Ripple (XRP) Poised For Bullish Reversal As Market Correction Hits Bottom

Quick overview

- Ripple (XRP) has shown resilience by defending a key support level at $2.1330 amidst broader market corrections.

- Technical indicators suggest a potential bullish reversal, with a target of $2.6656 if the price breaks above $2.255.

- Ripple's ecosystem developments, including a smart contract upgrade and the SEC dropping its legal battle, bolster medium-term bullish sentiment.

- Short-term pullbacks into the $2.20–$2.25 range present attractive long opportunities for traders.

Ripple (XRP) has been on the backfoot in recent weeks, caught up in the broader market correction driven by escalating tariff wars and risk-off sentiment across digital assets.

However, the technical structure now suggests that this correction may have run its course, with price action successfully defending a major key support level at $2.1330.

A large-scale upside reversal is now cocking up, with price action primed for a fresh bullish cycle targeting our original upside objective at $2.6656.

Key Breakout Levels to Watch

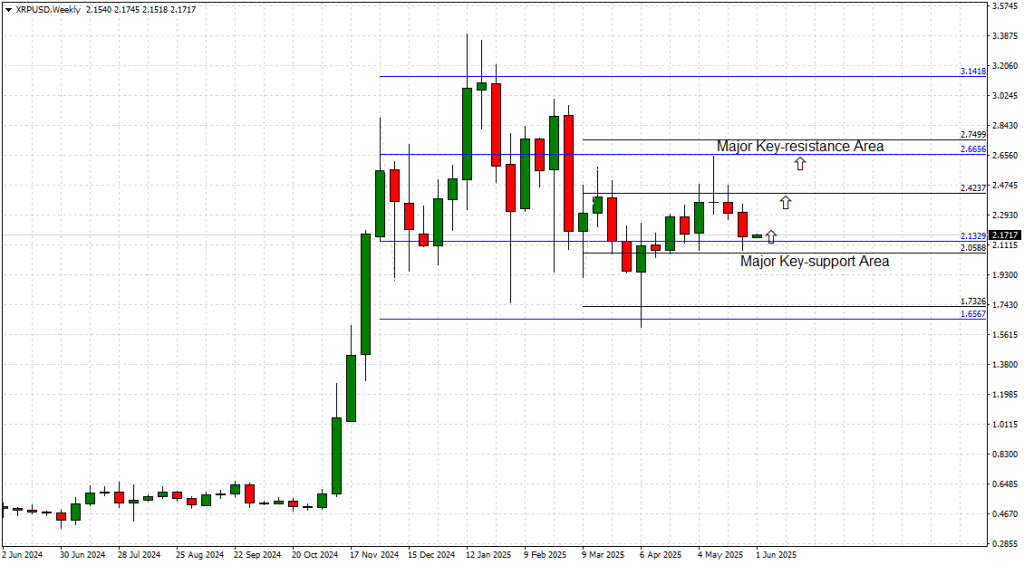

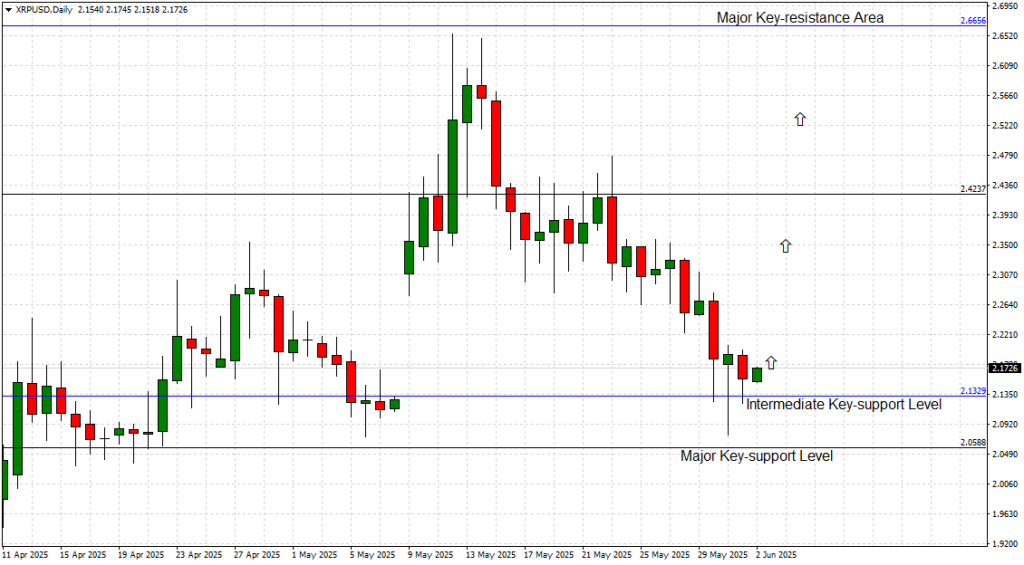

Weekly & Daily Chart:

-

Intermediate Key Support: $2.1330 — The price has tested and held this pivotal level, marking the exhaustion point of the corrective leg.

-

Inflection Point /Major Key Support: $2.0588 — A break and close below this major horizontal support would force us to re-analyze and re-position our overview of the technical situation.

-

Major Key Resistance & Primary Bull Target: $2.6656 — The next significant upside objective, representing a critical structural high from earlier in the year and a technical magnet for bullish continuation.

Price Action Momentum

After an extended corrective move off highs near $2.66, XRP printed a clean test of $2.1330, coinciding with a visible slowing of bearish momentum and early bullish tail structures on daily and 4H timeframes.

Key technical reads:

-

Bullish reversal patterns developing at $2.1330 on daily and 4H charts.

-

Momentum oscillators showing bullish divergence against price at the support.

-

Expecting a bullish breakout sequence to ignite above $2.255 — confirming the reversal structure and clearing the path toward $2.6656.

Volatility is likely to expand sharply on a confirmed break above $2.255 as liquidity builds for a move toward $2.6656.

Market Narrative & Ecosystem Developments

While macro uncertainty around tariff wars sparked the latest crypto-wide retracement, Ripple’s on-chain and ecosystem fundamentals remain resilient:

-

Ripple’s XRPL smart contract upgrade introduced native programmability, modernizing the network for institutional-grade financial products.

-

The SEC formally dropping its legal battle against Ripple has restored institutional confidence in XRP as a regulated, tradable digital asset.

-

Ripple’s new stablecoin RLUSD is gaining market traction as a compliant, enterprise-grade settlement instrument.

These factors continue to underpin medium-term bullish sentiment for XRP.

Final Thoughts

With the market correction appearing exhausted at $2.1330, Ripple is now technically primed for a decisive upside reversal. A break above $2.2550 would act as the trigger for a momentum-driven rally, with bulls targeting the major resistance at $2.6656 as the next key waypoint.

Short-term pullbacks into the $2.20–$2.25 zone would offer attractive risk-reward long opportunities, with stops logically placed below $2.0588.

This setup offers a compelling technical and narrative-driven opportunity heading into the new week.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account