Forex Brief August 6: Applovin, Uber, Shopify, MacDonalds , AirBnB Earnings Preview

Major corporations such as Applovin, Uber, Shopify, MacDonalds , AirBnB are set to release their earnings, with investors focusing on tech..

Quick overview

- Major corporations like Applovin, Uber, Shopify, McDonald's, and AirBnB are set to release earnings, with investors keenly observing their performance to assess market momentum.

- The Reserve Bank of India is expected to maintain interest rates at 5.50% amid global market uncertainties, reflecting a cautious approach to support growth.

- Earnings reports from McDonald's and Disney are anticipated to influence consumer confidence, while disappointing results from Uber or Shopify could negatively impact tech-heavy indices.

- In the cryptocurrency market, Bitcoin has shown resilience, rebounding from a dip, while Ethereum is gaining traction ahead of its upcoming upgrade.

Live BTC/USD Chart

Major corporations such as Applovin, Uber, Shopify, MacDonalds , AirBnB are set to release their earnings, with investors focusing on tech, streaming, retail, and fast food giants to gauge market momentum.

Key Market Events for the Day

RBI Expected to Hold Rates Amid Global Market Watch

India’s central bank is preparing to wrap up its three-day policy meeting next week, and market participants widely expect the Reserve Bank of India (RBI) to leave interest rates unchanged. A recent Reuters survey of 57 economists showed that 44 expect the Repurchase Rate to remain at 5.50%, while 13 foresee a modest 25-basis-point cut.

In June, the RBI shifted its stance from accommodative to neutral after a larger-than-expected 50-basis-point cut, which brought the Repo Rate to 5.50%—its third reduction of the year. The Standing Deposit Facility and Marginal Standing Facility rates were also lowered to 5.25% and 5.75%, respectively. This steady approach reflects the central bank’s focus on supporting growth while monitoring global uncertainties.

Earnings Calendar: Wednesday, August 6, 2025

Wednesday’s earnings releases will provide a cross-sector snapshot of market health, spanning fast food, media, ride-hailing, e-commerce, and ad-tech. Strong beats from McDonald’s and Disney could bolster consumer and media confidence, while Shopify and AppLovin will test the appetite for high-growth tech. Market sentiment may shift sharply if Uber or Shopify disappoint, given their influence on tech-heavy indices.

McDonald’s Corporation (NYSE: MCD)

- Market Cap: $214.22 billion

- EPS Estimate: $3.14

Notes:

- Investors will be watching for continued global same-store sales growth after last quarter’s strong U.S. performance.

- Menu innovation and international expansion, especially in emerging markets, are key drivers.

- A miss could indicate consumer pressure amid lingering inflation, while a beat might reinforce its defensive positioning.

The Walt Disney Company (NYSE: DIS)

- Market Cap: $213.63 billion

- EPS Estimate: $1.45

Notes:

- Results will be closely tied to streaming growth (Disney+), theme park performance, and studio releases.

- Investors will focus on progress toward profitability in the streaming division and parks’ rebound post-global travel normalization.

- Volatility is likely if streaming subscriber growth falls short.

Uber Technologies, Inc. (NYSE: UBER)

- Market Cap: $189.34 billion

- EPS Estimate: $0.63

Notes:

- Key metrics to watch include gross bookings, ride-hailing demand, and delivery segment growth.

- Profitability remains a highlight after the company’s turnaround in operating income last quarter.

- Potential downside if competitive pricing pressures emerge in rides or delivery.

Shopify Inc. (NYSE: SHOP)

- Market Cap: $163.77 billion

- EPS Estimate: $0.29

Notes:

- Investors are watching for e-commerce trends amid a slower consumer environment.

- Growth in Shopify Payments and fulfillment services will be key to margins.

- A strong earnings beat could reignite bullish momentum in high-growth tech.

AppLovin Corporation (NASDAQ: APP)

- Market Cap: $128.76 billion

- EPS Estimate: $1.96

Notes:

- Performance hinges on advertising demand and AXON AI-powered ad platform growth.

- Mobile gaming sector trends will significantly influence revenue.

- Traders expect high volatility, as APP is a favorite among momentum-driven investors.

Last week, markets were quite volatile, with gold retreating and then bouncing to finish the week unchanged. EUR/USD slipped toward 1.14 but also rebounded on Friday, while S&P and Nasdaq ended the week lower. The moves weren’t too big though, and we opened 35 trading signals in total, finishing the week with 23 winning signals and 12 losing ones.

Gold Holds in a Prolonged Consolidation Phase

Gold prices remain trapped below the $3,450–$3,500 resistance zone, despite repeated attempts to break higher. Following last week’s FOMC meeting, where the Federal Reserve kept interest rates unchanged, XAU/USD briefly dipped to $3,268 before rebounding off its 100-day simple moving average.

The current consolidation reflects safe-haven demand colliding with slowing bullish momentum. Investors are now watching U.S. unemployment claims and labor data closely, as they could either confirm or undermine last week’s weaker-than-expected NFP report, which helped gold recover into the weekend. A clear break above resistance may require a new macro catalyst, while the prolonged sideways trading signals caution among buyers.

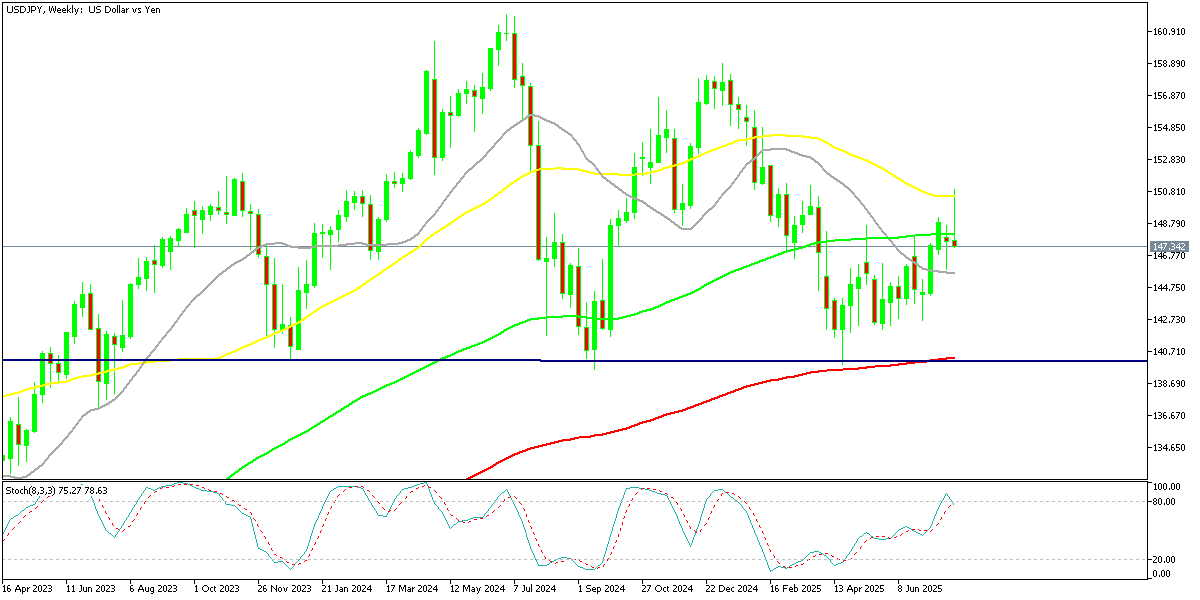

USD/JPY Volatility Highlights Fed–BoJ Divergence

The USD/JPY pair has been volatile as global rate differentials continue to drive flows. Early last week, the dollar broke above ¥150 and its 50-week moving average, fueled by Japanese capital seeking higher returns abroad. However, Friday’s disappointing U.S. jobs report reversed that move, dragging the pair nearly four yen lower, as traders reassessed the strength of the labor market and the pace of Federal Reserve policy adjustments.

USD/JPY – Weekly Chart

Cryptocurrency Update

Bitcoin Buyers Return

Cryptocurrencies remained a bright spot in an otherwise unsettled market. Bitcoin briefly fell below $112,000 last week before rebounding strongly off the previous high zone, which seems to have turned into support now.

BTC/USD – Weekly chart

Ethereum Inches Closer to $4,000

Ethereum continued to outshine Bitcoin, rallying 20% since April and breaking its 100-week moving average. The move has been fueled by optimism over the upcoming “Pectra” upgrade, which promises to enhance scalability and transaction efficiency, drawing renewed institutional inflows. Ethereum is now aiming for the $4,000 level, reinforcing its role as a favored high-conviction asset in times of macro uncertainty.

ETH/USD – Daily Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM