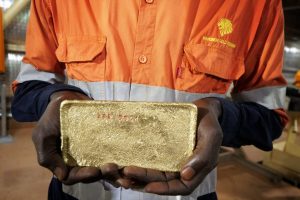

Gold Sparks at $3,400 per once despite Formal talks between U.S-China

Gold prices continued to surge Wednesday as investors positioned themselves ahead of the Federal Reserve's policy statement

Quick overview

- Gold prices surged as investors reacted to upcoming Federal Reserve policy statements and geopolitical risks.

- The Federal Open Market Committee is expected to maintain interest rates between 4.25% and 4.50% during its meeting.

- Gold's price volatility has been influenced by trade tensions and significant market movements in China.

- President Trump announced plans for new taxes on overseas products and drug-related items in the pharmacy sector.

Gold prices continued to surge Wednesday as investors positioned themselves ahead of the Federal Reserve’s policy statement and processed new trade-related and geopolitical risks.

The Federal Open Market Committee is expected to keep interest rates between 4.25% and 4.50% when it concludes its two-day meeting Wednesday afternoon, U.S. time.

As Chair Jerome Powell speaks shortly after, markets will be watching for any shifts in tone in response to recent signs of persistent inflation and declining consumer demand.

Gold spiked owing to high uncertainty regarding trade wars. Gold is usually used as a shield against financial market volatility. The precious metal peaked in the past weeks, only to be dethroned several times.

Gold’s exorbitant price seemed to be the talk of the town in China, and the People’s Bank started initiating plans to cooperate with the Gold Exchange. Diverting some attention, President Trump had some controversial statements to forward for discussion. He seems to endorse higher taxes on overseas products, films end up making a Cold War strategy.

The Fed has taken significant decisions at its headquarters, and everyone is keen on their approach to stagnation. It can be anticipated that they will start posting interest-dropping rates shortly.

Trump said he will release new taxes on drug-related items in the pharmacy business in the next two weeks.

According to research released last week by US investment bank Goldman Sachs, the SGE and Shanghai Futures Exchange flows have become more significant to gold’s recent price movements than US Comex futures and options.

The analysis noted that the record highs and steep declines in gold over the past month “almost all occurred around the opening hours of the Chinese market.”

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM