Ethereum Holds Critical $2,400 Support: Potential Rally Despite Recent Weakness?

Ethereum (ETH) is currently trading above the important $2,400 support level. In the last 24 hours, it has dropped about 1.5%. Even though

Quick overview

- Ethereum is currently trading above the crucial $2,400 support level, despite a recent 1.5% drop.

- Analysts believe that if ETH maintains this support, it could see a significant rise in the coming weeks.

- Whale activity and institutional interest in Ethereum are increasing, indicating growing confidence among investors.

- Key resistance levels to watch are $2,510–$2,520, with potential targets of $2,600 and $2,800 if broken.

Ethereum ETH/USD is currently trading above the important $2,400 support level. In the last 24 hours, it has dropped about 1.5%. Even though it has dropped recently, several well-known crypto analysts think that the second-largest cryptocurrency by market capitalization may be getting ready for a big rise in the next few weeks, as long as it stays above this important level of support.

ETH/USD Technical Analysis Suggests Range Breakout Potential

Michaël van de Poppe, the founder of MN Trading Capital, says that Ethereum’s ability to stay over $2,400 is a good sign for the asset’s short-term future. Van de Poppe said in a recent report, “So far, so good for ETH.” “Holding above this crucial range low, we’re likely going to be testing the other side of the range in the upcoming weeks.”

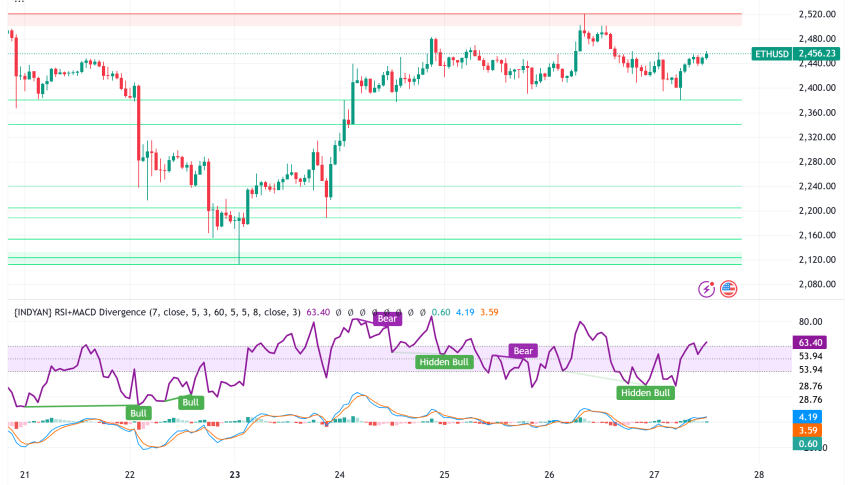

The technical picture shows that ETH just hit $2,520 but then hit a wall and fell back. The cryptocurrency fell below a connecting positive trend line that had support at $2,450, but it is still above the $2,400 mark and the 100-hourly Simple Moving Average, which is very important. This posture shows that even though bears have put pressure on the market, the support structure is still in place.

The forecast for technical indicators is mixed. The hourly MACD is losing strength in the bullish zone, while the RSI has gone below the neutral 50 mark. Analysts say that if Ethereum can go back above the $2,520 barrier level, it might aim for higher resistance levels at $2,550, $2,600, and maybe even $2,720-$2,800 in the near future.

Ethereum Whale Activity and Institutional Interest Signal Confidence

Even if prices have been falling lately, a lot of investors are still buying Ethereum, which shows that they are becoming more confident in its future. Crypto trader Quinten Francois pointed out that whales are buying a lot of ETH. On June 16, huge investors bought 1 million ETH, which is said to be the biggest single-day purchase since 2018, according to Glassnode data.

Institutional interest has also been rising thanks to spot Ethereum ETF flows. On Wednesday, the funds had their third straight day of inflows, bringing in $60.4 million and increasing the total for the three days to $232.4 million. This comes after a record-breaking 19-day stretch of inflows that concluded on June 14, showing that institutions still want to invest in Ethereum.

Network Fundamentals Show Encouraging Growth

Ethereum’s underlying network measurements show that the fundamentals are getting stronger, not just the price action. Active addresses have started to rise again after breaking a downturn that started on June 13. Between Sunday and Wednesday, the number of transactions rose from 1.23 million to 1.75 million. Even if prices have been going sideways, this 42% rise in network activity shows that more people are interested in the Ethereum ecosystem.

The rise in network utilization is often what leads to a longer-term rise in prices, which means that Ethereum’s value proposition is still strong among users and developers. But whale balances holding between 10,000 and 100,000 ETH have stayed rather constant, going up by only 7,000 ETH since the start of the week.

Ethereum Price Prediction: Key Levels to Watch

Ethereum is at important technological crossroads that will probably decide its path in the foreseeable future. If ETH stays above $2,400 and breaks through the $2,510–$2,520 resistance zone, it might confirm a bullish reversal pattern with goals that go up to $2,600 and maybe even $2,800.

But if the $2,400 support level doesn’t hold, a deeper fall could happen. The next big support level is at $2,320. If the price goes down more, it might go down to $2,250 or $2,200. If the price goes below these levels, it could test the bottom end of the current trading range, which is about $2,150.

The derivatives market is showing balanced attitude. In the last 24 hours, there have been $75.11 million in futures liquidations, with long and short holdings about evenly split. Since last Saturday, open interest has had a hard time going beyond 13 million ETH. This shows that traders are being careful.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM