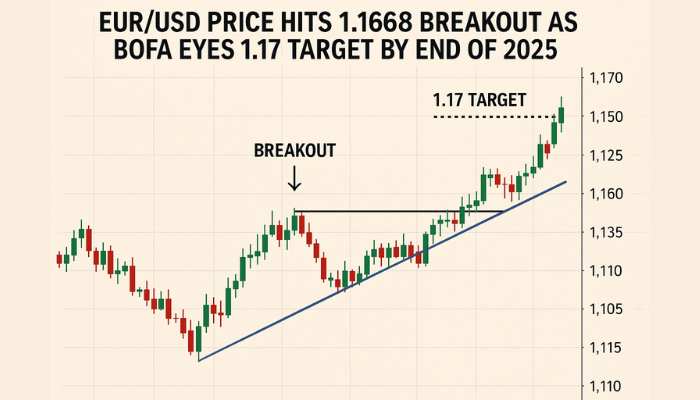

EUR/USD Price Hits 1.1668 Breakout as BofA Eyes 1.17 Target by End of 2025

Bank of America has doubled down on its EUR/USD forecast, expecting the euro to hit 1.17 by the end of 2025. And that’s even as the bank...

Quick overview

- Bank of America predicts the euro will reach 1.17 against the dollar by the end of 2025, despite expected rate cuts from the European Central Bank.

- The bank anticipates a reversal in ECB policy by 2027, with rate hikes bringing the deposit rate back to 2.00%.

- BofA highlights the euro's resilience against the dollar, driven by US policy uncertainty and favorable macroeconomic conditions in the eurozone.

- Technical analysis shows a bullish trend for EUR/USD, with key resistance levels identified and momentum indicators suggesting further upside potential.

Bank of America has doubled down on its EUR/USD forecast, expecting the euro to hit 1.17 by the end of 2025. And that’s even as the bank expects two rate cuts from the European Central Bank, one in September and one in December, each 25 basis points. That would take the ECB’s terminal deposit rate to 1.50%, the end of the easing cycle.

Interestingly, BofA’s forecast isn’t just about short term policy easing. The bank also expects the ECB to reverse course in 2027, with two rate hikes in March and June, and the deposit rate back up to 2.00% by the end of the year. That long term policy roadmap, combined with underlying economic resilience, means the euro can be strong even during easing.

What really sets the euro apart right now, according to BofA, is its resilience against the dollar, particularly when benchmarked against short term US-EU rate differentials. The dollar’s vulnerability to policy uncertainty – including ambiguity around future Fed decisions – is fueling this strength.

EUR/USD Breaks 1.1668 Channel Top

BofA’s forecast is backed up by a solid technical breakout on the EUR/USD chart. On the 2 hour chart the pair broke above a descending channel and took out 1.1668 with conviction. That level, once a ceiling, is now a base for further upside, with the 50 period SMA at 1.1621.

Momentum is shifting fast. The RSI has surged past 66, but not yet overbought. There may still be room to run.

Key resistance levels now in play:

- 1.1720 – a horizontal level

- 1.1765 – the mid July high

- 1.1815 – the June high

If 1.1668 fails, look for support at 1.1621, 1.1581 and 1.1535. But for now, the trend is with the bulls.

Macro Tailwinds

Beyond the charts, the macro fundamentals are lining up with the bullish case. The US dollar is under pressure from cooling inflation and rising odds of rate cuts by Q4. The eurozone has dodged recession for now and consumer resilience and regional stability is showing through.

This is a great environment for a stronger euro – especially as investors reprice the risk premium on US assets amid political and monetary uncertainty.

If EUR/USD can take out 1.1720 it may open the door to 1.1815 and BofA’s 1.17 target sooner than expected. In short, the fundamentals and the technicals are saying the same thing: euro strength is just getting started.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM