XRP Price Prediction: Ripple Eyes $50M SEC Settlement as Legal Battle Nears End

Ripple and the SEC may be nearing a settlement in their long-running XRP lawsuit. Legal expert Fred Rispoli thinks both sides will...

Quick overview

- Ripple and the SEC may settle their XRP lawsuit with a $50 million fine, leaving the ruling that XRP is not a security intact.

- Judge Torres denied a joint request from Ripple and the SEC to dissolve the permanent injunction, sending the case back to the appellate level.

- Legal expert Fred Rispoli predicts a mutual withdrawal of appeals, which could provide Ripple with regulatory clarity and avoid further litigation.

- XRP's price is currently showing weakness, with potential support levels identified below its current trading range.

Ripple and the SEC may be nearing a settlement in their long-running XRP lawsuit. Legal expert Fred Rispoli thinks both sides will drop their appeals and agree to a $50 million fine and leave Judge Analisa Torres’ ruling intact—XRP is not a security.

This would end over 4 years of litigation that has shaped the regulatory conversation around digital assets in the US.

Judge Torres Denies Joint Request

On Friday, Judge Torres denied the joint motion from Ripple and the SEC to dissolve the permanent injunction and reduce Ripple’s fine. The court’s decision sends the case back to the appellate level.

- Attorney James Filan said the court denied both parts of the motion.

- Ripple’s Chief Legal Officer Stuart Alderoty said, “The ball is back in our court.”

- XRP is still not a security.

Now Ripple has to decide whether to continue to appeal or dismiss it entirely—a move that would align with Rispoli’s prediction of a quiet settlement.

Legal Analyst Forecasts Quiet Finish

Fred Rispoli, who is following the case, thinks a mutual withdrawal of appeals is the most likely outcome. He expects a $50 million settlement that avoids further litigation and gives Ripple regulatory clarity.

He also thinks the SEC may privately tell Ripple that its business operations will not be further enforced as long as it follows the framework already established.

- Courts don’t enforce injunctions unless one side files a violation.

- The SEC won’t monitor Ripple after settlement.

- The current judgment will remain valid without further litigation.

Rispoli said the SEC’s approach during the lawsuit, especially under the previous administration, may have frustrated the court—maybe even influenced Judge Torres’ tone.

Political Backdrop and Timeline

The length of the XRP lawsuit, combined with the shift in political and regulatory attitudes, may have played a role in the court’s decision. Rispoli said Judge Torres’ tone may reflect the court’s frustration with both sides over time.

He also pointed to past mistakes by the SEC, including the Debt Box case where its attorneys were sanctioned, as part of the broader context behind the changing regulatory landscape.

XRP Price Prediction: Technical Outlook

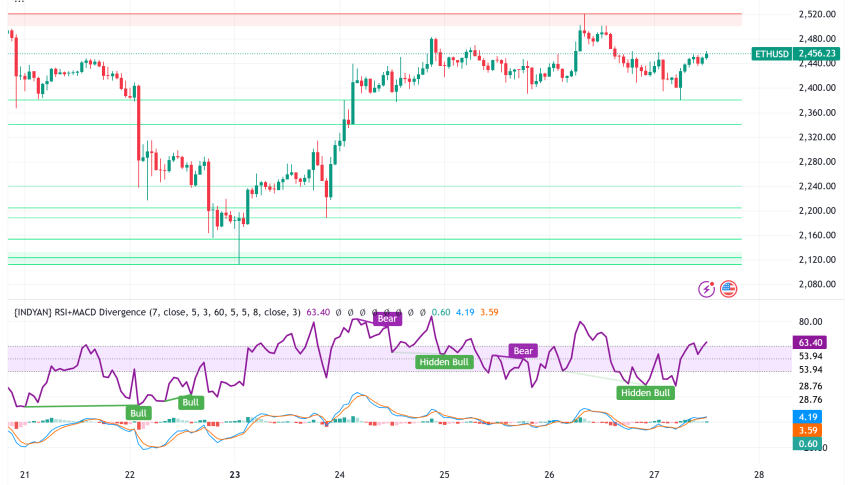

XRP/USD is showing signs of weakness after failing to sustain above $2.15 and breaking below the 50-EMA near $2.14. The pair is now hovering around the $2.09 level, slightly above the 0.5 Fibonacci retracement at $2.07. A sustained move below this level could expose the 0.618 Fib at $2.03, followed by stronger support near $1.97.

The bearish crossover of the 50-EMA and 200-EMA continues to weigh on sentiment, while the downward trendline from the $2.23 high caps upside potential. A rebound needs to clear $2.15 and break above the 200-EMA at $2.19 to revive bullish momentum. Until then, XRP remains vulnerable to further downside within this corrective phase.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account