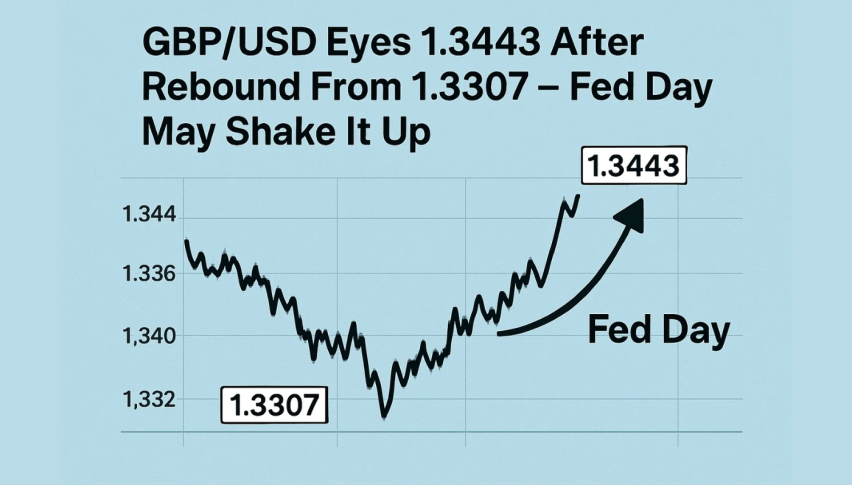

GBP/USD Eyes 1.3443 After Rebound From 1.3307 – Fed Day May Shake It Up

The British Pound is staging a cautious rebound against the US Dollar just hours ahead of a pivotal Fed day. GBP/USD is trading near 1.3375.

Quick overview

- The British Pound is cautiously rebounding against the US Dollar, trading near 1.3375 after finding support at 1.3307.

- Analysts expect Q2 GDP to rise to 2.5% and ADP jobs data to show 77K new hires, with the Fed's interest rate decision being crucial for GBP/USD's direction.

- Technically, GBP/USD faces resistance at 1.3380 and 1.3443, while support levels are identified below 1.3307.

- The next 24 hours are critical, with potential volatility driven by US economic data and the FOMC press conference.

The British Pound is staging a cautious rebound against the US Dollar just hours ahead of a pivotal Fed day. GBP/USD is trading near 1.3375, recovering from a sharp drop that found support at 1.3307. The recovery is taking shape as traders brace for a flurry of high-impact US events, including Q2 GDP data, the Fed’s interest rate decision, and Chair Powell’s press conference.

On the economic front, analysts expect Q2 GDP to bounce back to 2.5% from -0.5%, while ADP jobs data is forecast to show 77K new private-sector hires. Crude oil inventories and pending home sales will also provide insights into consumption trends. However, it’s the Fed’s tone that could make or break the current GBP/USD rebound. With the policy rate expected to remain at 4.50%, traders are laser-focused on any signal for a rate cut in September.

Technical Setup: Can GBP/USD Hold the Bounce?

From a technical perspective, GBP/USD is trying to carve out a bottom after slipping below the 50-SMA and descending for most of July. The pair’s rebound from the 1.3307 level is showing early signs of stabilization, but the upside remains capped near the 1.3380–1.3443 resistance zone.

Here’s what’s in focus:

- Immediate resistance: 1.3380 (minor horizontal barrier)

- Key upside target: 1.3443 (50-SMA + descending trendline)

- Support below: 1.3307 → 1.3245 → 1.3184

- RSI: Currently at 43, signaling weakening bearish pressure

Until bulls push price decisively above 1.3443 with rising volume, the broader trend stays tilted to the downside. A failure at current levels would signal renewed selling pressure, potentially targeting sub-1.3250 zones.

What Traders Should Watch Next

The next 24 hours are loaded with risk catalysts. If US GDP overshoots and Powell sounds hawkish, the dollar could strengthen, pressuring GBP/USD back toward recent lows. But a dovish pivot or disappointing data could breathe more life into this rebound.

Key scenarios to monitor:

- Bullish case: Clear breakout above 1.3443 opens 1.3508 and 1.3583 targets

- Bearish case: Rejection at resistance and break below 1.3307 paves the way for 1.3184

- Volatility trigger: FOMC press conference at 18:30 GMT

In short, GBP/USD is caught in a make-or-break moment. The recovery is fragile, but with the right catalyst, the pair could stage a stronger comeback. For now, all eyes are on the Fed.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account