Litecoin (LTC) Bounces Off Golden Ratio — Bull Run Reloaded Targets $132

Quick overview

- Litecoin (LTC) is showing signs of a bullish comeback after a corrective pullback, defending a key Fibonacci level around $77.50.

- Recent price action indicates buyers are stepping in, suggesting the corrective cycle may have ended and a new bull cycle could begin.

- A decisive weekly close above the $100.68 resistance level could trigger further upward momentum towards $132.63.

- Technological advancements, including the adoption of the MimbleWimble Extension Block and the development of LitePay 2.0, enhance Litecoin's real-world utility.

After enduring a corrective pullback since early May, Litecoin (LTC) appears to be staging a bullish comeback as it defends a key Fibonacci level and sets its sights on reclaiming critical resistance zones.

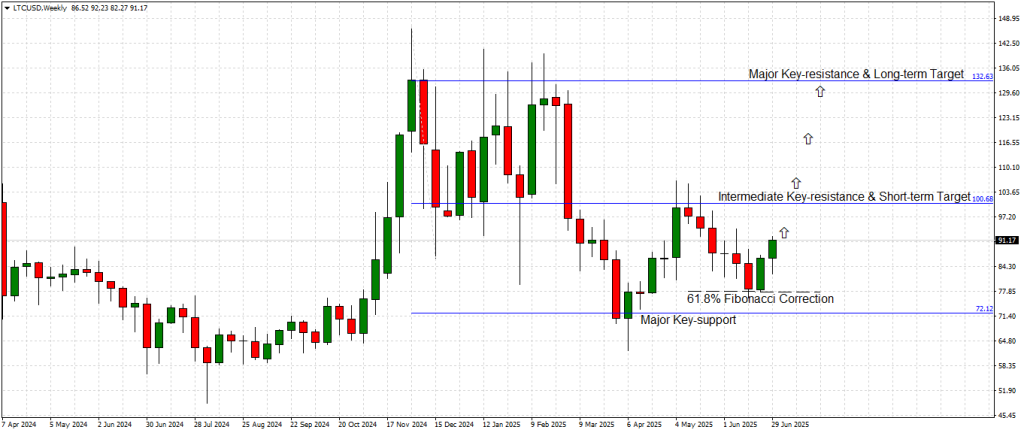

The market’s recent “risk-off” sentiment phase — driven by geopolitical volatility and inflation uncertainty — dragged LTC from its intermediate key-resistance at $100.68 down to the pivotal 61.8% Fibonacci retracement level around $77.50, a classic technical zone known for producing powerful market reversals.

The latest price action shows buyers stepping back in at this important support cluster, suggesting the corrective cycle has likely run its course. With sentiment stabilizing across the broader crypto market, the stage is set for Litecoin to embark on a fresh bull cycle.

Technical Outlook

The Weekly chart highlights the significance of recent moves. After its rejection at $100.68 in early May, Litecoin sold off sharply, finding solid footing just above $77.50, coinciding perfectly with the 61.8% Fibonacci retracement drawn from the April 2025 low to the May 2025 high. This “golden ratio” level frequently acts as a market inflection point, and Litecoin’s reaction here is textbook bullish behavior.

Currently trading around $91.17, LTC has formed a series of higher lows over the past three weeks, signaling fading selling pressure and building upside momentum. The immediate target remains the intermediate key-resistance at $100.68, which previously served as a ceiling for price action.

A clean, decisive weekly close above this level would constitute a breakout confirmation, likely attracting technical buyers and momentum traders. Should this occur, Litecoin would have a clear runway toward the next significant resistance at $132.63, a major level that capped price rallies throughout late 2024 and early 2025.

From a risk management standpoint, the $77.50–$72.12 zone remains the last structural support and invalidation area for this bullish thesis.

Long-Term Bullish Case

Beyond short-term levels, the broader technical structure favors Litecoin’s upside continuation. The asset’s cyclical price action — characterized by sharp rallies followed by corrective pullbacks into Fibonacci support — suggests the current recovery phase could extend well beyond the $132.63 mark, provided macro market conditions stabilize.

Historically, Litecoin tends to outperform during later stages of Bitcoin-led rallies, and with Bitcoin’s price action consolidating near key resistance zones, a sector-wide altcoin resurgence could lift LTC alongside other major market-cap coins.

Litecoin (LTC) Technology Update

On the technology side, Litecoin continues to evolve steadily, maintaining its relevance in the highly competitive crypto landscape. The MimbleWimble Extension Block (MWEB) privacy protocol, which went live last year, has been increasingly adopted by third-party wallet providers, improving fungibility and confidentiality for LTC transactions.

Moreover, the Litecoin Foundation recently announced the development of LitePay 2.0, a payment gateway solution tailored for e-commerce platforms and in-store crypto payments. The new iteration promises seamless conversion between crypto and fiat, low transaction fees, and near-instant settlement times — a move aimed at bolstering Litecoin’s real-world utility and merchant adoption.

Litecoin’s low transaction costs and high transaction throughput remain strong competitive advantages, particularly as network congestion and fee spikes continue to plague several smart contract-focused blockchains.

Conclusion

In summary, Litecoin appears to have completed its corrective cycle, finding support at the 61.8% Fibonacci retracement around $77.50. The formation of higher lows and rising momentum point to a potential bullish continuation toward the $100.68 resistance zone. A successful breakout above this inflection level would open the door for a sustained rally toward $132.63 and possibly higher.

Coupled with continued technology improvements and growing institutional-grade payment solutions, Litecoin’s medium-to-long-term outlook remains bullish.

Key Levels to Watch:

-

Resistance: $100.68, $132.63

-

Support: $77.50, $72.12

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM