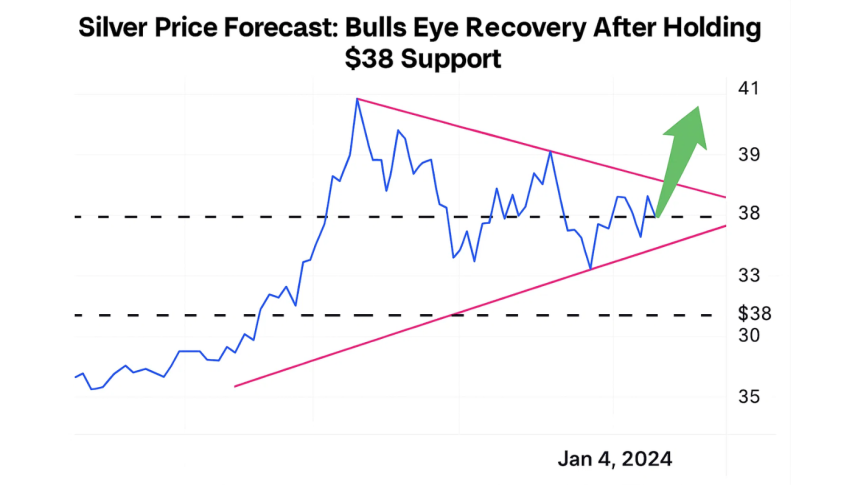

Silver Price Forecast: Bulls Eye Recovery After Holding $38 Support

Silver (XAG/USD) is holding up well after the early Thursday sell-off, staying above the rising trendline that’s been guiding higher...

Quick overview

- Silver (XAG/USD) remains above a rising trendline, indicating potential for buyers to step in after a recent sell-off.

- Momentum indicators show stabilization, with RSI bouncing back from oversold levels and MACD's bearish pressure fading.

- Traders are advised to wait for a close above 38.71 for a potential breakout, targeting 39.05 and 39.53.

- A break below 37.94 could shift sentiment to bearish, exposing lower targets at 37.03 and 36.50.

Silver (XAG/USD) is holding up well after the early Thursday sell-off, staying above the rising trendline that’s been guiding higher lows since the July 36.50 low. This test at 38.00 produced a small bullish candle just above the 50 SMA, so buyers are ready to step in. The bigger picture is an uptrend channel where dips have been met with demand.

Momentum is Stabilizing

Momentum is starting to look stable. RSI has bounced from the 40s and avoided the oversold zone that often leads to deeper corrections. MACD is below zero but the histogram is shrinking, bearish pressure is fading. On the 2 hour chart, no reversal pattern is formed yet but the trendline rejection could be the start of an up move. A close above 38.71 could lead to 39.05 and 39.53.

Trade Setup: Waiting for a Break Higher

Longs may wait for a close above 38.71, ideally with stronger volume, and stops under 37.94 to protect against a fake breakout. In that case 39.05 and 39.53 are the near term targets. If 37.94 breaks with momentum, sentiment will turn bearish and 37.03 and 36.50 will be exposed. This trade combines channel support, trendline resilience and momentum recovery, so it’s a balanced risk/reward.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account