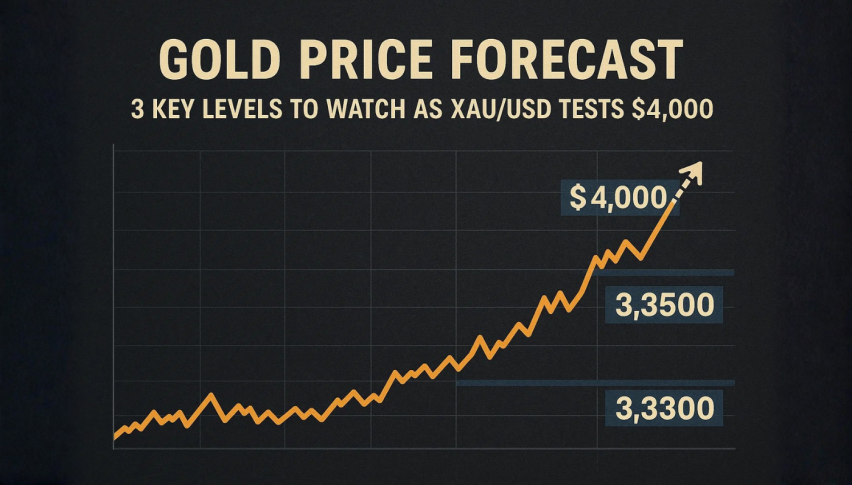

Gold Price Prediction Weekly: XAU Regains Shine as Global Inflation and EU Tariffs Persist

Gold prices are back on the rise after a brief correction, as renewed inflation concerns and a US credit rating downgrade boost demand for..

Quick overview

- Gold prices are rising again after a brief correction, driven by renewed inflation concerns and a US credit rating downgrade.

- Following a drop of over $180, gold rebounded above $3,360 as investors sought safe-haven assets amid fiscal instability.

- Technical support from the 50-day Simple Moving Average has held firm, indicating potential for further gains.

- Emerging inflation pressures suggest that gold could reach new all-time highs if current trends continue.

Live GOLD Chart

Gold prices are back on the rise after a brief correction, as renewed inflation concerns and a US credit rating downgrade boost demand for the safe-haven asset.

Gold’s Retreat from April Highs

After soaring to a record high of $3,500 per ounce in April, spot gold (XAU/USD) began to retreat as risk sentiment improved globally. This reversal came in the wake of a US-China trade agreement, which helped ease market fears of geopolitical tension. The improved mood saw investors pivot from traditional safe-haven assets like gold and government bonds to equities and risk-driven instruments.

During the past week, gold prices dropped over $180, briefly testing support at $3,120 before closing closer to $3,200—a weekly drop not seen since November. The shift reflected broader portfolio adjustments as traders welcomed a de-escalation in global trade hostilities under former President Donald Trump’s mediated truce.

Moody’s Downgrade Sparks Safe-Haven Bid

Despite the dip, the gold market found renewed buying interest late last week. The trigger came from Moody’s Investors Service, which downgraded the United States’ long-held ‘AAA’ credit rating to ‘AA1’. The downgrade added fuel to an already weakening US dollar, sending investors back toward gold in search of protection from fiscal instability.

This resurgence pushed gold above $3,360 by the end of the week, signaling a potential resumption of the bullish trend, especially as macroeconomic risks continue to brew.

Gold Chart Daily – Technical Support Holds Firm

The 50-day Simple Moving Average (SMA), represented in yellow on daily charts, has so far served as a resilient dynamic support. While momentarily breached, gold never closed below this level during the recent downturn. The SMA’s support was reaffirmed on Friday, when gold rebounded strongly from that level.

This technical bounce was further supported by new inflation data, particularly from the UK and Canada, which showed that consumer prices are rising again. This reinforces the narrative that inflation is not yet under control, and continues to bolster gold’s safe-haven appeal.

Inflation Pressures Resurface

Emerging signs of renewed global inflation—amid rising prices from major multinational companies—are strengthening the argument for persistent stagflation risks. The combination of slow growth and high inflation historically benefits commodities like gold, which tend to outperform in such macroeconomic environments.

Friday’s $70 surge in gold came as investors began to reassess inflation forecasts, raising speculation that gold could push to a new all-time high this week if momentum continues.

Conclusion: After a sharp correction triggered by renewed risk appetite, gold is once again gaining momentum, driven by a mix of technical support, downgraded US creditworthiness, and a resurgence of global inflation fears. If current conditions persist, XAU/USD may retest the $3,500 level and possibly carve out a fresh high.

Gold Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account