Uniswap (UNI) Long-Term Bullish Potential Faces Short-Term Bearish Pressure

Quick overview

- Uniswap (UNI) is currently ranked #27 in market capitalization, valued at $5 billion, and is a key player in the DeFi sector.

- While long-term indicators suggest a potential bullish breakout above $7.567, short to medium-term trends indicate a cautious bearish stance due to recent price action.

- Immediate downside targets for UNI are set at $6.998 and $6.080, with broader market conditions influencing potential further declines.

- Uniswap continues to lead as the largest decentralized exchange, with upcoming enhancements in its protocol aimed at improving liquidity and market efficiency.

Uniswap (UNI), currently ranked #27 by market capitalization with a $5 billion valuation, remains one of the most established and strategically important projects within the decentralized finance (DeFi) sector.

However, while its long-term technical structure points toward a potential bullish breakout and bull cycle ahead, the short to medium-term technical picture and fragile macro environment warrant a cautious, tactically bearish stance for now.

Let’s break down the current setup using both the long-term and short-term price charts alongside market context and protocol fundamentals.

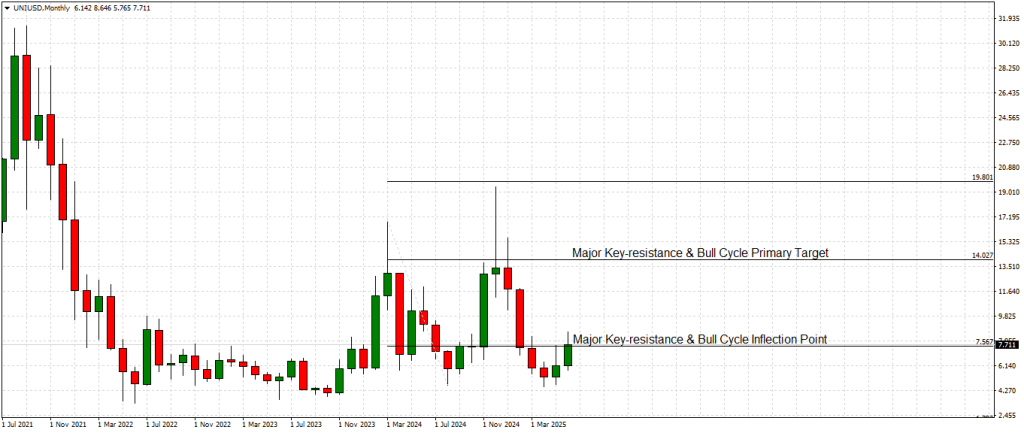

Long-Term Technical Outlook: Bull Cycle Inflection Point Nears

As reflected in the uploaded Monthly chart, UNI is approaching a massive inflection point at $7.567 — a level that previously acted as both a structural resistance and pivot zone over the past 18 months. A clean and decisive monthly close above this threshold would validate a long-term bullish breakout scenario.

Should this breakout materialize, the next substantial technical target resides at $14.027, marking a potential 100% return from current prices. This level represents a multi-year key resistance area and historically significant price pivot, last tested in mid-2024.

From a structural perspective, the current basing pattern and gradual series of higher monthly lows since January 2025 suggest early accumulation dynamics. However, for this bullish setup to activate, UNI must first overcome the $7.567 ceiling on a sustained basis, preferably confirmed by a monthly candle close above.

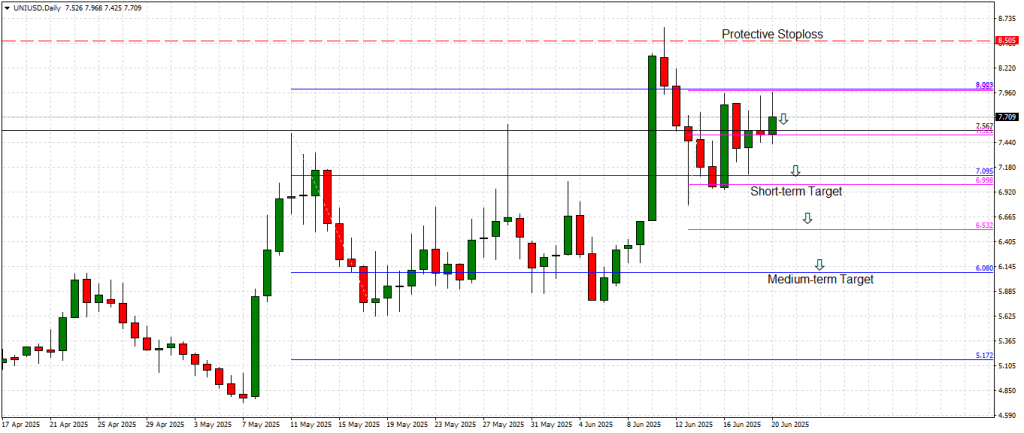

Short to Medium-Term Technical Outlook: Bearish Bias in Play

In contrast, the Daily chart indicates a fragile short to medium-term technical structure. After a sharp rally earlier in June that pushed prices to test $8.003, Uniswap failed to sustain upward momentum, retracing back to retest the $7.095–$7.567 zone.

Recent price action shows a cluster of small-bodied candles beneath this critical level, suggesting hesitation and weakening bullish momentum. The failure to reclaim $8.003 — coupled with successive lower daily highs — opens the door to further downside in the short term.

Immediate downside targets include:

-

Short-term target: $6.998

-

Medium-term target: $6.080

A breach of these levels would expose the market to an extended corrective move towards previouse lows around $5.70, though such a scenario would depend on broader market conditions and risk sentiment.

The protective stop for any short-term tactical positions remains well-placed at $8.505, above the recent June swing high.

Global Macro Backdrop: Risk-Off Bias Intensifies

Market-wide risk sentiment remains heavily skewed to the downside amid escalating geopolitical tensions in the Middle East, particularly the volatile situation between Israel and Iran. The conflict has intensified over the past week, leading to rising oil prices, equity market retracements, and sustained capital flight from high-risk assets — including altcoins and DeFi tokens like Uniswap.

With investors adopting a defensive posture, speculative plays such as UNI remain vulnerable to short-term downside pressure despite their fundamentally strong positioning within the crypto ecosystem.

Technology & Vision: Uniswap’s DeFi Dominance Persists

Uniswap continues to hold its title as the largest decentralized exchange (DEX) by trading volume and liquidity depth on the Ethereum network. Its recent introduction of Uniswap v4, now in advanced development, promises notable upgrades, including:

-

Hooks infrastructure for customizable liquidity pool logic.

-

Improved capital efficiency through adjustable fee structures.

-

Native ETH trading pairs without wrapped token dependencies.

These enhancements are designed to improve flexibility for developers and liquidity providers, bolster market depth, and reduce slippage across Uniswap’s markets. Additionally, the protocol remains actively engaged in expanding multi-chain support, with deployments already live on Polygon, Arbitrum, and Optimism.

Long-term, Uniswap aims to position itself as the foundational liquidity layer for decentralized finance across multiple blockchains, leveraging its early mover advantage and network effects.

Conclusion

Uniswap stands at a pivotal crossroads.

-

Long-term technicals and protocol fundamentals remain bullish, with a confirmed breakout above $7.567 likely opening the floodgates for a sustained rally toward $14.027.

-

However, short to medium-term technical weakness, compounded by intensifying global risk-off sentiment, suggests a tactical bearish bias, with downside targets at $7.095, $6.080, and potentially lower.

Traders should approach this market with caution — respecting the broader macro risks while remaining alert for technical breakout confirmations at higher timeframes.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM