Bitcoin (BTC): Bullish Retest Confirms Breakout, Eyes Set on $117,883

Bitcoin’s bullish momentum remains firmly intact following its breakout above the key inflection point at $101,276.

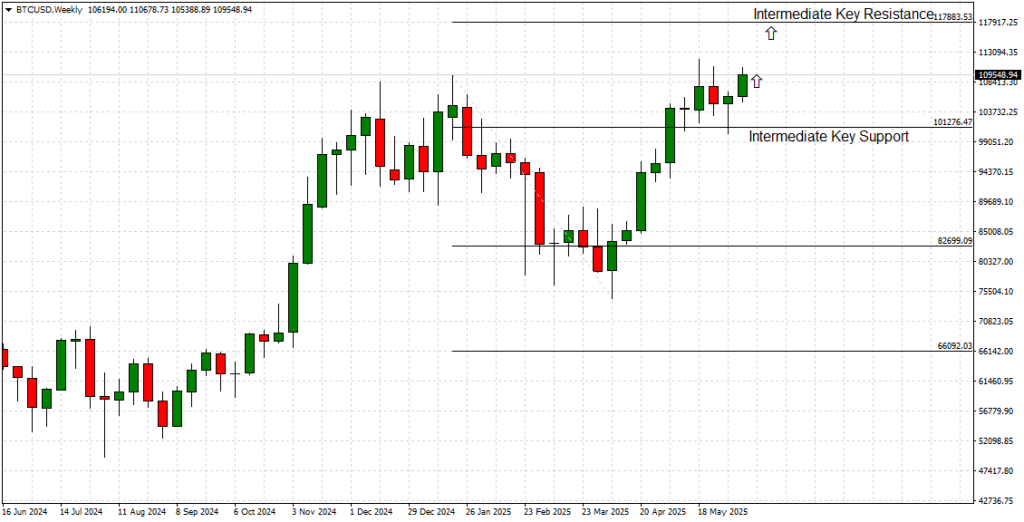

After piercing through that critical resistance on May 04, price action pulled back to retest that level—but instead of a breakdown, Bitcoin held firm, confirming the move as a legitimate breakout. With the retest successful and bulls defending the level convincingly, the path now appears clear for another leg higher, targeting the next major resistance at $117,883.

Breakout Level: $101,276

The $101,276 zone, marked as an intermediate key resistance, acted as both a psychological and technical barrier in prior sessions. Bitcoin finally mustered the bullish momentum to break above in early May. That move alone was a clear bullish signal, but as experienced traders know, the true strength of a breakout lies in its ability to hold upon retest.

Last week’s price action provided that confirmation. Bitcoin dipped back into the $101K range, briefly threatening to reverse, but was promptly rejected by buyers. This rebound has cemented $101,276 as a new support level, validating the previous breakout and reinforcing the bullish bias going forward.

Price Action Momentum: Retest Rebound & Bullish Continuation

Zooming into the weekly chart (see reference), the bullish narrative becomes even clearer. After forming a tight cluster of candles above the breakout zone, Bitcoin printed a strong green candle, bouncing decisively off the $101K region. This rebound is not only technically significant—it reflects underlying bullish sentiment returning to the market after what appeared to be a short-lived correction.

Volume metrics support the continuation narrative. Increasing buy-side pressure after the retest suggests that institutions and high-conviction traders are accumulating. The market structure remains firmly bullish, with higher highs and higher lows aligning consistently since the March bottom near $75,400.

From a momentum standpoint, the relative strength index (RSI) remains elevated but not overextended, leaving room for further upside. This adds fuel to the case for a sustained rally into the $117,883 resistance zone.

Bitcoin’s Vision: Macro and Market Factors Aligning

Bitcoin continues to benefit from a broader narrative shift in global markets. The fading of macroeconomic uncertainty—especially as interest rate hikes begin to plateau—and increasing institutional interest in digital assets are both contributing to renewed demand for BTC.

Moreover, with recent headlines pointing to increased ETF flows and sovereign accumulation, Bitcoin’s long-term fundamental vision remains on course: decentralization, store-of-value, and hedge against fiat dilution. As more capital migrates from traditional assets into the crypto space, Bitcoin stands as the primary beneficiary.

The recent rally also follows the asset’s typical halving-cycle behavior, where historical patterns show a bullish acceleration 6–12 months post-halving. This cyclical structure only strengthens the probability of continuation toward—and possibly beyond—the $117K range in the near to medium term.

Forecast Summary

-

Trend: Bullish Continuation

-

Breakout Level: $101,276 (confirmed as support)

-

Next Key Resistance: $117,883

-

Support Zone: $101,276

-

Bias: Strongly Bullish

-

Outlook: Price action validated the breakout with a textbook retest and bounce. Bulls are back in control, and Bitcoin now targets $117,883 as the next major milestone.

As long as Bitcoin holds above the $101K area, the bullish case remains compelling. The breakout is real, the retest is in, and the market is responding accordingly. The bulls have the ball—and they’re running with it.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM