EOS Bullish Forecast: Sets Up for Major Rally After Support Activation

Quick overview

- Despite current bearish pressure, EOS maintains a bullish medium to long-term outlook.

- The recent decline offers a tactical opportunity for traders to accumulate positions at favorable price levels.

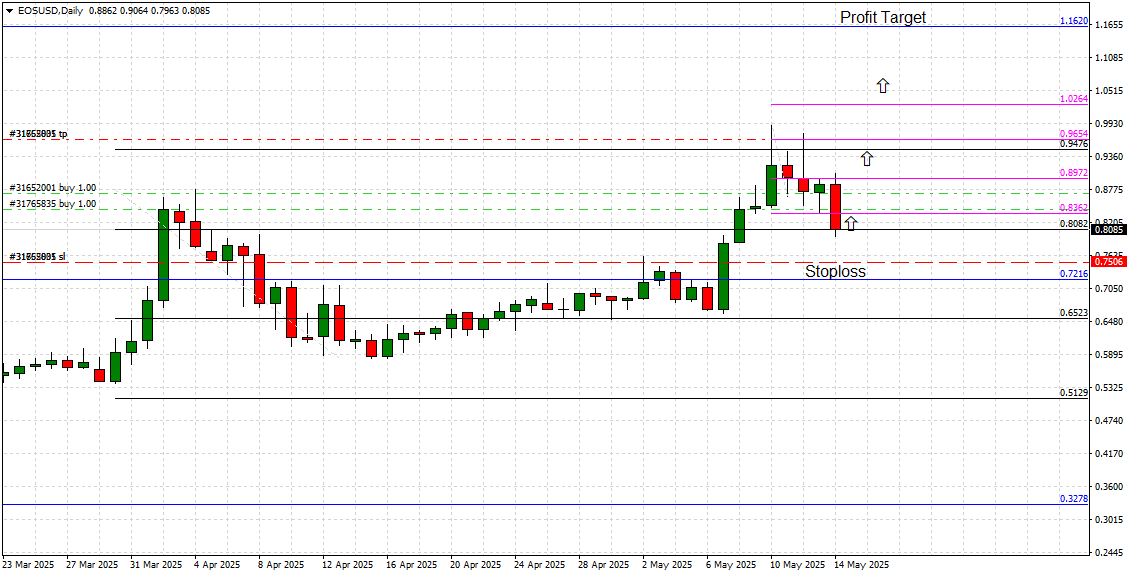

- Key support at $0.8082 has been validated, indicating a potential for a bullish rebound towards resistance levels of $0.9654 and $1.1620.

- Ongoing technological advancements and network upgrades further enhance EOS's long-term investment appeal.

Despite today’s notable bearish pressure, EOS continues to exhibit a promising medium to long-term bullish structure.

The recent decline presents itself as a tactical opportunity for traders and investors alike to accumulate positions at reasonable price levels before the next leg higher. With a resilient support base and a strong upward trajectory in play, EOS remains one of the more technically appealing altcoins in the crypto market at this stage.

Key Technical Levels

-

Major Key Support: $0.8082 (Activated)

- Local Key Support: $0.8362 (Activated)

-

Secondary Target / Local Key Resistance: $0.9654

-

Primary Target / Major Key Resistance: $1.1620

EOS Price Action Momentum

Today (May 14), EOS experienced a firm downside move, temporarily dropping from the recent highs of $0.8972 to touch the critical support level at $0.8082. As seen on the attached chart, this key support had been marked as a vital inflection point, and price action indeed respected it with precision. The moment the market reached this level, a rejection ensued, validating the strength of this support zone and confirming its role as a launching platform for the next bullish wave.

It’s important to highlight that despite today’s temporary bearish momentum, the broader price structure remains bullish. EOS has been forming a series of higher highs and higher lows since the April rebound, and this pullback fits well within a healthy uptrend. Such corrective moves are typical in trending markets and often offer high-reward opportunities for tactical positioning.

Looking ahead, the next significant resistance level lies at $0.9654, a price point that aligns with previous swing highs and Fibonacci projections. Breaking above this level will open the way for a rally towards the primary target at $1.1620, which also marks a major technical resistance zone, overlapping historical price clusters and key Fibonacci extensions.

Technology and Vision

EOS remains one of the most ambitious blockchain projects in the crypto space, known for its scalable smart contract platform that enables decentralized applications (dApps) with zero transaction fees. The EOSIO protocol, developed by Block.one, was designed with performance and user experience at its core, addressing key limitations faced by earlier networks such as Ethereum.

In recent months, the EOS network has made substantial progress in its roadmap, focusing on expanding partnerships, integrating interoperability solutions, and refining its governance model. The upcoming protocol upgrades aim to significantly boost transaction throughput while minimizing latency — positioning EOS as a preferred platform for high-frequency dApps, DeFi protocols, and NFT marketplaces.

Forecast Summary

Despite today’s corrective dip, EOS remains firmly bullish in its medium to long-term outlook. The activation of the $0.8082 support level presents a strategic accumulation opportunity for traders aiming to capitalize on the next upward move. A successful rejection at this level, followed by a bullish rebound, is expected to drive EOS towards the local resistance at $0.9654, and ultimately to the primary target at $1.1620.

The underlying technology, ongoing development, and network upgrades continue to strengthen the long-term investment case for EOS, offering both speculative upside and utility-driven demand.

Recommendation:

Monitor the price action around $0.8082. As long as this support holds, consider scaling into long positions with a partial take-profit at $0.9654 and the remainder targeting $1.1620.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account