Ethereum (ETH) Local Support Holds as Long-Term Bullish Outlook Remains Intact

Quick overview

- Ethereum is currently facing a critical resistance level at $2595.6, which is key for its next bullish cycle.

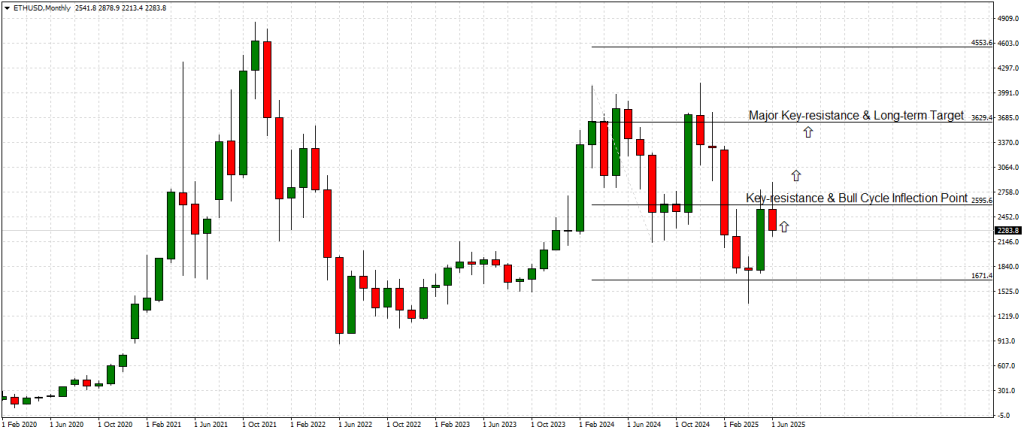

- A confirmed breakout above this level could lead to a significant price increase towards $3629.4, representing a potential 40% gain.

- Short-term support has been established at $2218.5, with signs of stabilization and increased buyer interest in this zone.

- Long-term investors are encouraged to accumulate above the $2218.5 level, as the overall market structure remains bullish.

In our previous Ethereum market analysis on May 16, 2025 (read here), we identified the $2595.6 key-resistance as the critical inflection point standing between Ethereum and its next major bullish cycle.

While the market has since oscillated around this decisive barrier, Ethereum continues to uphold its broader bullish structure within the monthly time frame.

The monthly chart (see attached Monthly chart) highlights this sustained battle beneath $2595.6. A confirmed breakout above this pivotal level would unlock significant bullish momentum with a projected upside to the next major key-resistance at $3629.4 — a potential 40%+ move from current levels.

Short-Term Market Action: Local Key-Support Activated

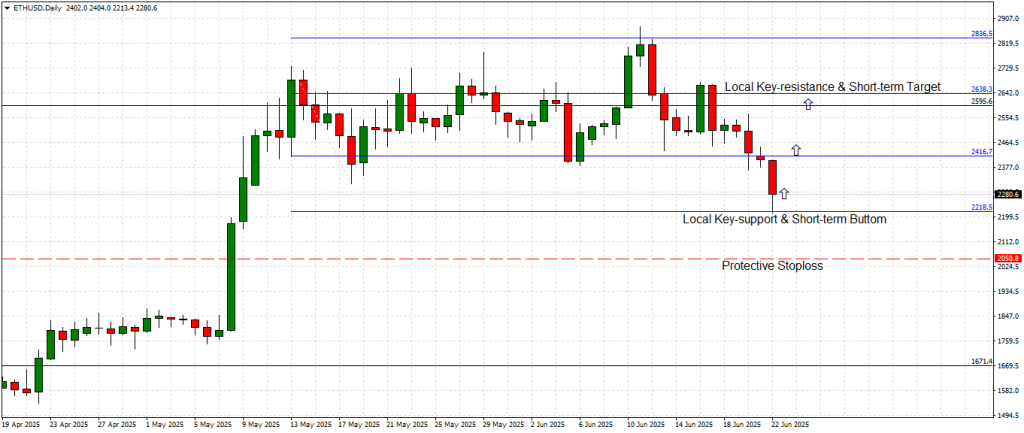

On the daily chart, Ethereum has now tested and validated a crucial local key-support at $2218.5. This level aligns seamlessly with previous price action pivots and acts as a critical technical floor within the short-term trend.

After an extended corrective pullback from the $2900 region, Ethereum has decisively tagged this support zone — and early intraday price behavior shows signs of stabilization and demand re-entry. Notably:

-

Bullish rejection wicks are appearing around the $2218.5 level.

-

Volume patterns show increasing buyer interest around this zone.

-

RSI and Stochastic indicators on lower time frames are beginning to turn from oversold conditions.

This local support offers a tactical short-term reversal opportunity, providing a high-probability setup for a rebound back towards:

-

$2416.7 local pivot

-

And the wider $2595.6 key-resistance in the coming sessions.

Trading Strategy Update

Short-Term / Long-Term Bullish Game Plan:

-

Buy range: $2218.5–$2280

-

Short-term Secondary Target: $2638.3

-

Long-term Primary Target: $3629.4

-

Protective Stop-loss: $2050.0

Long-Term Positioning:

Position traders should consider accumulating on dips above the $2218.5 zone, as the broader macro picture remains bullish pending a clean breakout over $2595.6.

Technology & Vision Update

Ethereum remains the undisputed leader in the smart contract space, currently processing over 1.3 million transactions per day and supporting the largest share of DeFi protocols and NFT marketplaces globally.

The Ethereum Foundation recently confirmed a scheduled rollout for the Pectra upgrade (expected in Q3 2025). This pivotal network enhancement will optimize transaction parallelization, enabling:

-

Faster processing speeds

-

Lower gas fees

-

And enhanced Layer-2 interoperability

Additionally, Ethereum’s leadership in modular blockchain infrastructure continues with EIP-7732 development, aiming to decouple transaction inclusion from consensus verification — a move expected to drastically improve block finality times and network security.

Institutional adoption also remains robust, with major players like BlackRock, J.P. Morgan, and Fidelity expanding tokenized asset operations on the Ethereum network in the last quarter.

Final Thoughts

Ethereum’s market remains one of the most structurally sound among major cryptocurrencies, and the current technical alignment — with local support now active and the long-term bullish inflection still intact — reinforces our positive bias.

In the short term, traders should monitor price behavior around $2218.5 closely for confirmation of a bullish reversal. A successful hold above this level is expected to trigger renewed upside momentum targeting $2416.7 and ultimately a return to the decisive $2595.6 breakout point.

Long-term investors should remain patient yet optimistic, with the bigger move toward $3629.4 still highly probable in the coming months as network upgrades and macro crypto recovery trends align.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account