Solana (SOL) Rejected at $186.20 — Bearish Pressure Builds as Geopolitical Tensions Rise

Quick overview

- Solana (SOL) faced rejection at the $186.20 resistance level, confirming its strength and triggering a retracement.

- The token is now approaching the key support level at $166.73, with bearish sentiment intensifying due to global tariff war tensions.

- A breakdown below $166.73 could lead to a significant decline towards $138.12, while a recovery above $186.20 seems unlikely.

- Current market momentum favors bears, with consistent lower highs and weakening demand indicating potential further downside.

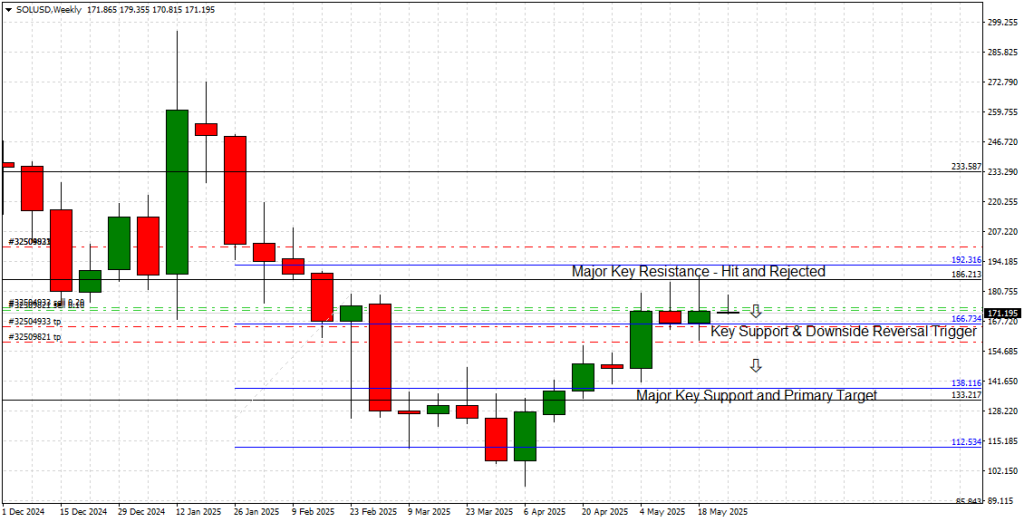

Solana (SOL) has delivered exactly as anticipated in our May 9, 2025 forecast where we highlighted the $186.20 Major Key Resistance as a critical inflection point for the token’s bullish momentum.

As expected, Solana advanced directly into this key resistance but was swiftly rejected, confirming the ceiling’s strength and triggering a retracement move.

In line with our projection, Solana is now approaching the Key Support at $166.73. With escalating global tariff war tensions injecting fresh uncertainty into the crypto market, our bearish conviction has intensified. The technical setup suggests Solana is teetering on the edge of a decisive breakdown — one that could trigger a substantial downside extension toward $138.12 in the coming sessions.

Breakout Levels and Technical Outlook

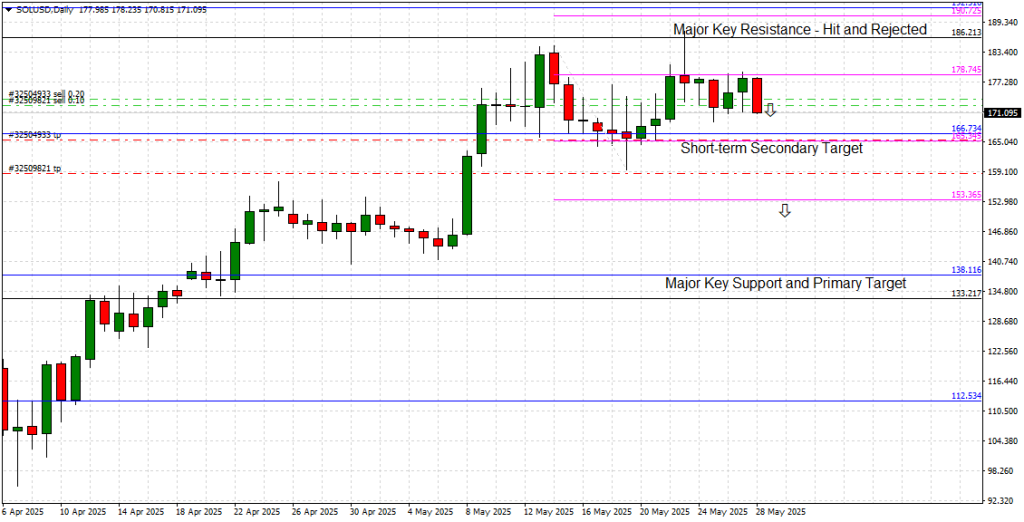

Both the Weekly and Daily charts (attached) clearly display Solana’s rejection at $186.20. Despite several bullish attempts, buyers were unable to sustain momentum above this pivotal resistance, with price action forming long upper wicks and lower highs.

Key Levels to Watch:

-

Major Key Resistance: $186.20

-

Immediate Key Support / Downside Trigger: $166.73

-

Short-Term Secondary Target: $165.35

-

Major Key Support / Long-term Bearish Target: $138.12

A clean daily or weekly close below $166.73 would confirm a fresh bearish breakout, opening the path for an extended corrective move toward the Major Key Support at $138.12.

The invalidation of this bearish scenario would require a high-authority close above $186.20, a move that appears increasingly unlikely given the current technical and macroeconomic backdrop.

Price Action and Market Momentum

Price action momentum has shifted decisively in favor of the bears. The Daily chart reveals a consistent pattern of lower highs since Solana’s rejection at $186.20. RSI indicators have rolled over from bullish territory, now trending lower without reaching oversold conditions — signaling room for further downside.

Recent candlestick formations confirm market hesitation and seller dominance. The market has repeatedly tested the $166.73 level without staging a meaningful recovery, indicating weakening demand and growing pressure for a breakdown.

If this level gives way, expect a rapid move toward $138.12 as broader market sentiment continues to sour.

Technology and Ecosystem Update

On the technology front, there have been no major protocol developments or integrations since our last report. Solana continues to position itself as a leader in high-throughput, low-cost blockchain infrastructure, with strong activity in DeFi and NFT markets.

However, these fundamentals have been overshadowed in recent sessions by mounting macroeconomic risks. The rapidly escalating tariff war tensions have unnerved risk markets, including cryptocurrencies, as traders reduce exposure to speculative assets. This shift further amplifies the bearish technical structure now forming in Solana.

Conclusion: Bearish Outlook Confirmed

In summary, Solana’s rejection at $186.20 validates our previous forecast. The market has since weakened, with price action gravitating toward $166.73 — a critical support level. A clean breakdown below this threshold would confirm bearish continuation, targeting $153.36 in the near term, and $138.12 as the primary downside objective.

Unless bulls can reclaim $186.20 — an increasingly improbable scenario — the bearish bias remains firmly in play.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM