Bitcoin ETFs Add $2.39B in Weekly Inflows as Holdings Hit $152.4 Billion

US spot Bitcoin ETFs continued to rise, with $2.39 billion in inflows for the week ending July 18. This is the 6th consecutive week of gains

Quick overview

- US spot Bitcoin ETFs saw $2.39 billion in inflows for the week ending July 18, marking the sixth consecutive week of gains.

- Ethereum ETFs experienced a significant surge with $2.18 billion in inflows, a 140% increase from the previous week.

- Despite the strong ETF inflows, Bitcoin's price dropped 2.2%, while Ethereum rallied 25% to reclaim the $3,800 level.

- Total inflows for Bitcoin and Ethereum ETFs in 2025 have approached $25 billion, indicating growing institutional demand.

US spot Bitcoin ETFs continued to rise, with $2.39 billion in inflows for the week ending July 18. This is the 6th consecutive week of gains, with total inflows now at $10.5 billion. The 12 ETFs have brought in $54.75 billion since inception and hold $152.4 billion of Bitcoin, 6.5% of the total BTC market cap.

The week’s inflows were strong:

- Monday: $297.4 million

- Tuesday: $403 million

- Wednesday: $799.4 million

- Thursday: $522.6 million

- Friday: $363.45 million

BlackRock’s IBIT led the way with $2.57 billion in inflows. VanEck’s HODL and Grayscale’s BTC followed with $31 million and $41.9 million respectively. While Bitwise, Invesco, Franklin Templeton and WisdomTree added $35 million, this was offset by $290.8 million outflows from Grayscale’s GBTC, Ark 21Shares’ ARKB and Fidelity’s FBTC.

Ethereum ETFs Surge with $2.18B Inflows

While Bitcoin ETFs were big in volume, Ethereum ETFs were the momentum story. US listed spot ETH funds saw $2.18 billion in inflows, a 140% increase from the previous week and the biggest inflow week since launch.

ETH ETF inflows are now 10 weeks of positive net flows and over $5 billion. As investor sentiment shifts towards altcoins, Ethereum is benefiting from the liquidity dynamics.

Nate Geraci, market analyst noted that spot Bitcoin and Ethereum ETFs have brought in nearly $25 billion in 2025, institutional demand is growing.

BTC and ETH Price Trends

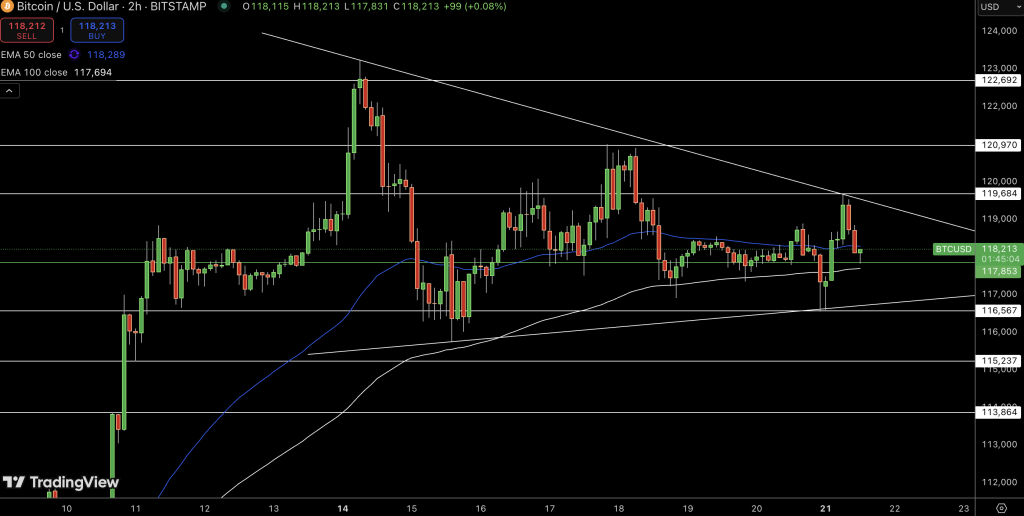

Despite the massive ETF inflows, Bitcoin price dropped 2.2% for the week and is hovering just below $120,000. Analysts say it’s profit taking near all time highs and a temporary cool off.

Ethereum on the other hand rallied 25% and reclaimed the $3,800 level for the first time since December. The big divergence has sparked renewed interest in ETH led altcoin rotations as market participants are diversifying away from Bitcoin’s slow price action.

Key Takeaways:

- Bitcoin ETFs: $2.39B weekly inflow, 6-week streak

- Ethereum ETFs: $2.18B weekly inflow, 140% weekly increase

- BTC down 2.2%, ETH up 25% in past 7 days

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account