SRM Stock Soars 533% After $210M Tron Merger and $100M Equity Boost

SRM Entertainment, a Florida based theme park merchandise company, saw its stock price skyrocket 533% after a reverse merger...

Quick overview

- SRM Entertainment's stock price surged 533% following a reverse merger with blockchain platform Tron, rising from $1.45 to $10.84 within three days.

- The merger, valued at $210 million, was led by Tron founder Justin Sun and resulted in a significant increase in trading volume from 2.05 million to 250 million shares.

- As part of the restructuring, SRM will be rebranded as 'Tron' and will focus on accumulating TRX tokens, moving towards blockchain-based financial innovation.

- The merger has drawn political intrigue due to ties with Dominari Securities, linked to Donald Trump Jr. and Eric Trump, although Eric Trump has denied any involvement.

SRM Entertainment, a Florida based theme park merchandise company, saw its stock price skyrocket 533% after a reverse merger with blockchain platform Tron. Listed on the Nasdaq under the ticker SRM, the stock went from $1.45 on June 13 to $10.84 on June 16 and closed at $9.19 that day.

According to Yahoo Finance, the surge was driven by a $210 million reverse merger with Tron led by founder Justin Sun. Trading volume also went from 2.05 million shares to 250 million after the news broke.

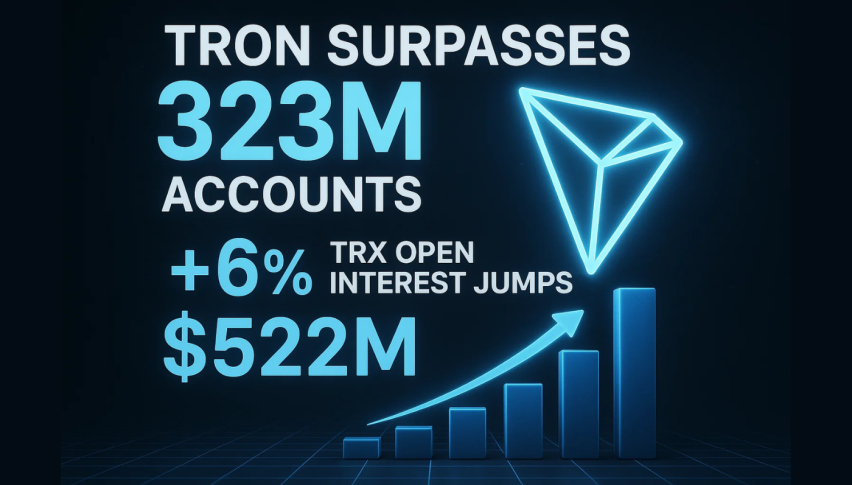

Tron’s native token (TRX) also reacted positively, up 2.5% to $0.28 after the announcement. Although still 35% below its all time high of $0.43 from December, the market’s reaction to the merger is a sign of renewed confidence in Tron.

Major Merger Details and Leadership Moves

As part of the restructure SRM Entertainment will be rebranded as “Tron” and will implement a new treasury strategy focused on accumulating TRX tokens. This means the company is moving from traditional merchandise to blockchain based financial innovation.

In a press release SRM CEO Rich Miller said, “We are excited to invest into the future of the world’s next generation financial infrastructure.”

Key points from the merger:

- Justin Sun appointed as an advisor to SRM Entertainment.

- $100 million equity investment from a private investor.

- Name change and treasury strategy focused on maximizing TRX token holdings.

Political Ties and Controversial Headlines

The merger was arranged by Dominari Securities, a boutique investment bank with ties to Donald Trump Jr. and Eric Trump. While the media reported family involvement, Eric Trump publicly denied any ties to the firm on X (formerly Twitter).

This added an extra layer of political intrigue to what is otherwise a bold corporate strategy. Whether or not these ties will impact public opinion, SRM’s stock price surge indicates high investor confidence in the merger.

This is a big moment where blockchain meets legacy industries, the role of crypto in mainstream finance is evolving. As SRM becomes Tron, we will be watching to see how they execute and how TRX performs.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM