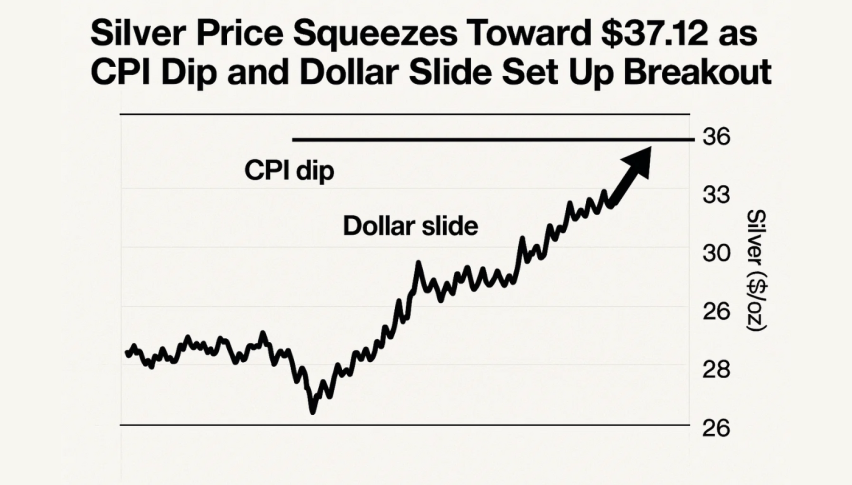

Silver Price Squeezes Toward $37.12 as CPI Dip and Dollar Slide Set Up Breakout

Silver (XAG/USD) is trading at $36.35 after the US inflation print came in lower than expected and is reinforcing the bets on Fed rate...

Quick overview

- Silver (XAG/USD) is trading at $36.35, boosted by lower-than-expected US inflation and expectations of Fed rate cuts by year-end.

- Geopolitical tensions, particularly in the Middle East and US-China relations, are increasing safe-haven demand for silver.

- Technically, silver is forming a symmetrical triangle pattern, with key resistance levels at $36.45-$36.65 and potential breakout targets at $36.89 and $37.12.

- Traders are advised to enter on a break above $36.65 or a bounce off $36.06, with a moderate risk strategy.

Silver (XAG/USD) is trading at $36.35 after the US inflation print came in lower than expected and is reinforcing the bets on Fed rate cuts by year end. The May CPI rose 0.1% month on month and 2.4% year on year, the lowest in over a year. The US Dollar Index has fallen to a 2 month low making dollar denominated assets like silver more attractive to global buyers.

Kelvin Wong of OANDA calls the dollar’s retreat a “bullish catalyst” as automated buy orders were triggered as traders reacted to the data and the break above $3,346 in gold. Markets are now pricing in 50 basis points of rate cuts by December. Traders await confirmation from today’s PPI release to firm up expectations.

Trump’s post-CPI calls for “significant” rate cuts and the Fed’s dovish tone have further fueled safe haven demand – especially as macro risks resurface.

Geopolitical Tensions Fuel Safe-Haven Demand

Beyond economic signals, geopolitical factors are adding to silver’s upside case. Trump has ordered the repositioning of US personnel in the Middle East due to elevated security concerns with Iran. Meanwhile talks between Washington and Beijing have resulted in a draft framework to revive their fragile trade agreement, giving temporary calm to broader markets.

These have only added to silver’s appeal:

- Middle East unrest: Safe-haven buying

- US-China framework: Reduces volatility but hasn’t dampened demand for precious metals

- Tariff deadlines (July 8): Keeps uncertainty high

- Inflation tailwinds: Hedges

Silver is often overlooked by gold but thrives in this dual threat environment where both inflation and global instability linger.

Technical Setup: Silver Ready to Breakout

From a charting perspective, silver is in a symmetrical triangle on the 1 hour chart – converging trendlines and low volatility. The 50 period EMA at $36.34 is the floor for price action and the MACD is showing early bullish momentum with a potential crossover.

Key levels to watch:

- Resistance: $36.45-$36.65

- Breakout targets: $36.89 then $37.12

- Support: $36.06 and $35.82

Beginner Trade:

- Entry: On a break above $36.65 or bounce off $36.06

- Stop: $36.00

- Targets: $36.89 and $37.12

- Risk: Moderate—MACD and volume confirmation

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account