EUR/USD Edges Lower as Traders Await ECB Decision, Eyes on 1.1830 Breakout

During the Asian session on Thursday, the EUR/USD pair softened slightly and traded near 1.1720 after gaining 1.3% over...

Quick overview

- The EUR/USD pair softened slightly to around 1.1720 after a 1.3% gain over the past three days, amid cautious market sentiment ahead of the ECB meeting.

- The Euro is under pressure due to stalled EU-US trade talks and the uncertainty surrounding potential tariffs on EU goods.

- Eurozone consumer confidence remains weak, with expectations for a slight improvement in the Consumer Sentiment Index, keeping pressure on the ECB.

- The US dollar strengthened following a trade deal with Japan, impacting the EUR/USD pair, while technical indicators suggest potential bullish movement for the Euro if ECB communications are favorable.

During the Asian session on Thursday, the EUR/USD pair softened slightly and traded near 1.1720 after gaining 1.3% over the past three days. The pair struggled to extend gains as market sentiment turned cautious ahead of Thursday’s European Central Bank (ECB) meeting and the renewed tensions between the EU and the US over trade.

EU-US Trade Dispute Weighs on Euro

Despite the improvement in global risk appetite following the US-Japan trade deal, the Euro is under pressure due to the stalled talks with the US. Talks over a 30% tariff on EU goods have made little progress and are unsettling investors. EU delegates are traveling to Washington today to revive talks and draft retaliatory measures, so the uncertainty around transatlantic trade is still high.

This has limited fresh buying in the Euro as traders wait for clarity on both trade talks and Thursday’s ECB communication.

Eurozone Sentiment Still Weak Ahead of ECB

Meanwhile, Eurozone consumer confidence is still weak. The European Commission’s Consumer Sentiment Index for July is due later today and is expected to edge up to -15.0 from -15.3, still below the historical average. The data reflects the ongoing concerns about the region’s economy and will keep pressure on the ECB to be dovish.

Markets expect the ECB to keep rates unchanged but the forward guidance on growth risks, inflation and future policy moves will drive Euro volatility.

US Dollar Strengthens on Japan Trade Deal

On the US side, the dollar strengthened after President Donald Trump announced a trade deal with Japan, which includes reducing tariffs from 25% to 15% and a $550 billion investment. This news has put pressure on the EUR/USD pair. Traders are also watching the Fed’s stance, with inflation and trade tensions impacting future rate expectations.

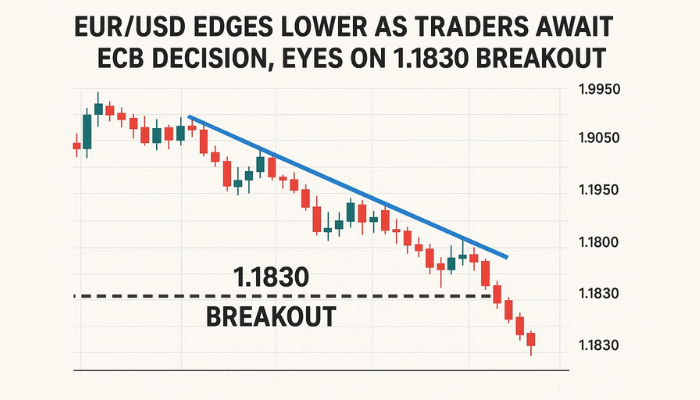

EUR/USD Technical Outlook: 1.1830 Resistance in Sight

From a technical perspective, EUR/USD has broken out of the descending channel and is bullish. The breakout above 1.1712, confirmed by a strong bullish engulfing candle, is a clear trend reversal.

The pair is now above the channel and the 50-period SMA, a setup that often precedes a strong move up.RSI is at 67.83, strong momentum without being overbought. Recent consolidation at 1.1780 is a bullish flag, so the move can continue. As long as the price is above 1.1712, the structure is still bullish.

- Immediate resistance at 1.1780. Clean break above this level and 1.1830 is next, then 1.1876.

- Support at 1.1712, then 1.1668 (50-SMA).

Overall, with bullish technicals and momentum building, EUR/USD can continue higher if Thursday’s ECB is Euro positive.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account