Ethereum Surges Above $2,750: $2.4B Options Expiry and Institutional Adoption Drive Bullish Momentum

Ether's recent 5% daily gain positions the cryptocurrency for a potential breakout toward $2,900, supported by favorable options dynamics

Quick overview

- Ethereum is currently trading above $2,750, marking a 5% increase in the last 24 hours and showing strong upward momentum.

- Corporate interest in Ethereum is rising, highlighted by BTCS Inc.'s acquisition of 3,450 ETH and SharpLink Gaming's $425 million private placement for an Ethereum treasury.

- A significant $2.4 billion Ethereum options expiry is set to drive price movement, with a majority of call options favoring bullish outcomes.

- Technical indicators suggest Ethereum is on track for a breakout towards the $2,900 target, supported by institutional adoption and favorable market conditions.

Ethereum ETH/USD currently trading above $2,750 indicates a noteworthy 5% increase over the past 24 hours and has its best posture in more than three months. With significant resistance levels in the $2,880-$3,066 zone acting as the next main target, the technical setup of the cryptocurrency indicates a likely continuation of this upward momentum.

Corporate Treasury Adoption Signals Institutional Shift

With BTCS Inc.’s recent acquisition of 3,450 ETH for $8.42 million highlighting increasing corporate interest, the institutional scene for Ethereum is fast changing. Representing a 38% rise from Q1 2025, the blockchain infrastructure company increased its Ethereum holdings to 12,500 ETH, therefore bringing their overall bitcoin assets to $38.42 million.

The institutional premise is validated even further by SharpLink Gaming’s announcement of a $425 million private placement to start an Ethereum treasury approach. Although this action conforms to the corporate Bitcoin treasury playbook, it is applied to Ethereum, hence possibly promoting more institutional use.

Despite the 21% drop year-to- date, Ethereum ETFs have drawn $287 million in net inflows between May 19 and May 27, proving ongoing institutional enthusiasm. “Ethereum benefits from having clearer institutional investment thesis (programmable money, DeFi infrastructure),” co-founder of Redstone Marcin Kazmierczak notes, “positioning it as the primary beneficiary when institutions eventually diversify beyond pure Bitcoin exposure.”

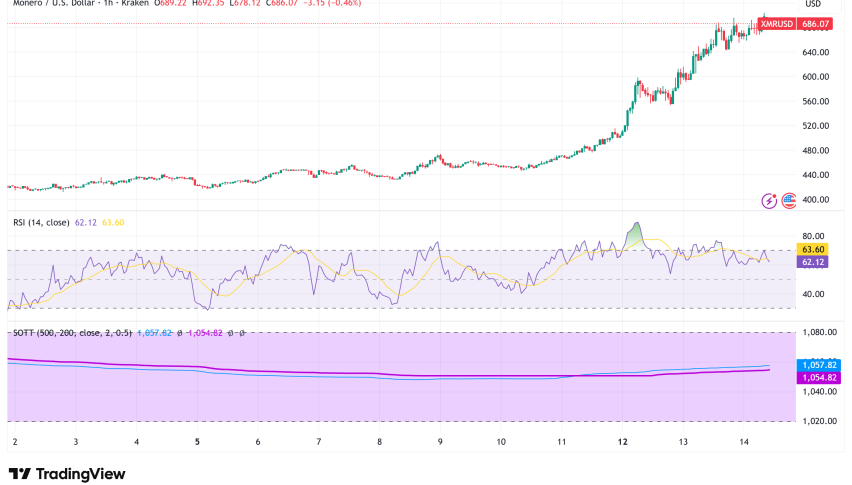

ETH/USD Technical Analysis Points to Bullish Breakout Above Key Resistance

With little lower shadow and a small bullish candle, the daily chart indicates strong buying support at current levels. The 30-day moving average maintains its upward trend while the MACD indicator shows diminishing downward velocity above the zero line, a typically good indication for continuous price gain.

With most immediate support coming from a rising trendline strengthened by the 50-period Exponential Moving Average (EMA), critical support levels are created at $2,540, $2,430, $2,310, and $2,200. Technical signals confirming short-term bullish dominance include the Relative Strength Index (RSI), Stochastic Oscillator, and MACD all still above neutral levels.

$2.4 Billion Options Expiry Creates Bullish Catalyst

Friday’s large $2.4 billion Ethereum options expiry acts as a major driver of price movement since market conditions strongly support optimistic results. The options structure exposes a significant disparity: 97% of the $1.1 billion in put options were positioned at $2,600 or less, so they will expire useless if ETH keeps current values above this level.

With $1.3 billion in open interest, call options rule the expiry and provide significant incentives for bulls to raise prices. The profit projections depending on price ranges show rising preference for call holders:

- $2,600-$2,700 range: Advantage for calls net $555 million.

- $2,700-$2,900 range: Net $777 million advantage for calls.

For institutional participants to keep increasing pressure on Ethereum’s price through the May 30 expiry date, this options structure offers significant incentive.

Ethereum Price Prediction: $2,900 Target Within Reach

Ethereum is positioned for a breakout above $2,740 based on present technical patterns and basic catalysts; this would set a long position setup aiming at the $2,850-$2,900 zone. Favorable options expiry dynamics, institutional adoption momentum, and technical strength taken together support this optimistic view.

Nonetheless, traders should be wary of possible sudden reversals after higher levels since liquidation data reveals notable short holdings concentrated in the $2,712-$2,780 zone that could offer transient resistance.

Macroeconomic elements could supersede technical signals in the link between the S&P 500 and ETH, therefore influencing larger market mood. Still, the road to $3,000 by June seems increasingly possible given institutional rotation could start and Ethereum’s technological benefits are becoming more clear.

With ETH spearheading this institutional diversification trend, current market dynamics point Ethereum may be approaching what analysts call “Phase 3 of the crypto bull cycle,” where Bitcoin BTC/USD strength stabilizes and capital expands across certain altcoins.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account