Bitcoin Cash (BCH) Holds Bullish Structure, Awaits Breakout Confirmation

Quick overview

- Bitcoin Cash (BCH) maintains a bullish outlook, confirmed by its sustained trading above the $378.19 support level.

- The immediate resistance to watch is at $454.74, which must be broken for BCH to target the next upside level of $612.88.

- A protective stop-loss is set at $365.10 to safeguard against potential pullbacks.

- The BCH ecosystem is benefiting from increased merchant adoption and scalability upgrades, positioning it well for future growth.

Bitcoin Cash (BCH) continues to honor the bullish momentum flagged in our May 8 forecast, where we identified a breakout scenario with significant upside potential.

The longer-term technical outlook remains firmly bullish, but recent price action highlights an important short-term hurdle before the next leg higher can materialize.

Breakout Levels and Price Action Momentum

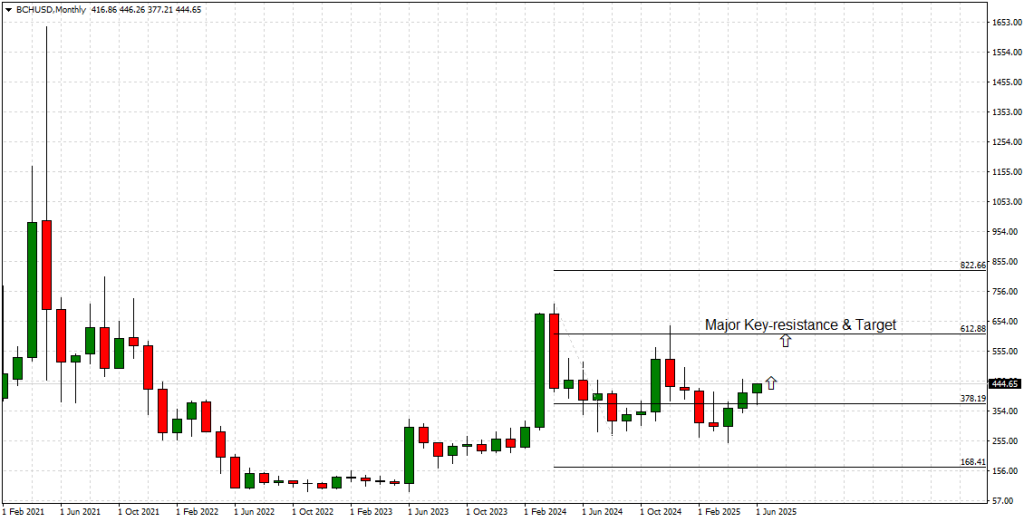

On the monthly chart, BCH has officially confirmed a new bullish cycle, with the pair comfortably sustaining above the $378.19 inflection level. This area, previously a ceiling for multiple failed rallies, now acts as foundational support. The bullish momentum from February’s surge has held, with BCH currently trading around $444.65, a clear higher-low structure in place.

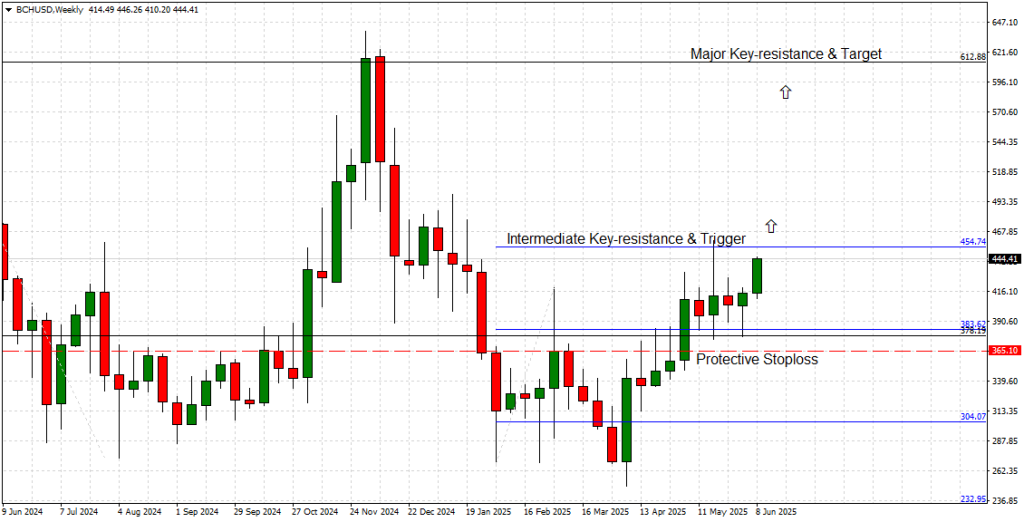

However, the weekly timeframe reveals an immediate obstacle in the form of intermediate key-resistance at $454.74. Price action is presently testing this barrier, and a decisive close above it is necessary to trigger the next bullish breakout. Until then, price action might keep consolidating within the $378.19 – $454.74 range.

A sustained breakout above $454.74 would expose the next upside target at $612.88, the major key-resistance identified on both the monthly and weekly charts. This level also coincides with a historical supply zone and former price rejection point, making it a critical destination for bulls.

On the downside, immediate support rests at $378.19, with a protective stop-loss positioned at $365.10, safeguarding the bullish scenario against sharp pullbacks.

Current Forecast and Scenario

Our May 8 forecast remains as valid as ever, with the bullish outlook intact as long as BCH holds above the $378.19 support. The current short-term obstacle at $454.74 represents the final intermediate hurdle before BCH can accelerate its march toward $612.88.

Forecast Summary:

-

Bullish Bias above $378.19

-

Next Key Breakout Trigger: $454.74

-

Primary Upside Target: $612.88

-

Protective Stop-Loss: $365.10

A clean break and weekly close above $454.74 would confirm trend continuation and likely attract fresh buying interest, accelerating the path toward the $612.88 objective.

Technology and Vision Update

Bitcoin Cash (BCH) continues to carve its place in the digital payments landscape, positioning itself as a peer-to-peer electronic cash system offering fast, low-fee transactions. In 2025, BCH development has been focused on two major pillars: scalability upgrades and interoperability improvements.

The Bitcoin Cash ecosystem also benefits from growing merchant adoption, particularly in Latin America and Southeast Asia, where transaction costs and banking limitations drive crypto-based payment solutions. Partnerships with regional fintech providers further strengthen its payment network footprint.

As institutional and retail interest in low-fee, scalable cryptocurrencies increases, BCH remains well-placed to capitalize on this narrative shift — and a technical breakout above $454.74 could serve as a market catalyst, reflecting both price and fundamental momentum.

Final Takeaway

The Bitcoin Cash bullish scenario outlined in our May 8 report has matured favorably, with the market now poised at a critical decision point. The $454.74 resistance must yield for bulls to reclaim control and target the next milestone at $612.88.

Traders should watch for a weekly close above $454.74 to confirm breakout validation. Until then, the current bullish outlook remains protected as long as BCH holds above $378.19

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM