Avalanche (AVAX) Bearish Setup Confirmed as Key Trigger Tested

Quick overview

- Avalanche (AVAX) is experiencing renewed selling pressure, with prices slipping below critical support levels.

- The AVAX/USD pair is currently trading around $21.60, facing a potential breakdown towards $19.925 and $17.174.

- Key resistance was rejected at $25.36, confirming a bearish trend with lower highs.

- Despite its technological strengths, Avalanche's price recovery is hindered by broader market trends and reduced investor appetite.

Avalanche (AVAX) is under renewed selling pressure as price action slips below a critical downside trigger, signaling a potential continuation of the bearish momentum that’s been weighing on the cryptocurrency over the past few months.

The AVAX/USD pair is currently trading around $21.60, having rejected a key resistance zone and now threatening to accelerate losses toward lower support levels.

Let’s break down the current market setup, key technical levels, and what traders should be watching in the days ahead.

Key Breakout Levels to Watch

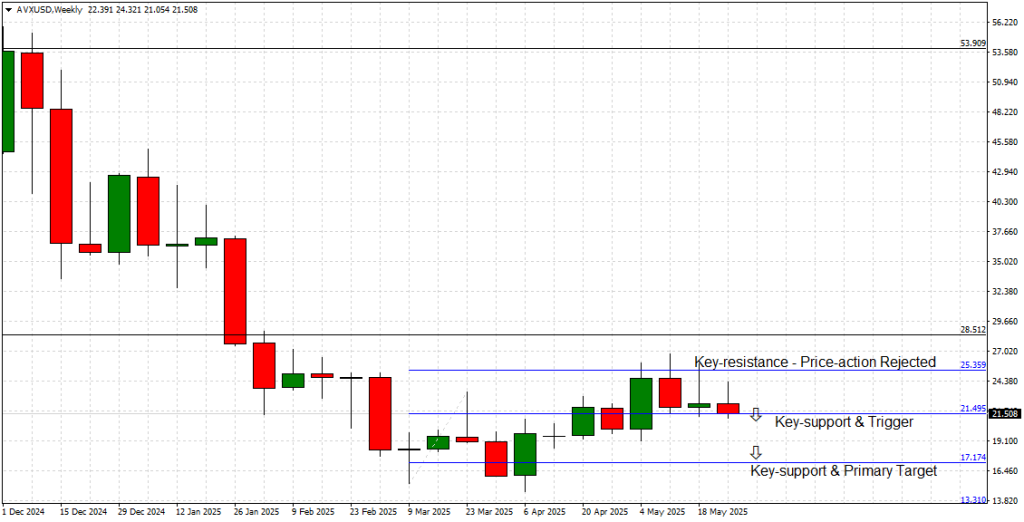

Referencing weekly chart attached:

-

Key Resistance (Rejected): $25.36 — Avalanche faced a firm rejection at this key level, confirming a lower high in the broader downtrend.

-

Key Support & Trigger: $21.495 — This critical horizontal level has now been tested. A clean bearish breakdown is likely to add pressure, setting up a new short-term downside sequence.

-

Key Support & Primary Target: $17.174 — The next major horizontal support level, marking the primary target for this potential bearish breakdown.

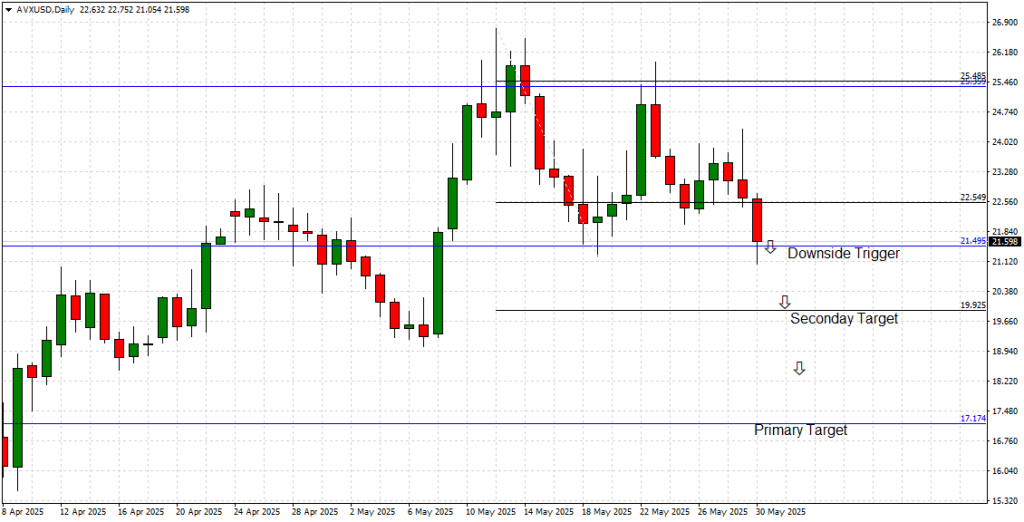

On the daily chart (Attached), additional levels come into play:

-

Downside Trigger: $21.495 — A Daily session closed below this zone, can validate a breakdown setup.

-

Secondary Target: $19.925 — An interim level to monitor for potential pauses or rebounds.

-

Primary Target: $17.174 — Coinciding with the weekly chart’s primary support level, this remains the high-probability objective for bears.

Price Action Momentum

From a technical standpoint, Avalanche has been consolidating in a narrow range over the past few weeks following a prolonged sell-off earlier in the year. The recent rejection at the $25.36 resistance zone resulted in a sequence of lower highs, maintaining the market’s bearish structure.

The decisive move towards the $21.495 downside trigger level on both the weekly and daily timeframes now opens the path to a breakdown toward $19.925, with $17.174 representing the primary bearish objective. The current potential breakdown has also formed a lower daily close, reinforcing selling momentum.

Technology & Vision Update

Avalanche remains one of the most scalable, efficient, and eco-friendly blockchain platforms in the crypto ecosystem. Built for decentralized applications (dApps) and enterprise blockchain deployments, Avalanche leverages its proprietary Avalanche consensus mechanism to deliver near-instant finality and high transaction throughput.

Key pillars of Avalanche’s value proposition:

-

Subnets Technology: Customizable blockchain networks operating within the Avalanche ecosystem, tailored for private enterprise use or public decentralized applications.

-

High TPS (Transactions Per Second): Capable of processing over 4,500 TPS, significantly outpacing competitors like Ethereum.

-

Low Fees and Eco-Friendly Consensus: Avalanche’s consensus design minimizes energy consumption while maintaining network security and decentralization.

Despite these technical strengths, AVAX’s price action has remained heavily correlated with broader crypto market trends and risk sentiment. The ongoing bear market conditions, coupled with reduced DeFi activity and cautious investor appetite, have limited Avalanche’s price recovery attempts.

On the long-term, Avalanche continues to position itself as a leading Layer-1 blockchain contender, with ongoing ecosystem development and partnerships. However, in the immediate term, technical charts suggest caution for buyers as the path of least resistance remains to the downside.

Final Thoughts

The attempted breakdown below $21.495 on both the weekly and daily timeframes confirms a bearish bias for Avalanche (AVAX) heading into June. Unless price can reject this critical support-trigger, traders should anticipate a move toward $19.925 and likely an eventual retest of the $17.174 primary support.

Technical traders can consider short setups on minor rallies toward the $22.55, while risk management should be prioritized given the market’s volatility. Stay tuned for further updates as we monitor Avalanche’s price action in the coming sessions.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM