Ripple (XRP) On the Edge: One Last Dip Before the Bull Breakout?

Quick overview

- Ripple (XRP) is currently navigating a complex technical landscape, attempting to establish a meaningful bottom amid market indecision.

- Despite signs of stabilization since June 2025, XRP struggles to reclaim key support levels, with recent price action hovering around $2.10.

- The long-term bullish outlook for XRP remains intact, supported by ongoing technological advancements and market normalization.

- Investors should monitor for a decisive breakout above $2.1329 to confirm a medium-term bottom and potential upward targets.

Ripple (XRP) continues its cautious navigation through a complex technical landscape, as price action attempts to carve out a meaningful bottom amid broad market indecision.

Since our previous forecast on June 1, 2025 — where we anticipated a potential bullish reversal after a corrective pullback — XRP has indeed shown signs of stabilization. However, the momentum to reclaim and decisively clear former key-support levels has so far been underwhelming.

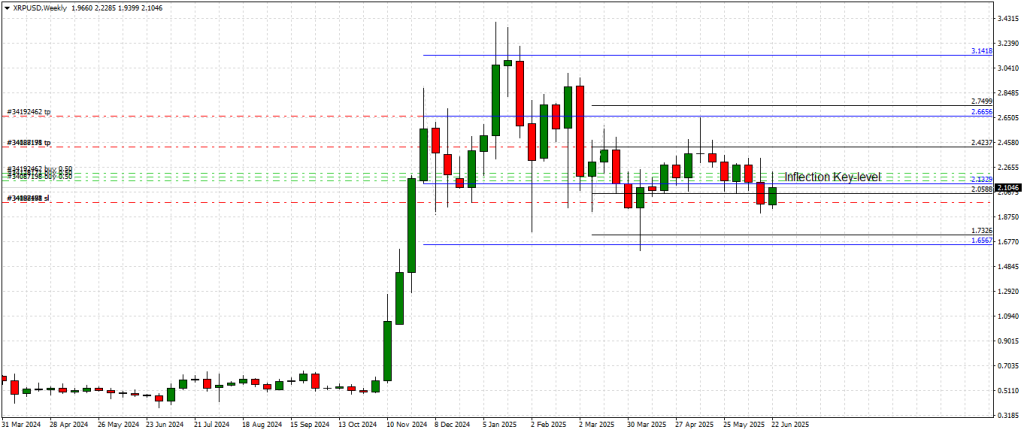

The latest weekly candle on the attached chart reflects a tentative bounce from the $2.0588–$2.1329 region, which we have repeatedly identified as a significant inflection zone. Price is currently hovering around $2.10, caught between bearish pressure and latent bullish demand. While the geopolitical cooling in the Middle East briefly lifted sentiment across risk markets, crypto investors remain wary — and this is visibly mirrored in XRP’s lack of conviction on the upside.

Price Action Outlook

From a technical perspective, XRP/USD is exhibiting classic symptoms of a market hunting for a sustainable low. After a strong impulsive rally in late 2024, Ripple entered a prolonged correction phase, repeatedly testing the $2.0588–$2.1329 band, now acting as stubborn resistance after its prior role as a support floor.

The chart illustrates that each bullish attempt in recent weeks has faltered at this barrier, indicating supply clusters from trapped long positions and cautious short-sellers reinforcing their exposure. The inability to sustain moves above $2.13 suggests that the market may require one more bearish leg, likely targeting the lower boundary around $1.7325 to $1.6567, before genuine accumulation begins.

While the recent higher low pattern hints at strengthening demand below $2.00, without a clear breakout above $2.1329, bullish traction remains speculative.

Long-Term Bullish Narrative Intact

Despite the current short-term hesitancy, our long-term bullish outlook for Ripple remains firmly intact. As global capital markets gradually normalize, and as investor appetite for blockchain utility tokens returns, XRP is poised to reclaim higher valuations — particularly considering its strategic positioning in cross-border settlements.

The higher timeframe structure still aligns with a bullish continuation model, provided that the $1.65–$1.73 demand zone holds on any future dip. A decisive breakout above $2.1329 would likely confirm a medium-term bottom, unlocking targets at $2.4237, $2.6656, and eventually $3.1418, as indicated by Fibonacci projection levels on the weekly chart.

Ripple (XRP) Technology Update

On the technology front, Ripple Labs has maintained a steady pace in expanding its On-Demand Liquidity (ODL) corridors, adding Vietnam and Brazil to its operational network this month. This expansion comes alongside a newly inked partnership with a tier-1 remittance provider in Southeast Asia, which is expected to drive increased transactional volume through the XRP ledger.

Additionally, RippleX developers rolled out XRP Ledger (XRPL) v2.2.1, addressing minor performance enhancements and refining the sidechain interoperability protocol — a core component of Ripple’s future scalability strategy. This upgrade strengthens Ripple’s appeal for enterprise-grade blockchain integrations, further underpinning the long-term demand case for XRP.

Conclusion

In summary, while Ripple’s short-term price action remains under pressure and might deliver one final bearish wave towards the $1.73–$1.65 region, the broader technical and fundamental narrative continues to favor a bullish resolution. Investors should watch for a decisive weekly close above $2.1329 as the key signal for resumption of the medium to long-term uptrend.

The latest technology developments and expanding ODL infrastructure only enhance the token’s utility and long-term investment thesis. Traders and investors should remain patient, as this consolidation phase is likely nearing its conclusion.

Key Levels to Watch:

-

Key Resistance Levels: $2.0588, $2.1329

-

Key Support Levels: , $1.7325, $1.6567

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM