lift from tariff delays and the Australian CPI inflation release, but key resistance caps momentum.

Quick overview

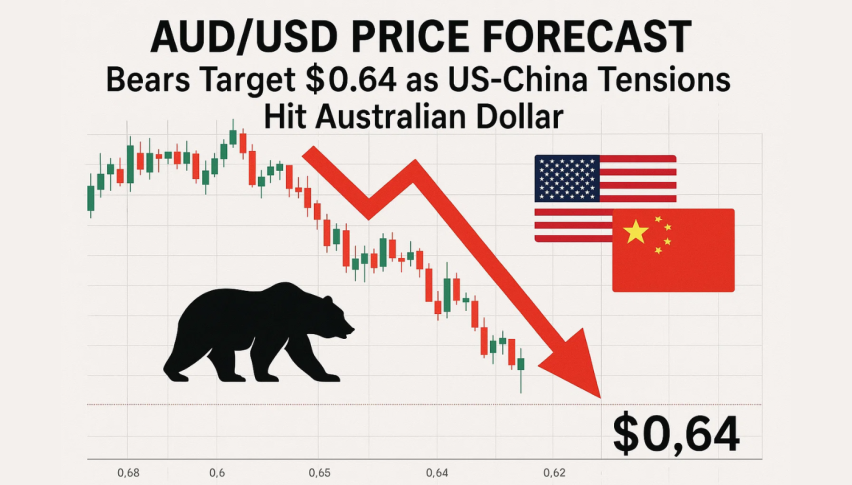

- The Australian dollar (AUD) has experienced a significant decline against the US dollar (USD), dropping nearly 8 cents in late 2024 and an additional 5 cents in early April 2025.

- A temporary lift in the AUD/USD exchange rate was driven by delays in US trade tariffs and steady Australian CPI inflation data, reaching the 0.6440 range.

- Despite this rebound, the pair faced strong resistance at the 100-day simple moving average, limiting further upward momentum.

- Mixed inflation data complicates the Reserve Bank of Australia's policy outlook, suggesting potential for a rate cut if economic growth continues to weaken.

AUD/USD finds temporary lift from tariff delays and the Australian CPI inflation release, but key resistance caps momentum.

The Australian dollar (AUD) has endured a prolonged slump against the US dollar (USD), having dropped sharply by nearly 8 cents during the final quarter of 2024, followed by another 5-cent decline in early April. The slide was severe enough to push the AUD/USD pair below the psychological 0.60 level, albeit briefly, before staging a modest recovery.

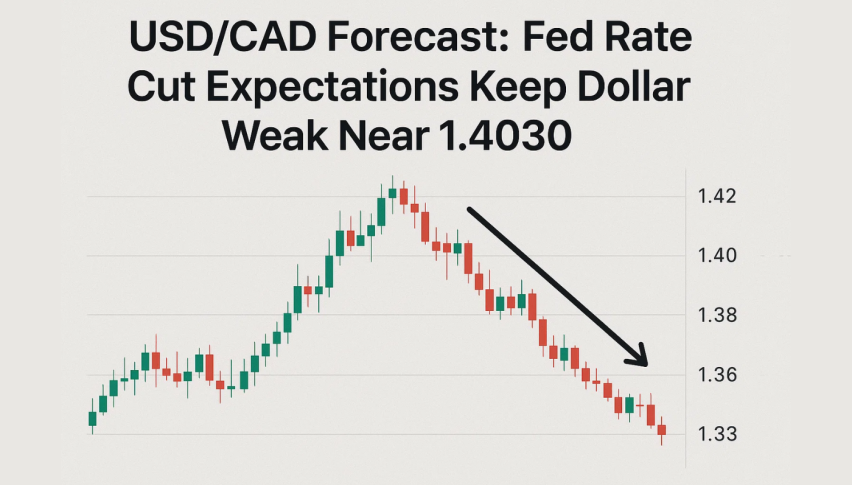

This recent rebound was largely driven by a delay in the implementation of US trade tariffs, which momentarily boosted risk appetite and allowed the AUD/USD exchange rate to climb back into the 0.6440 range. However, the upside has been limited, as the pair ran into firm resistance at the 100-day simple moving average (SMA), marked in red on daily charts. The technical ceiling has so far proven effective in halting upward momentum.

AUD/USD Chart Daily – The 100 SMA Stands as Resistance

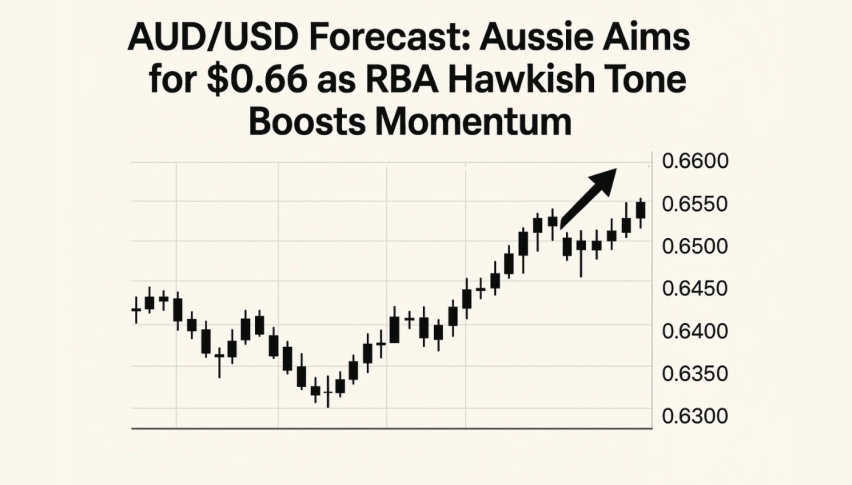

Early this morning, markets digested Australia’s Consumer Price Index (CPI) data for Q1 2025, including the month of March. The headline annual inflation figure held steady at 2.4% year-on-year, in line with the prior quarter but slightly above consensus expectations. The AUD/USD pair saw a brief 20-pip lift in response to the data release, suggesting modest optimism around inflation stability. However, the bounce was short-lived, and the pair remained pinned below the 100-day SMA—an indication that broader bearish pressures still dominate.

Australia Q1 2025 Inflation Report — Summary & Takeaways

Headline CPI (y/y):

- Rose 2.4% year-on-year in Q1 2025

- In line with Q4 2024’s annual pace of 2.4%

- Slightly above expectations of 2.2%

Headline CPI (q/q):

- Increased by 0.9% quarter-on-quarter

- Markedly higher than Q4’s 0.2%

- Consensus expectations were not explicitly stated, but 0.9% suggests a noticeable acceleration

Trimmed Mean CPI (Core Inflation Measure):

- 2.9% y/y, matching expectations

- Lower than Q4 2024’s 3.2%

- 0.7% q/q, also as expected

- Higher than the prior 0.5% q/q, indicating some short-term upward pressure

Weighted Median CPI (Alternative Core Measure):

- 3.0% y/y, slightly above expectations of 2.9%

- Down from 3.4% y/y in the previous quarter

- 0.7% q/q, in line with forecasts

- Up from 0.5% q/q in Q4 2024

Australia’s Q1 2025 inflation data reveals a mixed picture: while headline inflation held steady at 2.4% y/y and came in just above expectations, core inflation measures such as the trimmed mean and weighted median showed continued easing on an annual basis. However, both posted higher quarterly increases than in Q4, pointing to some recent momentum in price growth.

The data slightly complicates the Reserve Bank of Australia’s (RBA) policy outlook, but the overall deceleration in core inflation suggests the RBA may still have scope to consider a rate cut in May—particularly if growth data continues to soften.

Conclusion:

While the Australian dollar has gained some reprieve from tariff-related sentiment and steady inflation, technical resistance and a lack of convincing economic momentum continue to limit its recovery. Until AUD/USD can break decisively above the 100-day moving average, any rallies may remain short-lived.

AUD/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account