Ethereum Price Prediction: ETH Nets $2.12B Inflows as Price Eyes $4,110 in Bullish Breakout

Ethereum (ETH) is the institutional favorite in a record breaking week for crypto funds. According to CoinShares,

Quick overview

- Ethereum (ETH) experienced a record-breaking $2.12 billion in institutional inflows last week, more than double its previous record.

- Total digital asset inflows reached $4.39 billion, marking the 14th consecutive week of net inflows and pushing global crypto assets under management to an all-time high of $220 billion.

- ETH's price has surged 54% in the last month, currently sitting at $3,807, with key resistance levels at $3,832 and $4,110.

- U.S. funds led the inflows with $4.36 billion, while other regions like Switzerland and Australia also saw positive contributions.

Ethereum (ETH) is the institutional favorite in a record breaking week for crypto funds. According to CoinShares, ETH pulled in $2.12 billion in institutional inflows last week—its highest weekly total ever. That’s more than double its previous record of $1.2 billion and close to Bitcoin’s $2.2 billion.

This bullish momentum pushed total digital asset inflows to $4.39 billion and global crypto assets under management (AUM) to an all time high of $220 billion. It’s the 14th consecutive week of net inflows into digital assets, a clear sign of strong and sustained institutional interest.

Ethereum’s year to date inflows now total $6.2 billion—more than its full year 2024 total. Notably this has pushed ETH’s share of total crypto AUM to 23%—a significant rotation into Ethereum heavy portfolios.

ETH Price Up 54% in a Month, Targets $4,110

Ethereum’s price is following the institutional inflows. ETH is currently at $3,807 up 1.54% in the last 24 hours with a daily trading volume of $44.8 billion. In the last month ETH is up 54% driven by investor positioning and the growing optimism around an Ethereum spot ETF.

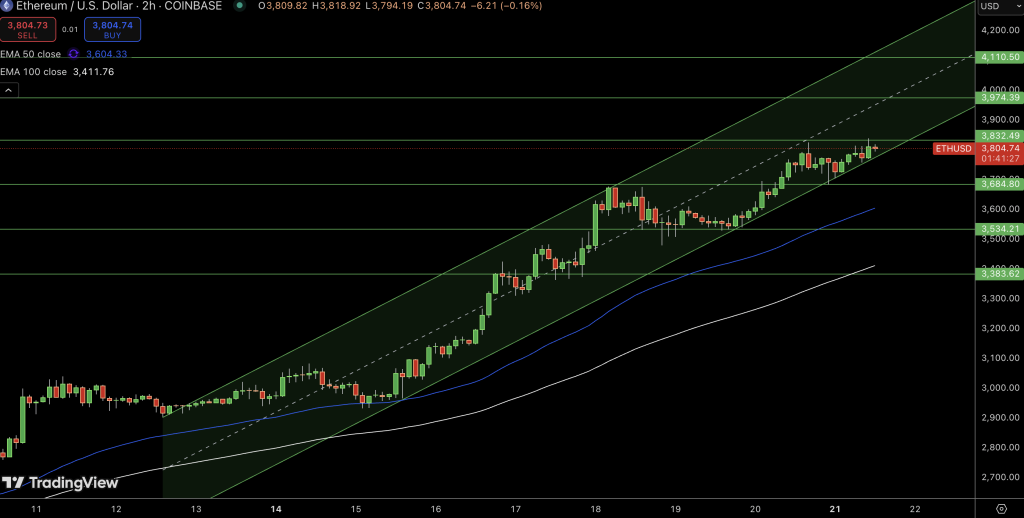

From a technical perspective ETH is trending inside an ascending channel on the 2 hour chart. The price is above the 50 EMA at $3,604 and the 100 EMA at $3,411. The next level is $3,832—a horizontal resistance that if broken could trigger a move to $3,974 and possibly $4,110.

Key levels to watch:

- Upside Targets: $3,832, $3,974, $4,110

- Support Zones: $3,684 (channel support), $3,534 (50 EMA), $3,383 (swing low)

Momentum indicators are getting overbought so the rally might take a breather before resuming. But the trend is still bullish unless price breaks the lower channel.

By region, U.S. funds pulled in $4.36 billion, U.S. is still the leader in crypto capital markets. Switzerland had $47.3 million, Australia had $17.3 million and Hong Kong had $14.1 million. Brazil and Germany were the only ones with outflows of $28.1 million and $15.5 million respectively.

Other altcoins also benefited:

- Solana (SOL): $39 million

- XRP: $36 million

- Sui (SUI): $9.3 million

Exchange traded products (ETPs) reflected this, BlackRock and Grayscale had strong ETH ETF demand. Ark Invest, Fidelity and ProShares had minor outflows.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account