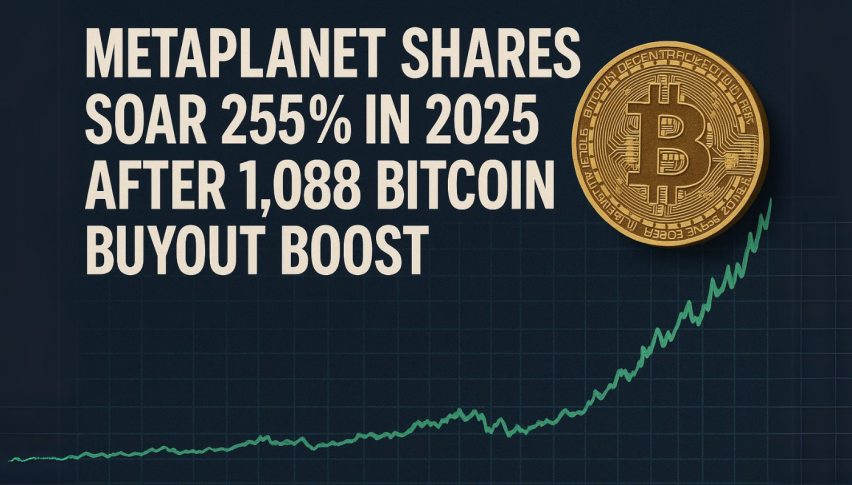

Metaplanet Shares Soar 255% in 2025 After 1,088 Bitcoin Buyout Boost

Metaplanet’s stock price went up 21% on Tuesday on the Tokyo Stock Exchange to an all-time high of 1,423 JPY.

Quick overview

- Metaplanet's stock surged 21% to an all-time high of 1,423 JPY after acquiring 1,088 Bitcoin, positioning it among the top 10 corporate Bitcoin holders.

- The company's stock has increased 255% since the start of 2025, outperforming major Japanese firms amid a crisis in Japan's bond market.

- Investors are turning to Metaplanet as a Bitcoin proxy due to instability in fixed income markets, while the company maintains transparency with Proof of Reserves for its Bitcoin assets.

- Analysts believe there is still potential for growth in Metaplanet's market net asset value despite the recent rally.

Metaplanet’s stock price went up 21% on Tuesday on the Tokyo Stock Exchange to an all-time high of 1,423 JPY. This follows the company’s recent purchase of 1,088 Bitcoin (BTC) and puts Metaplanet in the top 10 corporate Bitcoin holders. Since the start of 2025, the stock has gone up 255%.

Bond Market Chaos in Japan

While Japan’s bond market is in a “Greece-like crisis”, Metaplanet is becoming the go-to stock for investors. Over the last month, the stock has gone up 164% with the highest trading volume on the Tokyo Stock Exchange and outperforming major Japanese companies. Key points:

-

Japan’s 30-year government bond prices have dropped 45% since 2019 and yields have gone up 275 basis points to near historic highs.

-

Financial institutions are sitting on big unrealized losses on their bond holdings.

-

Investors are looking at Metaplanet as a Bitcoin proxy, seeking value in a fixed income unstable world.

Analysts say despite the big rally, Metaplanet’s market net asset value (mNAV) is still reasonable and there is more room to grow.

Transparency is Key

Unlike some of its peers, Metaplanet is being transparent by providing Proof of Reserves for its Bitcoin holdings. CEO Simon Gerovich has publicly shown on-chain verification of the company’s BTC assets. This is in contrast to Michael Saylor, founder of Strategy (MSTR) who recently criticized Proof of Reserves at the Bitcoin 2025 Conference saying it’s a security risk.

Strategy also bought 705 BTC for $75 million but the stock only went up less than 1% on Monday. Metaplanet’s transparency may be a big plus for investors as there are growing calls for accountability in crypto asset management.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM