Newegg Heats Up: NEGG Stock Jumps 25% After Pullback on ATM Offering, Strong Sales Outlook

As we anticipated, Newegg Commerce (NASDAQ: NEGG) is causing a significant market upswing after a period of support.

Quick overview

- Newegg Commerce (NASDAQ: NEGG) experienced a 20% bounce after a significant pullback, indicating resilient investor sentiment.

- The company announced an at-the-market equity offering to raise up to $65 million, aiming to support ongoing operations.

- Insider purchases by major shareholders reinforce confidence in NEGG's stock at current levels.

- Newegg's recent FantasTech Sale is expected to contribute positively to its financial performance, with projected net sales between $678.3 million and $713.1 million.

As we anticipated, Newegg Commerce (NASDAQ: NEGG) is causing a significant market upswing after a period of support.

Post-Pullback Rally Reignites NEGG Momentum

Following a blistering 300% rally earlier this month that pushed Newegg stock to $56 — its highest since 2021 — the e-commerce company faced a sharp selloff, falling more than 50% to as low as $25 last week. But that pullback appears to have been short-lived. On Tuesday, NEGG shares bounced 20% intraday, reclaiming the $30 level and signaling that bullish sentiment hasn’t fully disappeared.

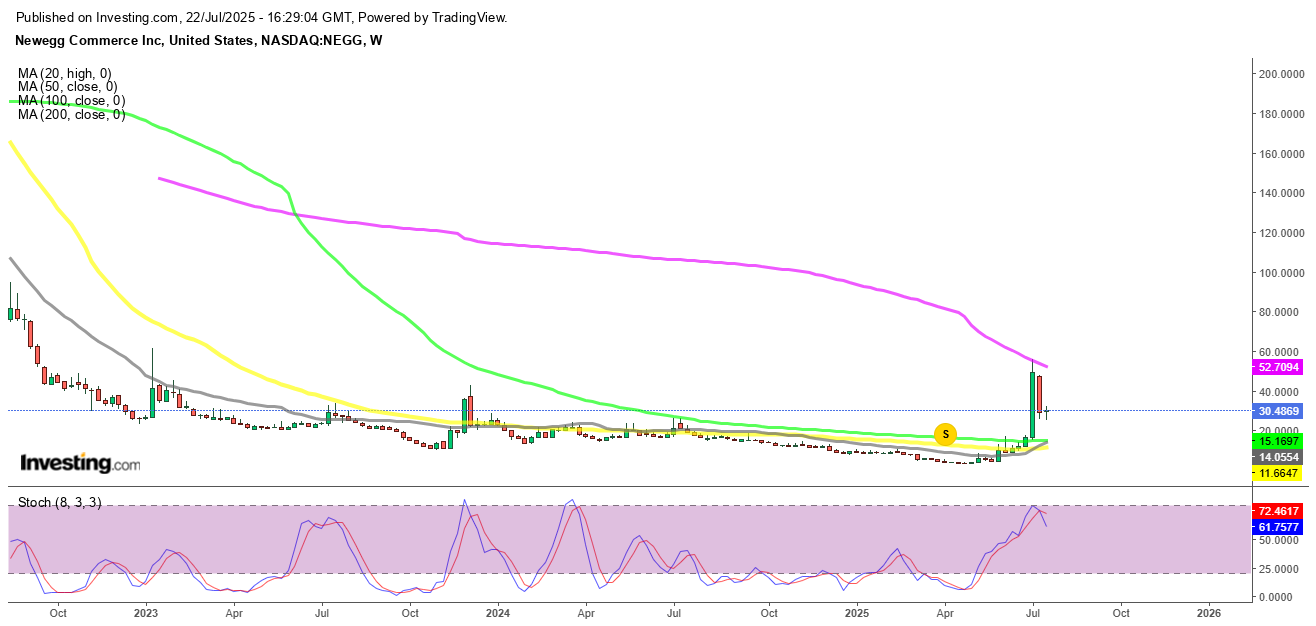

NEGG Chart Weekly – The 200 SMA Stopped the Surge

The technical recovery aligns with prior analysis: traders were eyeing the 20-day simple moving average (SMA) as a potential re-entry level, which we highlighted two weeks ago, and this bounce from that zone reinforces the strength of the trend. The sharp rebound suggests new accumulation is underway following last week’s panic selloff.

NEGG Chart Daily – The 20 SMA Held As Predicted

At-the-Market Offering Announced With Needham & Company

In parallel with the rally, Newegg also entered into a sales agreement with Needham & Company, allowing it to sell up to $65 million worth of its common shares via an at-the-market (ATM) equity offering. Under the agreement, Needham will act as sales agent and receive a 3% commission on any gross proceeds from shares sold.

This move is widely seen as an attempt to capitalize on the recent rise in NEGG’s share price and to raise cash in support of ongoing operations and strategic initiatives. While equity offerings can sometimes weigh on a stock’s momentum, the bounce suggests that investor sentiment remains resilient — especially given recent insider confidence.

Galkin Insider Buys Underscore Long-Term Confidence

Earlier this week, Vladimir and Angelica Galkin, both classified as 10% owners of Newegg Commerce, purchased more than $3.28 million worth of NEGG shares on July 15. The trades were executed at prices between $29.29 and $30.23, nearly identical to today’s intraday bounce range — further reinforcing investor confidence at current levels.

With NEGG already up over 250% year-to-date, the purchases serve as a strong bullish signal, particularly given the timing near the company’s share offering and the upcoming release of its financial figures.

FantasTech Sale, Technical Setup, and Expected Results Fuel Speculation

Much of the recent upside has been tied to the success of Newegg’s 11th annual FantasTech Sale, which ran from July 7 to July 13. The sales event — originally launched as a seasonal clearance strategy — has become central to the company’s growth playbook, offering deep discounts, price protection features, and short-term revenue boosts.

In terms of financial performance, Newegg expects to report net sales between $678.3 million and $713.1 million for the six-month period ending June 30, 2025. While full details are yet to be released, the top end of that range would reflect a meaningful step toward returning to consistent top-line growth.

Meanwhile, the stock’s recovery above key technical support has emboldened traders watching for a possible second leg higher, with short interest remaining elevated and volatility still extreme.

Conclusion: NEGG’s Volatility May Be Wild, But It’s Still in Play

Between a sharp bounce, insider activity, a strategic share sale, and promising guidance, Newegg is once again at the heart of the retail trader spotlight. Though risk remains high due to the company’s history of wild price swings, momentum traders and bullish speculators may continue to circle as long as technical patterns hold — and management maintains transparency on performance.

With a compelling mix of catalysts, NEGG is proving that its summer rally might not be over just yet.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM