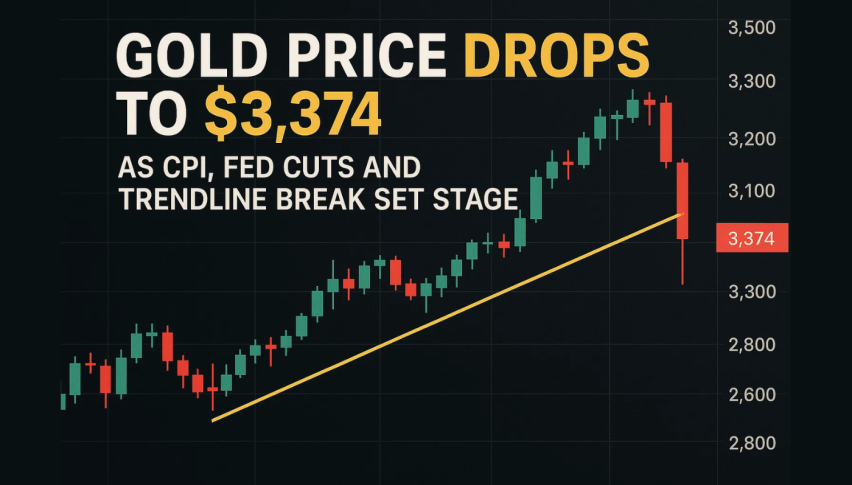

Gold Price Drops to $3,374 as CPI, Fed Cuts and Trendline Break Set Stage

Gold retreated to $3,374 on Monday as easing geopolitical risks trimmed safe-haven demand. News that President Donald Trump...

Quick overview

- Gold prices fell to $3,374 as easing geopolitical tensions reduced safe-haven demand.

- The upcoming U.S. CPI report is expected to show core inflation rising to 3.0%, which could impact gold's performance.

- Technical indicators suggest weakening momentum for gold, with immediate support levels at $3,354 and $3,333.

- Traders are considering short positions on a retest of $3,380–$3,385, while a reclaim of $3,400 could signal a bullish reversal.

Gold retreated to $3,374 on Monday as easing geopolitical risks trimmed safe-haven demand. News that President Donald Trump will meet Russian President Vladimir Putin in Alaska on Aug. 15 to negotiate an end to the Ukraine war reduced market stress, shifting focus to economic data.

All eyes now turn to Tuesday’s U.S. CPI report, with analysts expecting core inflation to rise 0.3%, bringing the annual pace to 3.0% — still above the Fed’s 2% target. A hotter-than-expected print could strengthen the dollar and limit gold’s upside.

At the same time, a softer-than-expected U.S. jobs report last week boosted bets for a September Fed rate cut, with markets pricing a 90% probability of easing and at least one more cut by year-end. Lower rates tend to favor non-yielding assets like gold.

Gold (XAU/USD) Technical Picture Weakens

On the 4-hour chart, gold has broken below a rising trendline that had supported higher lows since July 30. Multiple upper-wick rejections near $3,400 signaled fading bullish momentum before the drop.

The RSI has retreated from 60.47 toward mid-40s, indicating cooling buying pressure. MACD has turned bearish, with a red histogram and downward crossover. Immediate support lies at the 50-SMA around $3,354, followed by $3,333. A break below these levels could open the door to $3,310, near prior swing lows.

Gold Trade Setup Ahead

Aggressive traders may eye shorts on a retest of $3,380–$3,385, with stops above $3,400 to avoid false breakouts. Initial profit targets sit at $3,354 and $3,333, with partial profit-taking at the first support.

If gold reclaims $3,400 on strong volume, the bullish structure could resume, targeting $3,420 and $3,438. The next 48 hours will be shaped by CPI data, which could either confirm the breakdown or spark a reversal.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account